Mortgage Rate Update: Rates Stabilize In January 2024

In some good news for prospective home buyers, interest rates on home loans moderated some in January 2024. Rates dipped below 7% in December and stayed stable throughout the month. Whether or not that will be sustained into February depends on factors like the Federal Reserve’s end-of-the-month meeting, the updated inflation report, and the jobs market.

Federal Reserve Updates Its Policy

In its first meeting of the year, the Federal Reserve’s Federal Open Market Committee (FOMC) voted to maintain its current fiscal policy. That keeps its basis rate at 5.25-5.5%.

The decision weighed the moderate economic activity, job gains, and unemployment rate against an inflation rate that has declined but is still above the Fed’s 2% target rate.

The FOMC said that based on the current projections, it does not anticipate any reductions in its basis rate until it has better confidence that inflation is heading closer towards 2%. It will also keep reducing its holdings of agency mortgage-backed securities.

All that aligns with what the economic experts anticipated at the end of 2023. Most experts believe the Federal Reserve may only lower its basis rate three times during 2024 and probably in the latter half of the year.

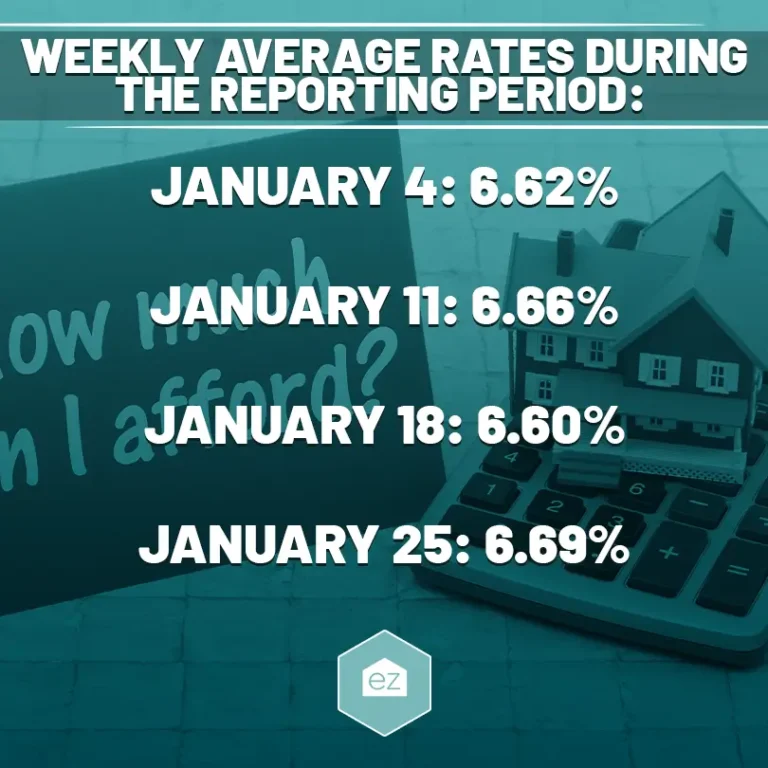

How January 2024 Mortgage Rates Reported

Using the 30-year fixed-rate mortgage as a market gauge, the good news is that 2024 started with a stabilization in the mortgage sector. Rates peaked in October 2023 at over 8% but have since dropped around 6.6%.

These rates are still elevated. Even with improving economic conditions, it may not be enough yet to encourage homeowners to get off the bench and list their homes.

But the nationwide market needs more homes to help bring it closer to balance and slow price appreciation. January’s housing report has yet to be released, but December 2023 saw a 4.4% increase in median home prices nationwide. It was the sixth month of price increases. Between the higher mortgage rates and higher home prices, affordability is the most significant hurdle towards home ownership.

Most experts believe that rates will drop further, including government-backed lender Freddie Mac. The month ended with the 10-year Treasury Yield dipping below 4%. Mortgage rates usually track with this index; if it rises, expect home loan rates to rise, too.

February Mortgage Rates

In the mortgage market, February 1 began with 30-year fixed-rate mortgages at 6.63%. That’s down slightly from the prior week but up 0.54% from February 2023. The 15-year fixed-rate mortgage of 5.94% was also down incrementally from the preceding week and very close to last year’s rate.

Both figures are at the lower end of their one-year outlook.

Nationally, rates ticked up slightly in the wake of the jobs report and Federal Reserve meeting. The average was at 6.96%.

Most market experts believe it will take time, but the mortgage market should gradually move closer to sustained 5.5-6% interest rates on 30-year fixed-rate home loans.

Even a 0.5% change in the interest rate could improve home affordability. On a $300,000 30-year-fixed rate home loan, that difference amounts to $96 a month.

If you are on the hunt for a home loan, explore your different mortgage options and ways to make homebuying more affordable.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Mortgage News

April 2024 Mortgage Market Update

Mortgage News

Can A Reverse Mortgage Help You In Retirement?

Mortgage News

Mortgage Rate Update: Rates Increase In February 2024

Mortgage News