Mortgage Rate Update: Rates Increase In February 2024

Unfortunately for the year’s early home buyers, mortgage rates aren’t any more favorable than in January. In many cases, rates are up. How did mortgage rates fare in the second month of 2024?

Rates hit 6.9%

US Federal Reserve reported an average rate of 6.63% on 30-year fixed-rate products to start the month. The hope after the Federal Open Market Committee (FOMC) decided to keep its basis rate at the January 31 meeting was rates would stabilize for February. Unfortunately, prospective buyers seeking financing found rates increased throughout the month. By February 29, the average rate was reported at 6.9%.

These rates come from Freddie Mac based on weekly submitted applications from lenders nationwide.

The middle-of-the-month rate bump correlates to a jump in inflation and a hot labor market report. Even though the increase was statistically insignificant, it’s still enough to pull back on consumer spending and the lending market. Price hikes are causing people to pull back on spending.

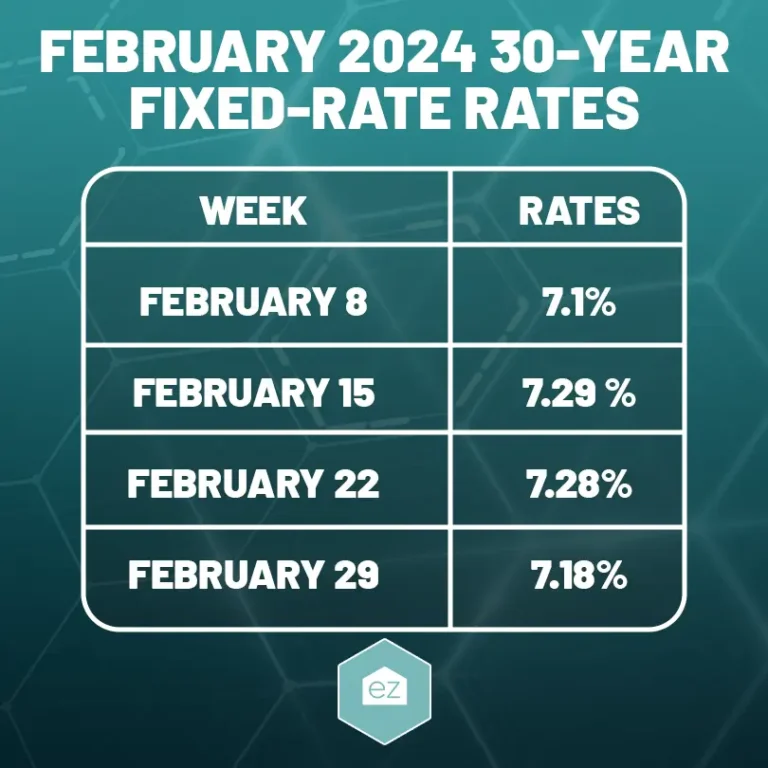

30-Year Fixed-Rate Mortgages

Using the 30-year fixed-rate mortgage as a benchmark, interest rates from private and governmental lenders remained elevated in February 2024. Looking at the reported average rate on these products reported at the end of each week, we see rates were consistently higher than last month.

This contradicts experts’ belief that the mortgage rates will trend lower in 2024. Following the 10-Year Treasury Yield, future mortgage rates should begin a gentle journey downward.

Rates were lower in January when the end of the month reported an average of 6.92%.

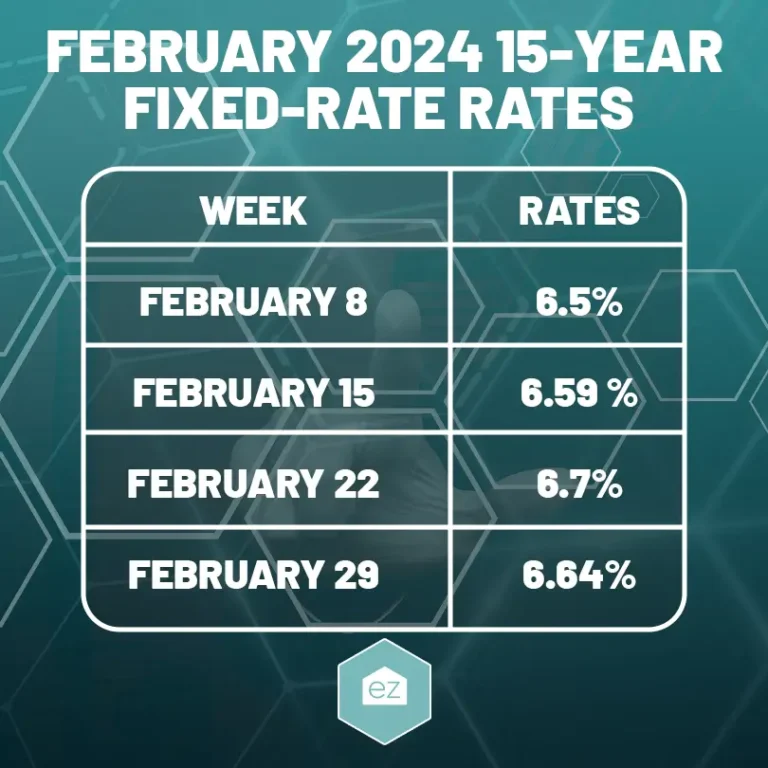

15-Year Fixed Rate

Rates on the 15-year loan product were more stable across February, with a slight uptick in the third week before pulling back in the final week. Still, these rates are also higher than when the month began. Applicants paid 0.14% more than when the month began for the 15-year home loan.

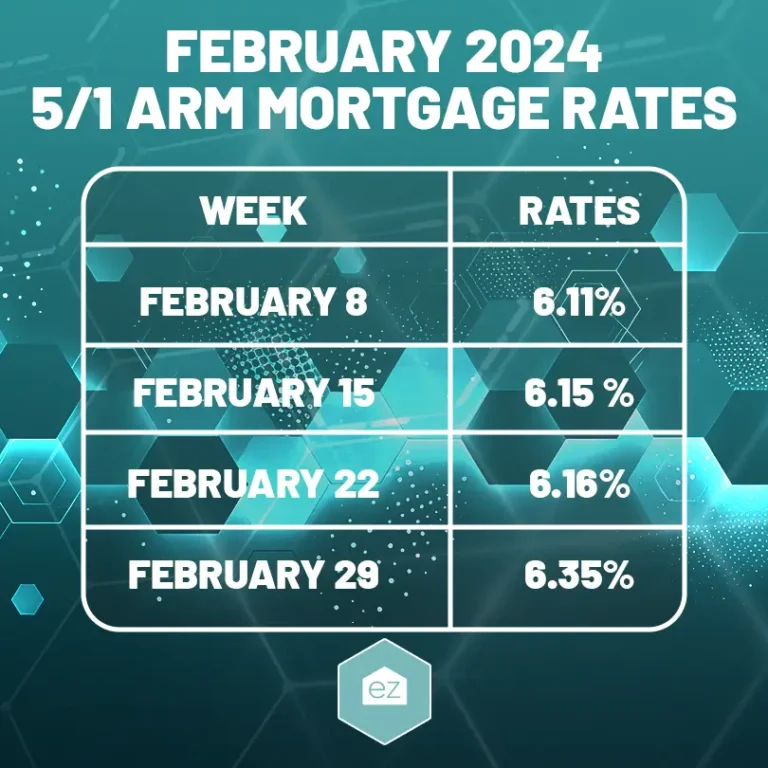

5/1 ARM

Adjustable-rate mortgages also had more stable rates throughout February but, like other loan products, ended higher for the month. Applicant rates were 0.25% higher than the first week of the month. The 5/1 ARM seemed more resilient against the mid-month inflation hike.

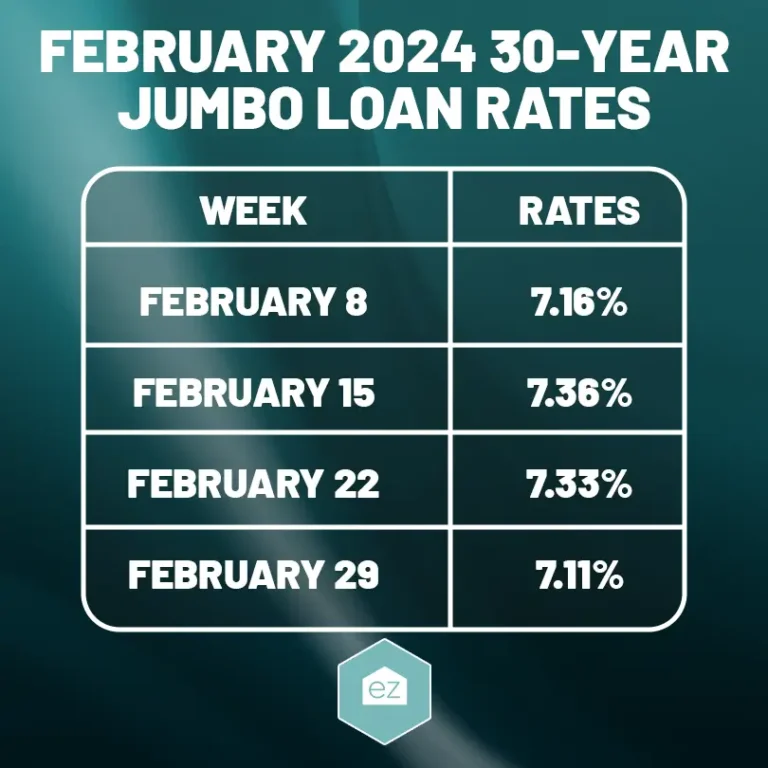

30-Year Fixed Jumbo Loan

The jumbo loan was the only tracked loan product that ended February more favorable than when it started. However, its rates increased by almost 0.2% in the middle of the month thanks to the inflation increase. Overall, it cost 0.05% less for a jumbo loan by month’s end.

Monitoring interest rates

Interest rates vary from the day-to-day, but a weekly snapshot is better at tracking trends. Borrowing to buy a home got more expensive in February 2024, which isn’t good news for home buyers who are expecting the rates to come down. Rates are above where they started the year.

Alternative loans, like the 5/1 ARM report, increased applications, but the 30-year loan remains the most in-demand product. The final tally on mortgage applications has yet to be out for February, but week-to-week tracking shows originations for purchase and refinancing products dropped week-to-week. On February 23, nationwide applications were down 5.6% from the prior week based on the Mortgage Banker Association’s (MBA) survey.

The Federal Reserve meets again in March, and the economists watching their moves anticipate another month of no change.

Overall, inflation is cooling, but the downward track won’t be smooth sailing. Expect a gradual downward trend with week-to-week hikes, as played out in February. Already for January 2024, personal consumption expenditures were up 2.4% from December 2023. The Fed uses this PCE index as the basis for its 2% inflation target.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Mortgage News

April 2024 Mortgage Market Update

Mortgage News

Can A Reverse Mortgage Help You In Retirement?

Mortgage News

Mortgage Rate Update: Rates Stabilize In January 2024

Mortgage News