Federal Reserve Maintains Rate–What Does That Mean For Mortgages?

The Federal Reserve opted to maintain its current base interest rate of 5.5 points in its final meeting for 2023. That signals current mortgage rates will likely hold steady around their 7% averages as the market transitions into the new year. But, some good news may be on the horizon for home buyers based on what the Fed indicated in its conference.

Federal Reserve Meeting Acknowledges Progress

Acknowledging that economic indicators were strong and inflation was easing, the Federal Open Market Committee (FOMC) emphasized its goal to return inflation to 2% over time. As of November, the Consumer Price Index demonstrated inflation for all items, which stood at 3.1%, down from its 9% spike last year.

The Committee plans to reduce its holding of Treasury-backed Securities, including agency mortgage-backed Securities.

In making their decision, the Federal Reserve Committee looks at a combination of data. With low unemployment rates, moderating job gains, and easing inflation, the current financial system is strong. It also weighs job and wage growth when setting monetary policy.

The FOMC further recognized how higher lending rates are causing reduced business investment and causing sales in the housing market to moderate.

Future inflation forecast

To see where the housing market interest rates may go, watch inflation. The Federal Reserve’s current fiscal policy is intended to bring the rate closer to 2%.

The FOMC members projected that inflation will finally get closer to this mark in 2024. It also feels consumer consumption, as measured by the CPI, will drop to 2.2% in 2025 and hit the 2% target in 2026.

Currently, their release notes that elevated prices remain a challenge. Notably, shelter costs–mortgage and rent–were up 6.5% unadjusted for the twelve months ending November 2023. Month-to-month costs increased 0.4%.

Future interest rate changes

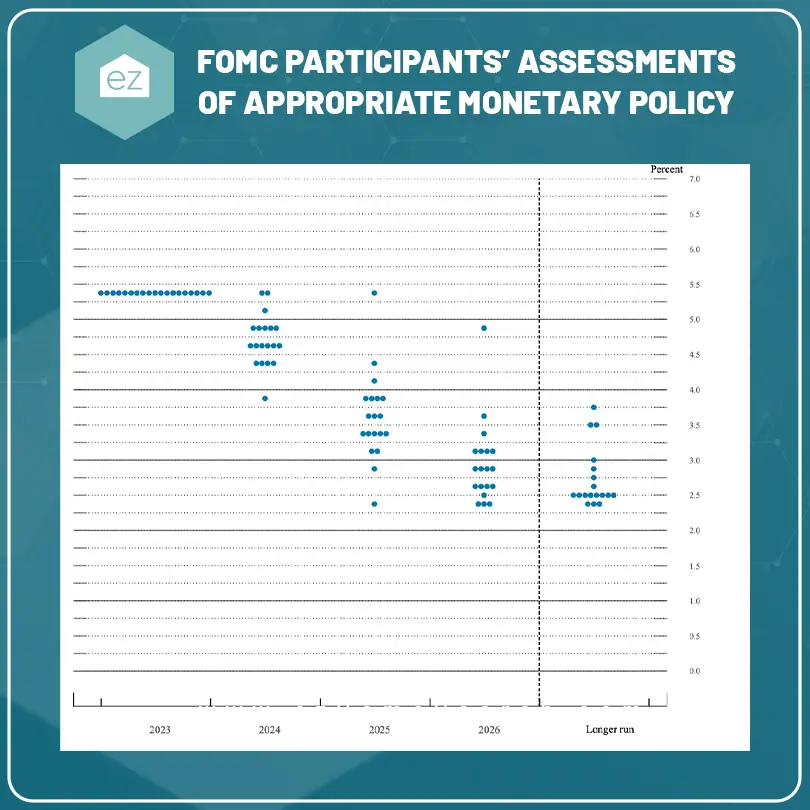

To gain insight into what the Federal Reserve may do, the “dot plot” charts individual committee members’ thoughts on policy for the next three years. The consensus hints that the FOMC will begin recommending pulling back its base rate. The bank is tracking for a median rate of 4.6% by the end of 2024, which would be achieved with three rate cuts.

The FOMC recognizes that hanging onto its higher basis rate for too long could endanger the economy. Continued increasing expenses could outpace what every day Americans earn in income, as we’ve already seen in the 2023 housing affordability index.

However, as Chairman Jerome Powell noted in the post-meeting conference, “While participants do not view it as likely to be appropriate to raise interest rates further, neither do they want to take the possibility off the table.”

The Impacts on Housing in 2024

The Federal Reserve’s basis rate does not directly influence the mortgage industry rates. However, there is a correlation because of the 10-Year Treasury Yield, a bond issued by the US government that guarantees repayment of borrowed money plus interest. It often serves as a benchmark for other borrowing rates, including the mortgage industry.

A day after the FOMC meeting, the 10-year Treasury Yield fell to 3.95%. It’s the first time it’s dropped below 4% since August.

Since the Yield and Mortgage Rates often correlate, mortgage rates will also likely adjust downward in the coming weeks. Freddie Mac’s 30-year fixed-rate mortgage for the week of December 7 averaged 7%, down from 7.8% six weeks prior.

So, homebuyers can anticipate some easing in affordability challenges in the months ahead if the FOMC sticks to its intention to lower its basis rate.

However, mortgage rates are unlikely to drop closer to the 3% rates keeping many existing homeowners put. Instead, industry experts anticipate mortgage rates ending the year around 5-6%. Still, that could help spur sales activity as Americans adjust to the idea of higher mortgage rates.

Even a 1% decline in interest could help increase affordability. Here’s how an interest rate drop reduces monthly payments on a $300,000 30-year fixed-rate home loan.

| Interest Rate | Monthly Payment* |

| 7% | $1,996 |

| 6% | $1,776 |

| 5% | $1,610 |

*Does not include taxes and interest

What to Watch

The first FOMC meeting of 2024 is January 30-31. The Fed made no commitments to make its first cut at this meeting. To make that determination, it will watch the CPI, GDP, and labor reports from the end of the year. The Fed also watches closely for signs that the US economy is heading for a recession.

The interest rate is just one lever pulling at the US housing market. Wage growth matters, as does the amount of inventory. Low levels but sustained demand for housing keep pressure on price appreciation, affecting how much home Americans can afford. If mortgage rates lower, it could encourage more people to buy homes. Without more homes for sale, this would exacerbate housing challenges.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Mortgage News

April 2024 Mortgage Market Update

Mortgage News

Can A Reverse Mortgage Help You In Retirement?

Mortgage News

Mortgage Rate Update: Rates Increase In February 2024

Mortgage News