Fewer Buyers Using Temporary Rate Buydowns

Home buyers have multiple tactics to make purchasing a home more affordable. Among them are temporary rate buydown mortgages, a special program offered mostly by nonconforming lenders. Activity for these types of loans surged in late 2022, but a recent report showed applications have slowed in the last six months.

What is a temporary rate buydown mortgage?

As explained by Freddie Mac, home buyers enjoy a reduced interest rate for a set period no longer than three years with this type of loan. The duration and extent of the rate reduction will vary depending on the specific mortgage chosen. For example, the popular “2-1” buydown allows homebuyers to pay two percentage points less in interest for the first year, followed by one percentage point less in the second year, before settling at the full rate after that. Other options include the “3-2-1,” “1-0,” and “1-1” buydowns.

The cost of the rate difference is also paid upfront, whether by the builder, seller, owner, or another party.

It’s important to note that regardless of the type of buydown chosen, lenders assess the homebuyers’ eligibility based on the market’s full interest rate.

These are not like adjustable-rate mortgages, which change periodically throughout the life of the loan. A temporary rate buydown still pays a fixed rate; what changes is who buys down the interest rate. Nor are they discount points, which permanently reduce the monthly mortgage payment, but at more incremental amounts.

Temporary rate buydown loans were last popular in the previous big mortgage rate spike in the 1970s and 1980s. Today, this loan product represents a small fraction of the mortgage market as funded by Freddie Mac–only 2.8% of its loans in June 2023. The study did not include loans backed by Fannie Mae or other lenders.

Temporary rate buydowns increased with interest rates

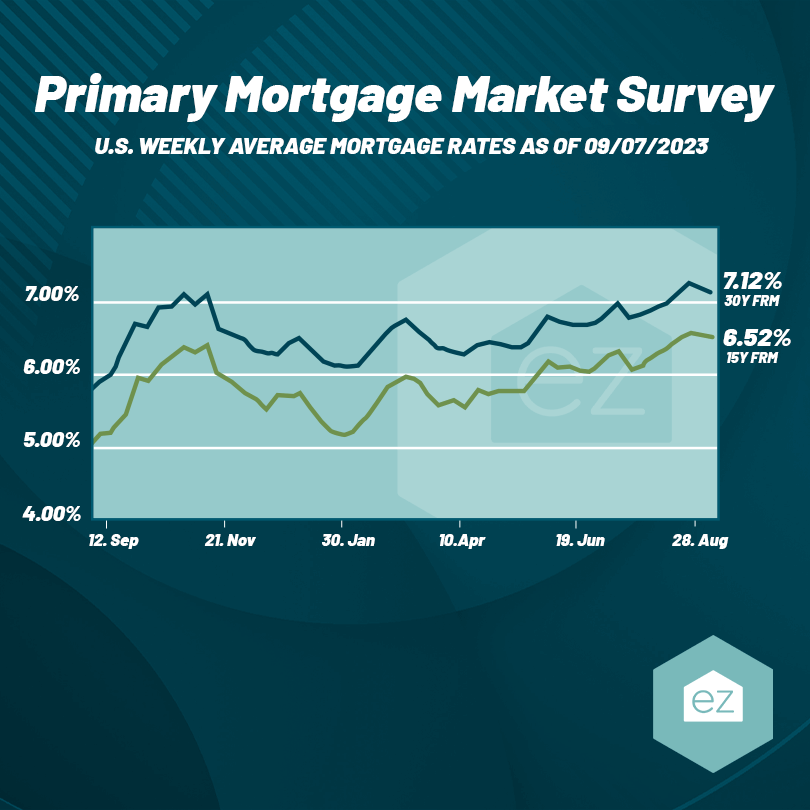

When average mortgage rates surpassed 6% for the first time in over a decade, more buyers opted to pay extra upfront to lower their monthly payments during the initial years of their mortgage. The peak of activity for temporary rate buydowns was 7.6% in December 2022–still a small fraction of the market. So why has buyer sentiment towards these loan products eased since then based on the Freddie Mac loan activity analysis?

It suggests a growing willingness among homebuyers to invest in long-term savings. Homeowners who bought into a temporary buydown mortgage between June 2022 and June 2023 ended up with interest rates averaging 15 basis points higher. For those doing the math, it wasn’t working in their favor.

Another factor is homeowners turning to other ways to find cost savings in their interest rates, like paying for points or upping their down payment. Around 45% of home buyers in 2022 purchased points on their mortgage to lower their monthly payments.

Who provides temporary rate buydowns

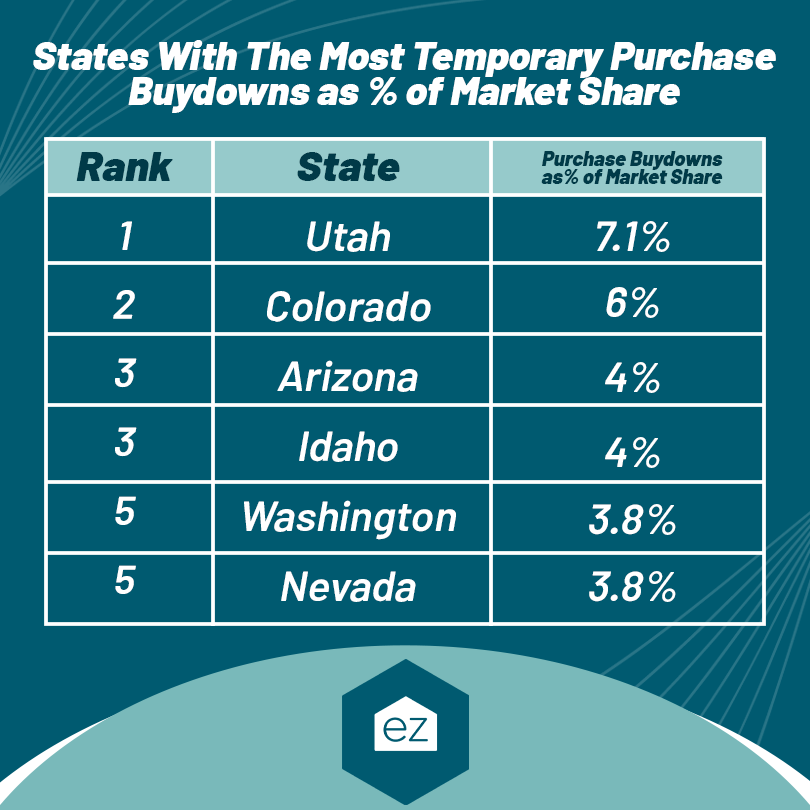

These niche products are more common to particular regions and lenders. Notably, around 12 lenders initiated 80% of the temporary buydowns from June 2022 to June 2023. Temporary rate buydowns were more popular out West, with Utah and Colorado having the highest number of initiated buydown loans.

That may be because homebuilders can leverage these products with their mortgage company affiliates to make the cost of a new home more appealing. The builder “discounts” the interest rate at closing by depositing the amount in an escrow account the loan company draws on for the buydown period. Since the West has reported more new home construction activity, it makes sense there would be more of these loans in that region.

The government-sponsored mortgage companies, Fannie Mae and Freddie Mac, have set limits on seller concessions and temporary buydowns. These limits depend on the size of your down payment. In addition, Fannie and Freddie have capped temporary buydowns at a maximum of three years, and the year-over-year change in the interest rate can’t jump more than one percentage point a year.

With higher mortgage rates likely to stay through the remainder of 2023 and into 2024, leveraging temporary rate buydowns to encourage buyers may be more common again. That’s especially true as existing home inventory lags and those tired of waiting are turning to new construction properties.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate News

New Laws Taken Action On Rising Squatting Reports

Real Estate News

White House Proposals Aim to Boost Housing Supply

Real Estate News

NAR Settlement Set to Reshape The Business of Real Estate

Real Estate News