Ways to Lower Your Mortgage Interest Rate

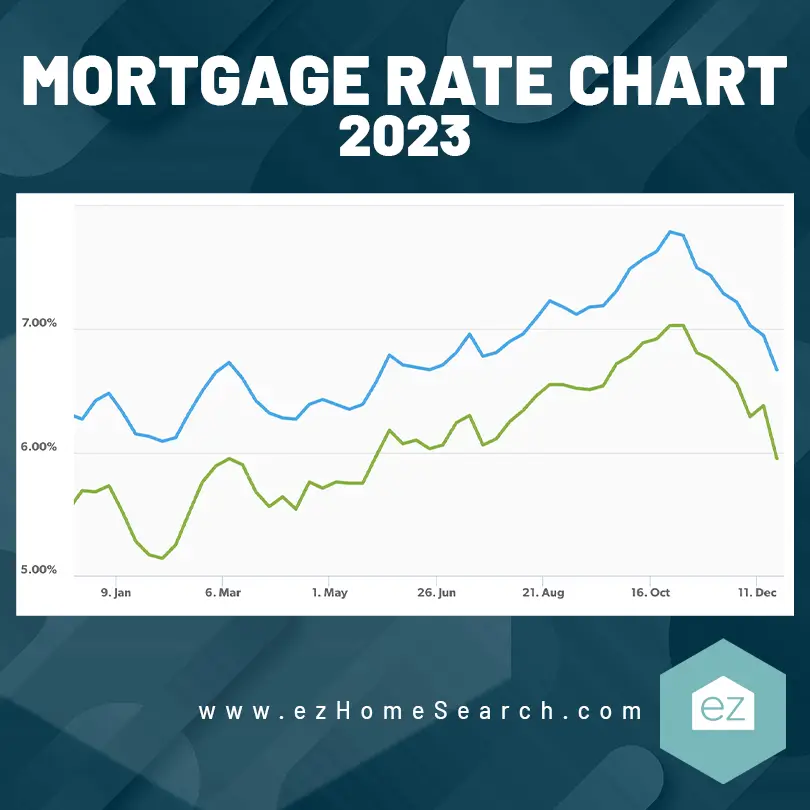

Mortgage rates have been higher for quite some time now, and experts say they are here to stay. The predictions for 2024 anticipate interest rates persisting around 6-7%. For those still waiting to buy a new home or refinance your mortgage, dealing with those increased interest rates is a reality. However, this doesn’t mean you can’t get a better mortgage rate. Look into these tactics home buyers use to improve their mortgage interest rate.

Debt-to-income ratio

Understanding how lenders qualify and underwrite your mortgage is part of lowering your mortgage rate. Remember, lenders prefer low-risk borrowers. Default and foreclosure on a mortgage are expensive for them, so they want to avoid this. Prospective borrowers who demonstrate they have enough income to afford the requested loan are preferred.

Mortgage lenders heavily consider a potential home buyer’s debt-to-income ratio (DTI). This is the percentage of your monthly income compared to owed debts, including your mortgage.

Lenders prefer a lower DTI, usually 30% and under, as it shows you have enough disposable income to afford your mortgage payments comfortably. So, lowering your DTI could be a way to qualify you for a lower interest rate.

Having a higher DTI isn’t the end of your home-buying or refinancing aspirations. Work first on reducing some of your other debts or increasing your income before applying for a mortgage. This will improve your chances of getting a lower interest rate, not to mention helping you stand on a stronger financial footing.

Changing your DTI is a longer-term goal to work on well before you’re ready to buy a home and apply for a mortgage.

Credit score

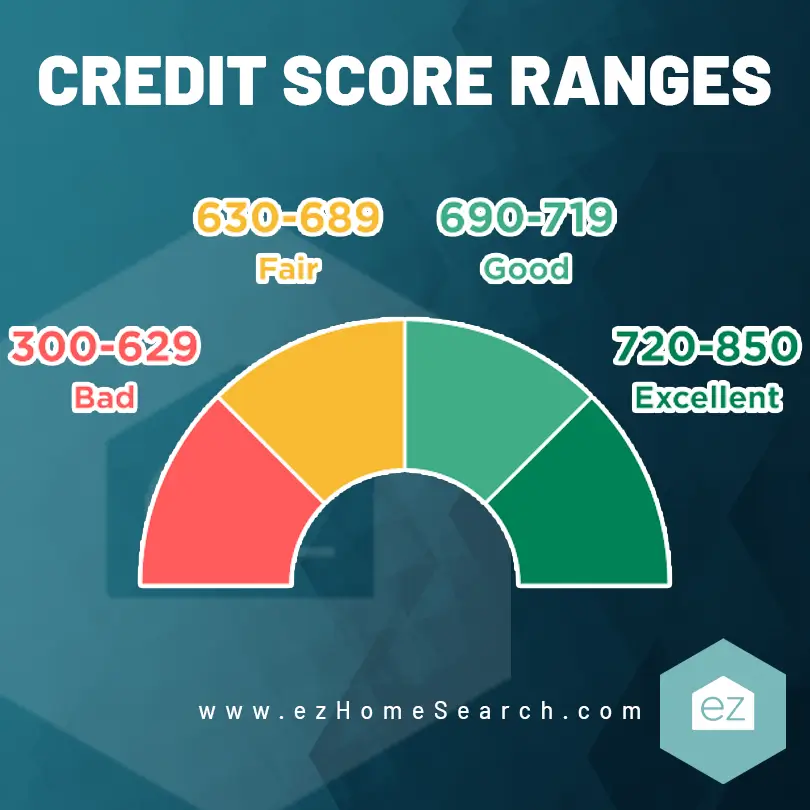

The credit score is another leading factor in determining your mortgage rate. The best mortgage rates go to those with a responsible credit history, as reflected in the FICO credit score. Usually, this is at 720 or higher. Credit scores in the “good” or “fair” range may be offered at a higher rate. Even incremental interest rate bumps translate to thousands over time.

Boost your credit score by paying all your bills on time, keeping credit card balances low, and avoiding opening too many new accounts. Pay off the credit card as soon as possible rather than letting interest kick in. Don’t use the full extent of your credit limit, and if you do, pay it down quickly. Managing your credit score is another long-term strategy for improving mortgage rates.

Loan-to-value ratio

Presenting a lower loan-to-value (LTV) ratio helps earn better mortgage rates. LTV is the percentage of the property’s value that you’re borrowing. The higher the LTV, the riskier it is for the lender, which can result in a higher interest rate. The market considers loans with 80% LTV or less the least risky.

To improve your LTV and land a better mortgage rate, you can either make a larger down payment or find ways to boost the property’s value. Saving for a down payment obviously takes time. It’s becoming increasingly common for families to gift money towards a down payment. You could also take a loan out against your retirement savings to boost what you put down on the home.

As for boosting the home’s value, this could include renovations or improvements to increase its overall worth. Check out the 403(b) loan and how it may work for buying or refinancing a home.

Another upside to a down payment of at least 20% is you may be able to waive private mortgage insurance (PMI), which also adds to your monthly mortgage payment.

Mortgage points

Another tactic mortgage lenders like to offer is buying mortgage points to lower interest rates. Think of it as paying interest upfront. One point typically costs 1% of the total loan amount and can reduce your interest rate by 0.25%. For example, if you have a $200,000 mortgage and buy one point, you’ll pay an extra $2,000 upfront but save $500 in interest over a year.

Buying mortgage points may not be worth it if you plan on moving or refinancing within a few years. It’s essential to do the math and see how long it will take for the savings from buying points to outweigh the upfront cost.

Shop around

Feel free to shop around for the best mortgage rate. Mortgage rates aren’t loaned equally, so different lenders may offer rates and terms for nearly the same loan product. It’s worth comparing them to find the best deal.

Lack time to shop around? Consider using a mortgage broker who can help you navigate multiple lenders and find the most competitive rates.

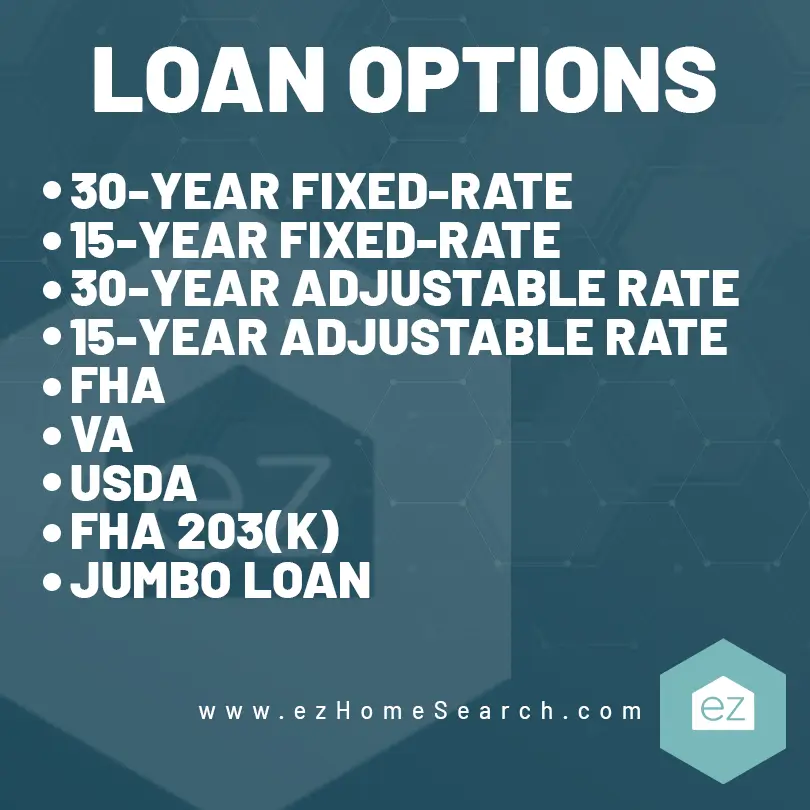

Explore different loan products

You don’t have to go with a traditional 30-year fixed-rate mortgage. Other loan options may have better interest rates. Check out adjustable-rate mortgages or government-insured loans like the FHA or USDA loan. The 15-year fixed rate may be a larger monthly payment, but the interest rates are frequently lower. Be sure to explore all your options and choose the best option for your financial situation.

Ask for a rate buydown

Another tactic that’s become more prevalent in this high-interest rate environment involves asking for a temporary interest rate buydown. New construction builders have offered it to entice home buyers, but it can also be negotiated as a seller concession. The seller will pre-pay the buyer’s mortgage interest payment for a set time and rate.

You’ll see it as a 3-2-1, 2-1, or a 1-1 buydown. In the first, the seller pays 2% of the interest for a year, followed by 1% for a year, after which the buyer pays the full interest rate. A 1-1 buydown is 1% of the interest paid for two years. This interest rate cost is paid at closing. At the end of the temporary rate buy down, the interest rate always returns to its “normal” negotiated amount.

Lowering your mortgage rate

Don’t let higher mortgage rates deter you from buying a home. Keep working on those long-term strategies, like saving for a down payment and managing your credit score. When you’ve found the right home, creative options are available to make homeownership a reality.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Mortgage News

April 2024 Mortgage Market Update

Mortgage News

Can A Reverse Mortgage Help You In Retirement?

Mortgage News

Mortgage Rate Update: Rates Increase In February 2024

Mortgage News