Hold on: 8% mortgage rates are coming

The recent surge in mortgage rates has sparked concerns about affordability among homeowners and potential buyers alike. Now, experts believe seeing 8% mortgage rates isn’t a matter of “if” but “when,” with that possibly being very real in the next few weeks.

The 10-year Treasury Yield, which serves as a benchmark for long-term interest rates, reached levels last seen over two decades ago, back in 2007. The Treasury Yield has produced strong returns recently thanks to a strengthening economy. Mortgage rates track with this Yield, so strong returns equal continued higher rates.

According to Freddie Mac‘s latest report, using the 30-year fixed-rate mortgage as a benchmark, interest rates have reached their highest level in almost 23 years. Rates are half a percentage point higher just than one month ago, at 7.49%.

Mortgage News Daily, which runs a daily survey of mortgage rates, said the October 6 average offered by lenders was 7.81%.

As of October 10, 2023, average mortgage rates were reported as:

30-year fixed-rate: 7.5%

15-year fixed- rate: 6.61%

5/1 ARM: 7.36%

30-year FHA: 6.75%

Higher Mortgage Rates and Home Affordability

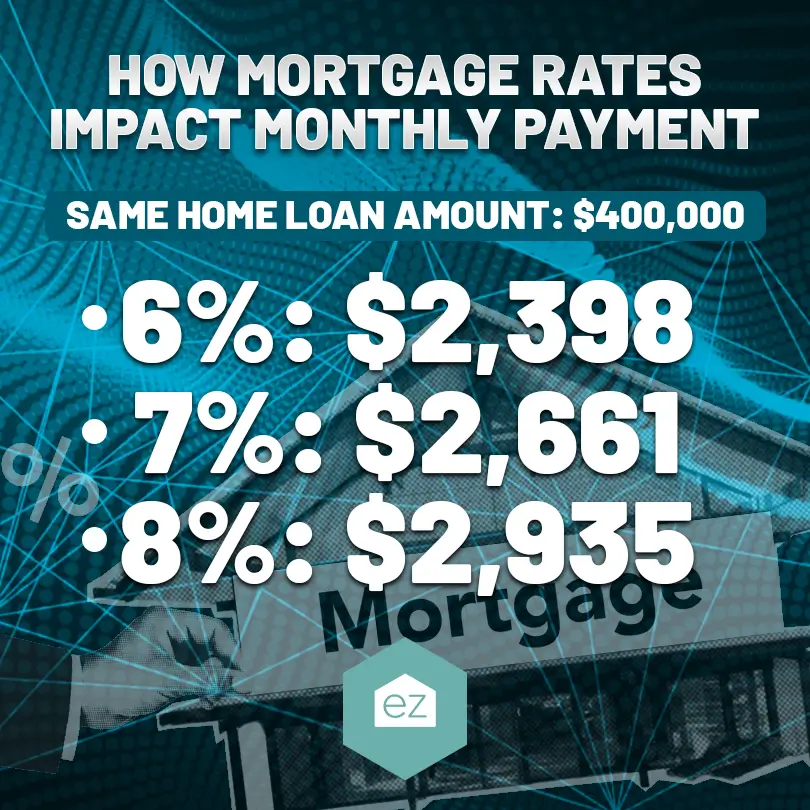

Home affordability has been severely impacted by higher rates, affecting both new and existing home sales markets. If the average mortgage rate hits 8%, a $400,000 home with 20% down and a 30-year fixed-rate loan would owe $2,348 monthly in payments before taxes and fees.

Higher rates are part of why nationwide home sales have been down by double-digits month after month this summer–15.3% in August 2023.

Builders, who previously benefited from the limited supply of existing homes for sale, are now greatly concerned about the impact of higher mortgage rates. In September, builder sentiment turned negative for the first time in five months.

The National Association of Home Builders, Mortgage Bankers Association, and National Association of Realtors joined forces in an open letter to the Federal Reserve Chair Jerome Powell. These industry leaders warn that the current fiscal policy is setting up a different economic crisis from the inflationary woes driving the policy over the last twelve months.

“Further rate increases and a persistently wide spread pose broader risks to economic growth, heightening the likelihood and magnitude of a recession,” wrote the organizations, “Sustained…increases in interest rates make [reducing shelter costs] more challenging by limiting lot development and home construction, exacerbating housing supply, and pricing out millions of households from the goal of homeownership.”

Home prices have surged by almost 30% since the initial days of the COVID-19 pandemic, while sales volumes have declined over 15% compared to 2022. Add onto that multi-decade high mortgage rates, and real estate experts have justified fears the lack of affordable housing will cause adverse ripple effects across the economy.

Is relief on the horizon?

It’s not all bleak forecasting. The Federal Reserve declined to raise its basis points in its September meeting, hinting it may do so at its next if the economy doesn’t turn around. However, the early economic indicators of a strong economy in early October 2023 give the Fed a reason to hold back or possibly start to drop its base rate.

According to Fannie Mae’s September 2023 housing forecast, mortgage rates will hover around 7.1% as 2023 closes. It projects 30-year fixed-rate loans to begin 2024 at approximately 6.8% and gradually decline to 6.3% by the end of the year.

This anticipated rate decrease would present a significant opportunity for aspiring homebuyers, enabling them to enter the market and fulfill their dreams of homeownership.

But the NAR says it would take double the housing inventory to bring relief to the current real estate market. With the housing supply lagging behind, that would be a tall goal to achieve. Easing mortgage rate pains could certainly help encourage homeowners to list their properties.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Mortgage News

April 2024 Mortgage Market Update

Mortgage News

Can A Reverse Mortgage Help You In Retirement?

Mortgage News

Mortgage Rate Update: Rates Increase In February 2024

Mortgage News