Two Years Until the Housing Market Becomes Affordable Again

If you’ve been waiting on the sidelines to scoop up an affordable house in a more favorable market, it looks like you’ll be waiting some more. MorningStar is making a bold prediction for housing market affordability, saying it won’t look reasonable again until 2025.

How we arrived at stressed affordability today

Consider the three big levers influencing the housing market: mortgage rates, home prices, and income levels. Fortune says the last time housing affordability looked like it does in 2023 was back in 2006. That was the peak of the housing market bubble before predatory lending practices helped ignite the Great Financial Crisis of 2008-2009. That’s an ominous comparison for the current housing market.

But even with the drawn comparison, the state of the real estate market and the economy are in a much different place. For starters, some statistics estimate 46% of Americans are waiting to buy a home and are reporting that they’re not sure when they’re going to pull the trigger.

For Millennials, and now Zoomers, entering the housing market has been delayed by one economic challenge after another. It’s become a familiar refrain: wait to buy a home until you can afford it.

Yet a significant “dip” in median prices, mortgage rates, or buying power is rare. If you look at the average sale prices of houses sold in the United States, the housing market isn’t nearly as volatile as the stock market. Prices climbed steadily until 2006, for example. And even then, the “housing market crash” wasn’t the giant thud we saw in the stock market. Housing prices took a hit, but not a catastrophic downturn.

After the Great Financial Crisis, home prices remained low for a while. Then confidence eventually returned to the real estate markets, and home prices resumed their steady upward trajectory.

Then: COVID-19. In the wake of the pandemic, the explosion in average house prices was unlike anything we’ve ever seen in the housing market, even going back to the 2006 numbers. In a few short months, from 2021 to the end of 2022, the average price of homes sold rocketed up $100,000.

The explosion has been a financial thorn for renters waiting for housing affordability to improve. Income levels haven’t kept pace with the increasing prices, and higher inflation has eroded buying power.

While there’s been a recent stabilizing or dip in average home prices in some markets, it’s still not enough to return to even 2021 levels. Currently, the big picture of housing affordability is looking rough.

Will the housing market really recover in two years?

That brings us back around to the housing market recovery. According to the projection, three primary factors could improve the housing affordability outlook:

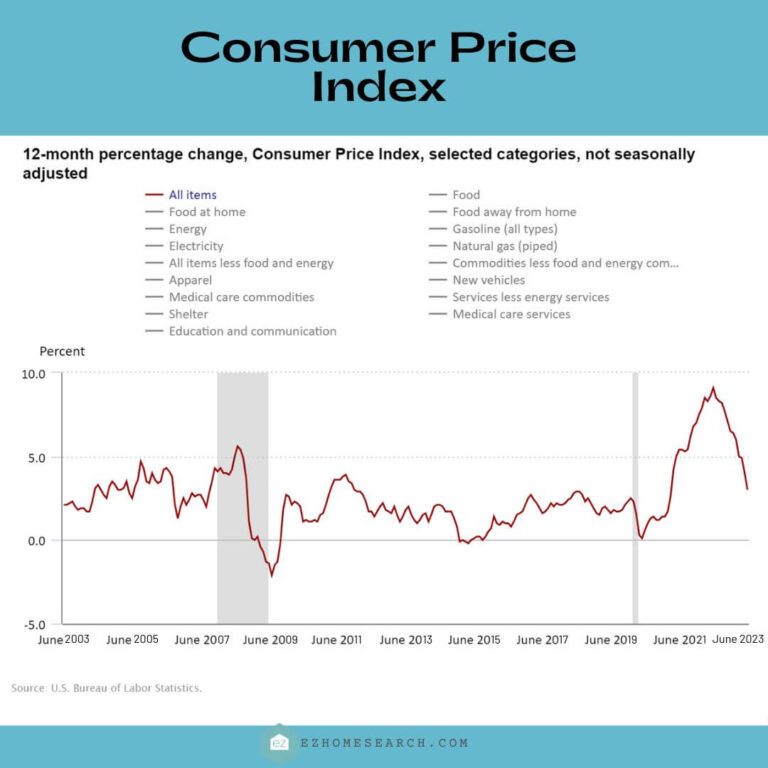

- Falling mortgage rates. In June 2023, falling inflation numbers have given market optimists a shot in the arm. If inflation is coming under control, the Fed may bring its interest rates back down. That eventually will bring about lower mortgage rates, one of the key factors in improving home affordability.

- Falling home prices. The St. Louis Fed numbers posted above show that housing prices peaked in 2022. History suggests housing prices don’t typically fall very far when they dip, meaning home prices may not correct much more but have stagnant price growth. But it’s still a variable to keep an eye on.

- Rising incomes. If home prices stay static and incomes gradually increase, that’s a net benefit to the home buyer. This economic lever is harder to see in the regular economy, particularly because of the interplay between the cost of living and rising incomes. But if individuals have more income at their disposal and lower inflation increases their buying power, swinging a home mortgage becomes more possible.

Tracking these variables should give us a hint where the economy, and housing prices in particular, are headed.

What Morningstar is saying about the economy

By analyzing these three factors, housing affordability may be headed for a massive rebound within two years. Morningstar believes that when it comes to the first lever (mortgage rates), consumers should expect them to fall in the second half of 2023. They think we’ll average mortgage rates of 6.25% in the second half of 2023. By 2024, they anticipate those rates will be down to 5%, then 4% in 2025. With every percentage point making monthly mortgage payments more affordable, this factor alone could help housing affordability.

They see a few other economic shifts that will influence this change: aging demographics, slowing growth in productivity, and increasing equality. These have kept interest rates low for some time (decades, according to Morningstar), and since they haven’t gone away yet, that downward pressure remains in the market.

Combine these economic factors with a dip in housing prices, and the Morningstar prediction for 2025 seems more reasonable. For now, the only thing to do is wait, save, and keep an eye on the economic trends to see where the interest rates and median home prices are heading.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate News

New Laws Taken Action On Rising Squatting Reports

Real Estate News

White House Proposals Aim to Boost Housing Supply

Real Estate News

NAR Settlement Set to Reshape The Business of Real Estate

Real Estate News