Market Alert! Mortgage Rates Reach New Highs

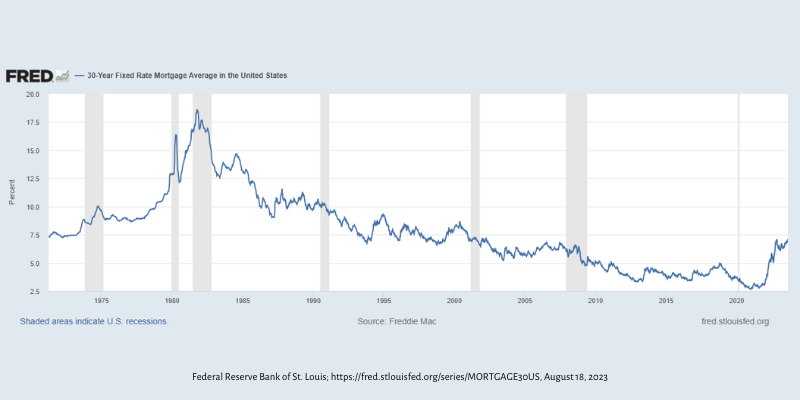

In more distressing news for homeowners waiting for affordability to improve, mortgage rates achieved a new record this week. With the 30-year fixed rate reaching 7.09% the week of August 14, rates are now at their highest in 22 years.

Freddie Mac released its update on Thursday, noting that the last time the rate was this high was in April 2002. At the same time last year, the 30-year mortgage rates were at 5.93%. Just last week, it averaged 6.93%. The average was at its lowest in February 2023, when it was 6.09%.

The rate on 15-year fixed rates was at 6.46%, an increase from last year’s 4.55%.

The government institution figures the average mortgage rate based on the applications it receives each week from lenders across the nation. Notably, it only includes applications with buyers putting 20% down and with excellent credit.

Better market performance

Homebuyers hoping that a recession and an improving economy would ease interest rates have been sorely disappointed.

In a release, Sam Khater, Freddie Mac’s Chief Economist, said that the 10-year Treasury Yield has increased, which trickled over into the mortgage market. He also cited the nation’s low housing inventory as more of a root cause behind affordability challenges than mortgage rates.

There was also hope that the Federal Reserve would begin backing off its policy of raising its basis rate to combat inflation. But last month, the Fed announced another 0.25% basis point raise, bringing its rate to 5.5%. That was also its highest level in 22 years.

While the Fed believes its aggressive rate raises have worked to clamp down on a potential economic recession, it still sees inflation as too high. Chairman Jerome Powell hinted that the Reserve might raise its basis rate again at its next meeting.

The Federal Reserve doesn’t directly impact the mortgage industry, but its moves have trickle-down influences. Not only does it erode a potential buyer’s overall purchase power by making goods and services more expensive, but the rates tend to track with Treasury yields, which move based on the Fed’s actions.

Owners pay more each month

Even if the root of housing affordability lies in the pervasive undersupply of homes, it’s still more expensive to buy than a few years ago.

With median single-family homes priced at $410,000 in July 2023, a 30-year fixed-rate mortgage with a 7.09% rate and 20% down will run about $2,184 monthly. In comparison, a 3.5% fixed-rate mortgage had a monthly payment of $1,473. That’s a huge difference for home buyers, who also have to tack on property taxes and insurance.

Mortgage rates for the 30-year fixed rate reached 7.08% in November 2022 but fell about 1% after, giving homebuyers and homeowners hope that market affordability was improving. Unfortunately, mortgage rates have been on the rise since June.

The current dynamics continue to restrict supply. Homeowners with 2-3% mortgage rates that don’t need to move are staying put, with one recent survey finding that 90% of homeowners have a mortgage rate of 6% or less.

This is reducing the resale inventory and further pushing housing prices up. Further proof is in the current real estate market numbers, as existing home sales were down 18.9% nationwide in June 2023. It’s a cycle with no end currently in sight.

What to watch

Mortgage rates are influenced by the 10-year Treasury yield, which has recently been on the rise. The 10-year yield rose to 4.3% this month. This rate spike comes as the Federal Reserve considers keeping interest rates higher for longer to manage inflation. This is a key metric to watch for those concerned about where mortgage rates are heading.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Mortgage News

April 2024 Mortgage Market Update

Mortgage News

Can A Reverse Mortgage Help You In Retirement?

Mortgage News

Mortgage Rate Update: Rates Increase In February 2024

Mortgage News