Strategies to Improve Your Debt-to-Income Ratio

Are you looking to buy a new home or refinance your current mortgage? If so, pay attention to your debt-to-income ratio (DTI). Lenders use this factor to determine your creditworthiness and ability to make timely mortgage payments. The end result? The lower the DTI, the better the loan terms. Anything you can do to improve your debt-to-income ratio makes approval for the loan amount you want more likely.

So, how can you get to a better DTI? We break down what to know about the debt-to-income ratio and drop a few tips to lower that number.

What is DTI?

The debt-to-income ratio assigns a fast and easy number for a simple question: how much do you owe compared to what you bring in?

In other words, it compares your monthly debt payments to your monthly income. A lower DTI means you earn more than you owe, which lenders consider favorable when you’re asking to borrow hundreds of thousands of dollars. On the other hand, a high DTI hurts your chances of getting approved for a home loan or, if a lender does opt to work with you, may result in higher interest rates.

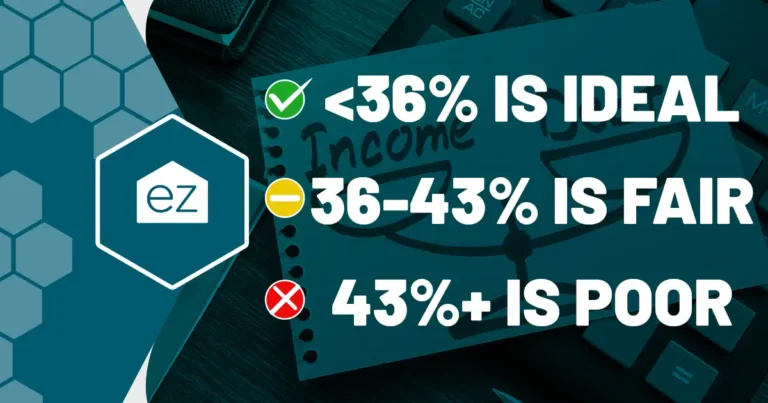

A low debt-to-income ratio is considered to be 36% or lower. This is the sweet spot that many lenders look for when evaluating loan applications. If this is you, you’re welcome to improve your DTI, but chances are you’re already on the pathway to qualifying for the best loan terms.

What if your DTI falls between 36% and 43%? This score is considered fair but indicates some potential for financial strain. Lenders will determine why the DTI is higher and if it’s within acceptable limits for them.

Score beyond 43%, and you’ll definitely want to take measures to improve your loan qualifications and overall financial well-being.

Perks of having a low DTI

Now that you know what a DTI ratio is, let’s talk about the benefits of having a low DTI.

-

Better loan terms: A low DTI means you are a lower risk borrower. Lenders may offer better interest rates and loan terms as long as your credit history and score match up. This can save you thousands of dollars over the course of your mortgage.

-

More lender options: With a low DTI, you have more flexibility when choosing a mortgage lender. Shop around for the best rates and terms without worrying about being limited in your funding options.

-

Easier budgeting: With less debt to worry about, it becomes easier to budget and plan for future expenses. This can give you peace of mind and help you reach other financial goals, such as retirement savings or a dream vacation.

What factors into the debt-to-income ratio?

DTI is calculated by dividing your monthly debt payments by your gross monthly income. The “debt” side includes:

-

Credit card bills (the monthly minimum)

-

Auto loans

-

Student loans

-

Rent or monthly mortgage payment

-

Alimony or child support

What’s not included are things like:

-

Utilities

-

Groceries

-

Insurance premiums

-

Phone bills

These are considered living expenses and not recurring debt.

Your gross monthly income is your total income before taxes and other deductions. Factor in any self-employed or side job income.

Ways to Lower Your DTI

If you have a high DTI, don’t worry! Pick and choose from the following strategies to lower it.

Pay off existing debts

Less debt means lower DTI, so if you can, pay some off! Plus, paying off debt means you’ll have more disposable income to put towards your dream home.

Depending on what and how much you owe, paying down debt is a longer-term strategy. So, what do you pay down first to gain the most benefit in the shortest amount of time? Generally, financial experts recommend two strategies for paying down debt.

Snowball method: Pay off your smallest debts first. As that is paid off, roll that amount into the next largest payment. When that’s paid off, move onto the next larger ones.

For example, you owe $100 a month on a furniture loan. Focus on paying that off, then add that $100 a month you were paying to your $363 car payment.

This can give you a sense of accomplishment and motivation as you check off debts from your list.

Avalanche method: Focus on paying the debt with the highest interest rate first and work your way down. High interest payments can compound what you owe, making it harder and taking longer to pay down your principal. This method saves you more in the long run, but it may take longer to see progress on the DTI ratio.

Increase your income

More work, you say? Not necessarily. Maybe it’s time to evaluate your contributions at work, especially if you haven’t had a cost-of-living or performance pay raise in a while. Any additional income boosts your DTI, making you a more attractive loan candidate.

But you could consider taking on a side job if asking for a raise isn’t in the cards for your employment situation. Many skills work with today’s gig economy to make a little more cash every month. And if that extra cash flow helps you save up for a down payment or pay off debts? A double win!

Keep credit card balances low

High credit card balances quickly dent DTI ratios. Lenders see maxed-out credit cards as a sign of financial stress and may consider you a higher-risk borrower.

Try not to overextend your credit card debt. Aim to use less than 30% of your available credit limit if possible. It’s tempting to put larger purchases on the card for the points, but ask yourself: can you pay that big ticket item off within a reasonable time?

If you struggle with keeping credit card spending in check, why not move to paying in cash? Sure, it’s unconventional these days, but having to physically hand over funds anytime you buy groceries or other goods does keep spending in check.

Refinance existing debts

If you have an auto loan or high-interest-rate credit card debt, look into refinancing options to lower your monthly payments. This can free up some cash flow and improve your DTI. Just be cautious when refinancing a mortgage, as there may be additional fees and costs involved.

Practice good financial habits

Never letting your DTI get out of hand is the best way to keep it low in the first place. That requires consistent, good financial habits, like:

-

Making timely payments on all your debts

-

Avoiding taking on more debt than you can handle

-

Regularly checking your credit report for any errors or discrepancies

-

Tracking your spending and creating a budget

Knowing where your money is going at all times. In this way, you’ll always know your debts and never let your DTI get out of whack.

Debt-to-income is just one factor

Remember, DTI is just one piece of the puzzle lenders assemble when determining if you’re a good borrower. Credit scores, credit history, and employment history also play a significant role.

But lowering your DTI does boost the chances of securing better home loan terms or even qualifying for a mortgage in the first place. Plus, keeping a low debt-to-income ratio leads to financial stability. It helps you achieve goals like buying a home, saving for your kid’s college, or buying that fancy vacation for your 50th birthday.

Changing the ratio takes time and effort, but the benefits of a low DTI are well worth it in the long run. Don’t be discouraged if your DTI is above 36%. Start implementing these tips today and watch your DTI improve over time!

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Mortgage News

April 2024 Mortgage Market Update

Mortgage News

Can A Reverse Mortgage Help You In Retirement?

Mortgage News

Mortgage Rate Update: Rates Increase In February 2024

Mortgage News