April 2024 Mortgage Market Update

Rates Hit New Yearly Highs in April

Homebuyers had more roadblocks to purchasing a home this month: ever-increasing interest rates. Where market experts had expected a gradual tapering, April bucked the prediction and headed the other way. As the month closes, experts now are wondering if their predictions of 5.5-6% by year’s end is on track.

Plus, the ever-rising rates are making it challenging for home buyers to afford a purchase. That’s leading sellers to adjust their prices.

Here’s what happened to mortgages in April 2024

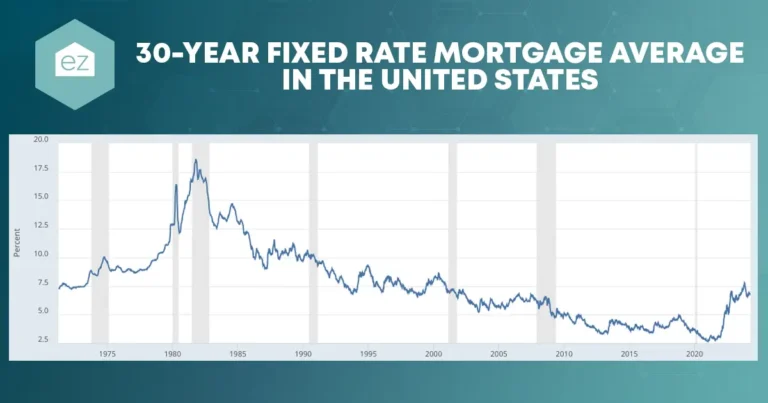

Benchmarking Mortgage Rates

Using Freddie Mac’s 30-year fixed-rate mortgage as a benchmark, April mortgage rates jumped back over a 7% average. That’s up 0.71% over April 2023 and above the 52-week average.

The rates are tracking with the 10-year Treasury Yield, which increased again during the month and approached a high point for the year. Part of that was in response to an inflation report that showed it’s sticking hard around the 3.5% mark.

The Federal Reserve and investors closely monitor the Personal Consumption Expenditures (PCE) index, which measures the costs of goods and services. When it goes up, so does the Treasury Yield, and usually the mortgage rates after it.

It combined to increase mortgage rates week over week across the board. This is not the news home buyers wanted to hear.

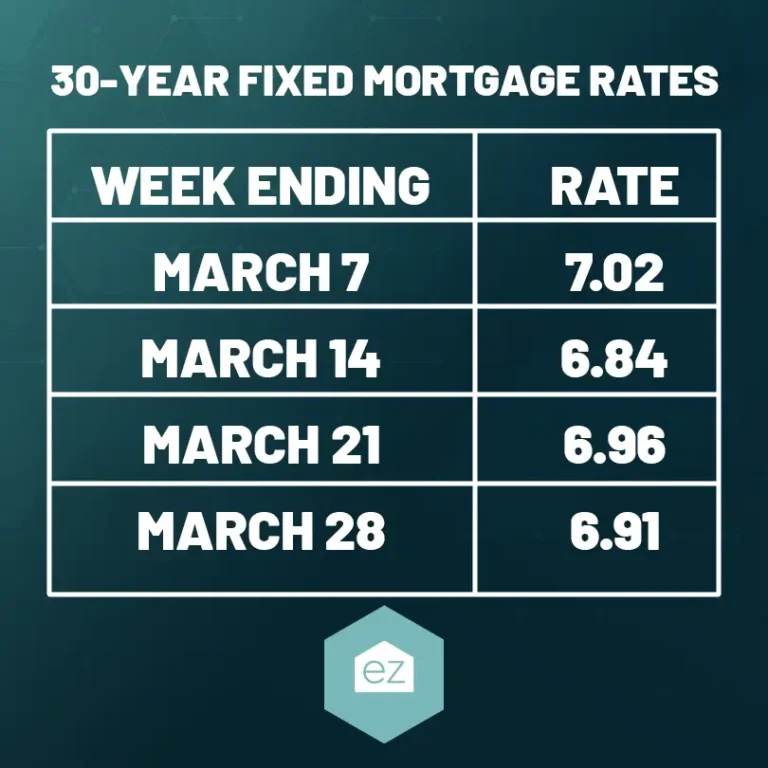

30-Year Fixed Mortgage Rates

Mortgage rates on the most common loan type spiked weekly to end the month solidly over 7%. It’s still off last year’s high of 8%, but if inflation doesn’t ease soon, returning to that mark is possible. These are the highest 30-year fixed rates of the year thus far.

| Week Ending | Rate |

| April 4 | 6.91 |

| April 11 | 6.95 |

| April 18 | 7.22 |

| April 25 | 7.3 |

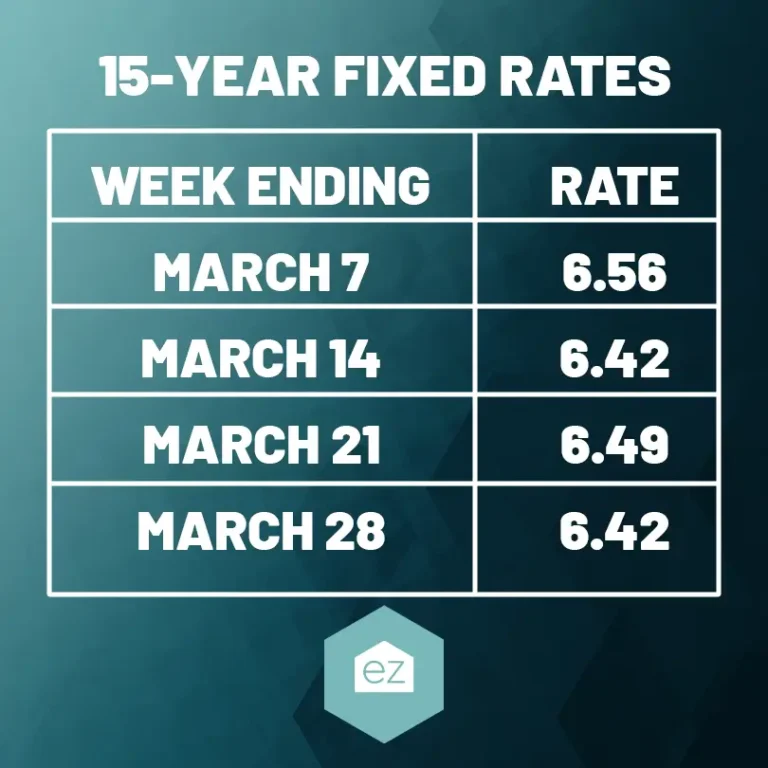

15-Year Fixed Rates

The 15-year fixed-rate mortgage rates fared little better. The figures also rose week-to-week, spiking from the second to third week after the updated inflation report. Again, these are the highest rates for this loan product in the year to date.

| Week Ending | Rate |

| April 4 | 6.36 |

| April 11 | 6.44 |

| April 18 | 6.66 |

| April 25 | 6.67 |

5/1 ARM

The only mortgage product to end the month than less it started, ARMs still saw their interest rates increase. ARMs have seen a surge of interest in the wake of higher interest rates. Their market share was up 7.6% in the third week of April.

| Week Ending | Rate |

| April 4 | 6.61 |

| April 11 | 6.45 |

| April 18 | 6.5 |

| April 25 | 6.53 |

30-Year Fixed Jumbo Loan

Those seeking nonconforming loans faced ever-increasing interest rates for their higher loan amounts. Like other loan products, it achieved its highest rate thus far in April.

| Week Ending | Rate |

| April 4 | 7 |

| April 11 | 7.09 |

| April 18 | 7.33 |

| April 25 | 7.35 |

Mortgage Applications

Initially increasing, the weekly application survey showed applications decreased by 2.7% from April 17 to April 24. The higher cost of borrowing hit across all loan products, and discouraged buyers from following their home purchase plans.

Future Mortgage Activity

The Federal Reserve’s next Federal Open Market Committee meeting is May 1. The chances of the FOMC cutting the rate look bleak as inflation persists despite a stabilized labor market.

Some are beginning to doubt that interest rates will come down to 5.5-6% by the year’s end. The higher rates could tamper with any real estate market growth, as buyers hesitate in the face of higher borrowing costs. Even a 1% change greatly influences their purchasing power.

March 2024: Rates Drop Slightly, But Still Near 7%

Home buyers waiting for mortgage rates to change will keep waiting this spring. Current market conditions have rates and applications holding steady during the early despite this being a busier time to buy in many southern markets. However, March did show an incremental decline in the going rates across mortgage products. That should be an encouraging sign that rates are heading in the right direction.

Federal Reserve Update

The Federal Open Market Committee held its basis rate position in its second meeting of the year, held on March 20. This decision aligns with economic experts’ position, with the release language still hinting that it may make marginal cuts later in 2024.

In the days following the meeting, the 10-year Treasury Bond and mortgage markets reported small rate drops but remained high overall. The rates rebounded in the last week of the month.

The decision signals that the current mortgage rates will likely hover near the 7% mark as spring proceeds and summer looms.

Where Mortgage Rates Headed

Using the 30-year fixed-rate application data from Freddie Mac, the government-backed institution placed the national rate at an average of 6.79% in the last week of the month. That may be lower than the prior week, but rates are still higher than last year. In March 2023, the average rate was at 6.32%.

Average rates were also higher for a 15% fixed-rate mortgage: 5.56% last year compared to 6.11% this year.

These average rates are calculated from conventional loans where the home buyers did make a 20% down payment and had an “excellent” rated credit score.

30-Year Fixed Mortgage Rates

The good news is that 30-year fixed-rate mortgage rates are less than where they started in March and consistently remained below February’s mortgage rates. However, they remain elevated and near the 7% mark. The going rate ended the month similarly to January 2024, which ended with a 6.92% average rate.

15-Year Fixed Rates

Like the 30-year fixed rate, the 15-year fixed mortgage saw rates decrease slightly from where March began. However, they remain elevated and are consistently near 6.5%. They did see some improvement from the prior month.

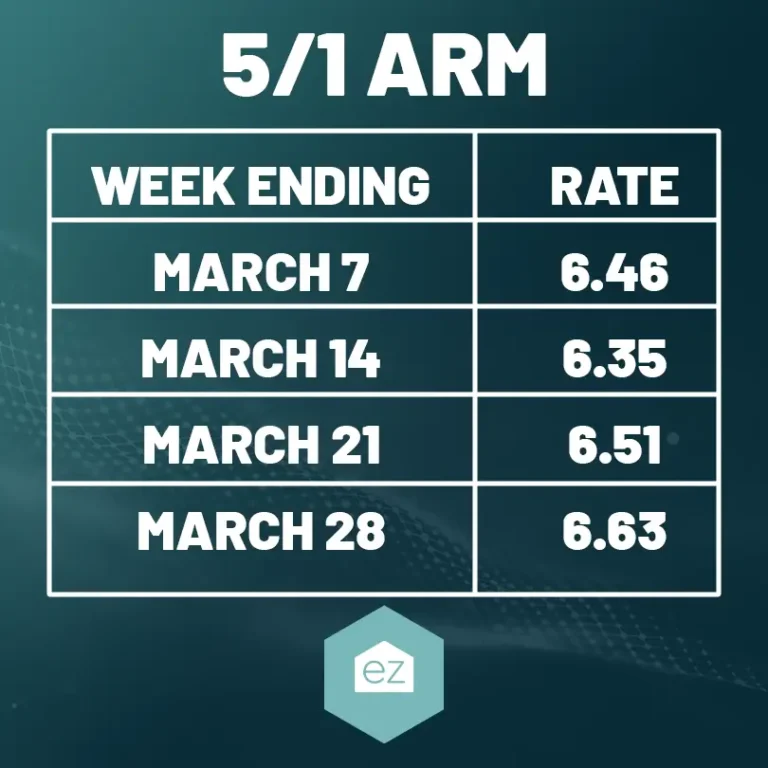

5/1 ARM

Unlike other mortgage products, the 5/1 ARM mortgage rates increased during March 2024. Applicants faced rates almost 0.25% higher by month’s end. Overall, ARMs were more expensive this month than in February.

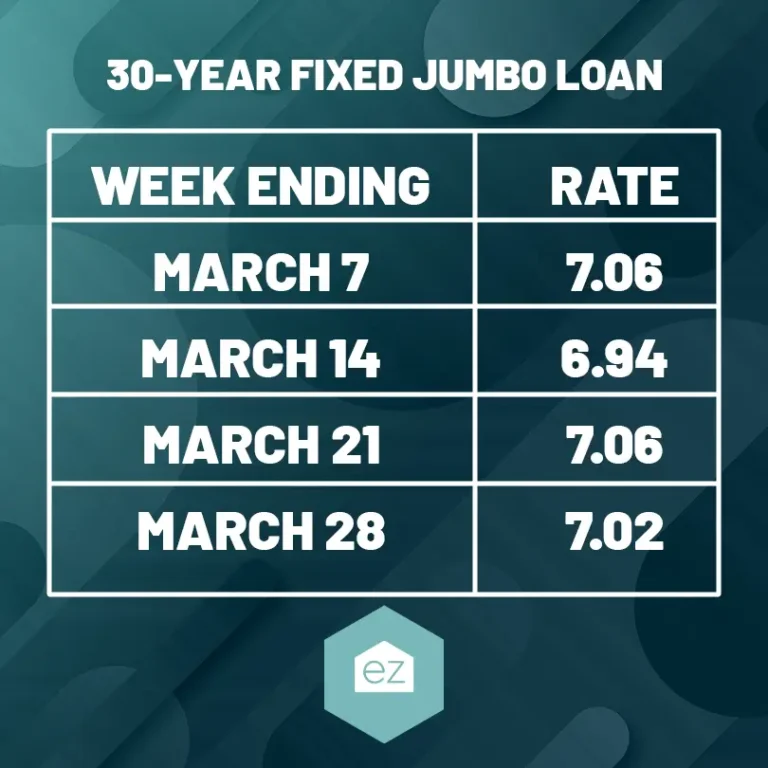

30-Year Fixed Jumbo Loan

Jumbo loans saw the most stability in their interest rates, starting and ending just 0.04% apart. And their rates were overall less than last month by about 0.1%.

Monthly Mortgage Applications

Tracking applications can signal an increase or decrease in the demand for homes. In many southern markets, the spring is their busiest season for transactions. Places like Arizona, Florida, and coastal Alabama or South Carolina typically experience increased demand from retirees looking for second homes or to relocate.

However, March’s nationwide application volume reported to the Mortgage Bankers Association shows buyers remained constrained by the higher prices and mortgage rates. Year-over-year, mortgage applications were down 16%, and week-to-week, they trended downward.

Where Mortgage Rates Are Going

Remember that mortgage rates change daily in response to the housing market and economic conditions, like the 10-year Treasury Bond. The Federal Reserve rate can influence this in the long term.

Inflation is still not quite at the 2% benchmark the FOMC would prefer, and costs are still increasing by over 2% a month, as shown in the Personal Consumption Expenditures Index. Therefore, its March decision to keep its rate stable should keep mortgage rates running on the same track at least through its next meeting in May.

The rates did incrementally slide downward in March 2024 but are still higher than last year. April’s mortgage rates will likely remain near 6.5-7% for the various mortgage products. Experts have said any changes will be gradual. It will not be as dramatic as when rates increased several percentage points over the year.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Mortgage News

Can A Reverse Mortgage Help You In Retirement?

Mortgage News

Mortgage Rate Update: Rates Increase In February 2024

Mortgage News

Mortgage Rate Update: Rates Stabilize In January 2024

Mortgage News