Mortgage Rates Locked In Over 7% For Now

In more challenges for home buyers and real estate investors, mortgage rates keep floating above 7%.

Mortgage lenders were offering 30-year fixed rates averaging over 7.5% as of September 21, the highest in over 22 years. Although there are some adjustments for discount points, many loans are being quoted with points, resulting in slightly lower rates being reported than this figure. And average borrowers–those without the highest credit scores–are even facing rates higher than that.

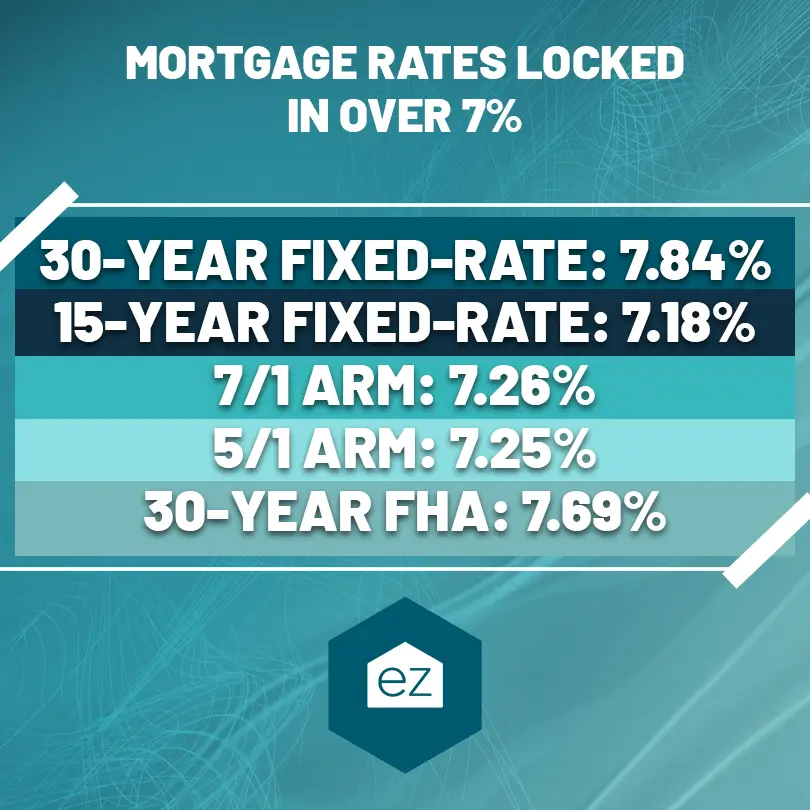

Mortgage rates are high across the board

For 30-year fixed-rate mortgages with an 80% loan-to-value ratio and a 700-760 FICO score, the average rate was 7.84%. On September 21, that was 7.92%, a multi-decade high. Even government lender Freddie Mac had its highest reading since June 2011, at 7.23%. That’s higher than the last time rates broke a 20-year record.

15-year fixed-rate mortgages also touched record highs, reporting an average 7.18% rate for the week of September 25.

As of September 26, the national average mortgage rates on new purchase home loans were:

- 30-year fixed-rate: 7.84%

- 15-year fixed-rate: 7.18%

- 7/1 ARM: 7.26%

- 5/1 ARM: 7.25%

- 30-year FHA: 7.69%

Refinancing rates were also near record highs and above new purchase rates.

- 30-year fixed-rate: 8.16%

- 15-year fixed-rate: 7.26%

- 10-year fixed: 7.21%

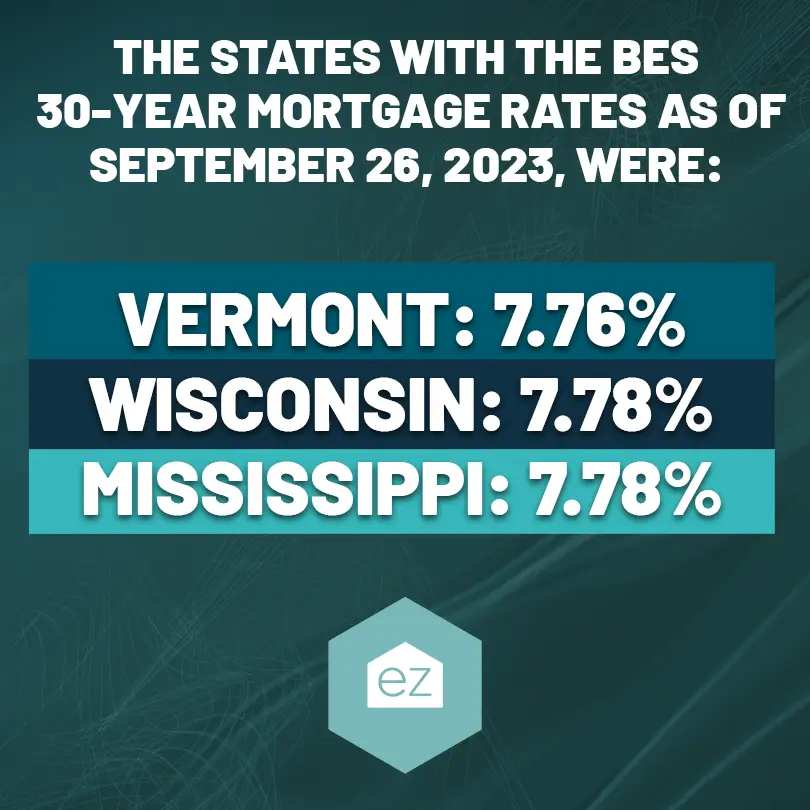

The states with the best 30-year mortgage rates as of September 26, 2023, were:

- Vermont: 7.76%

- Wisconsin: 7.78%

- Mississippi: 7.78%

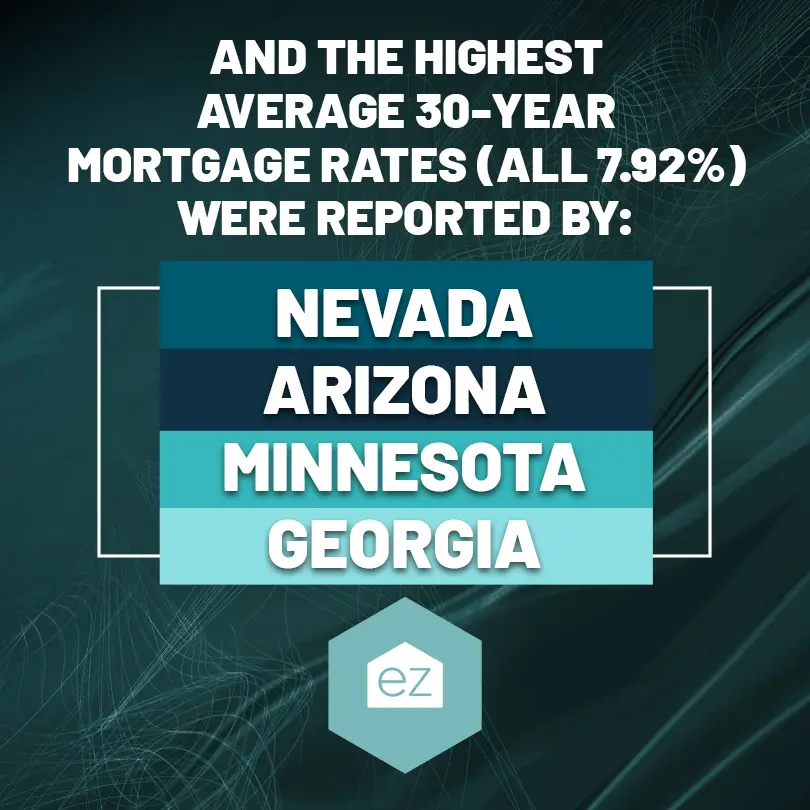

And the highest average 30-year mortgage rates (all 7.92%) were reported by:

- Nevada

- Arizona

- Minnesota

- Georgia

Inflation is keeping borrowing costs high

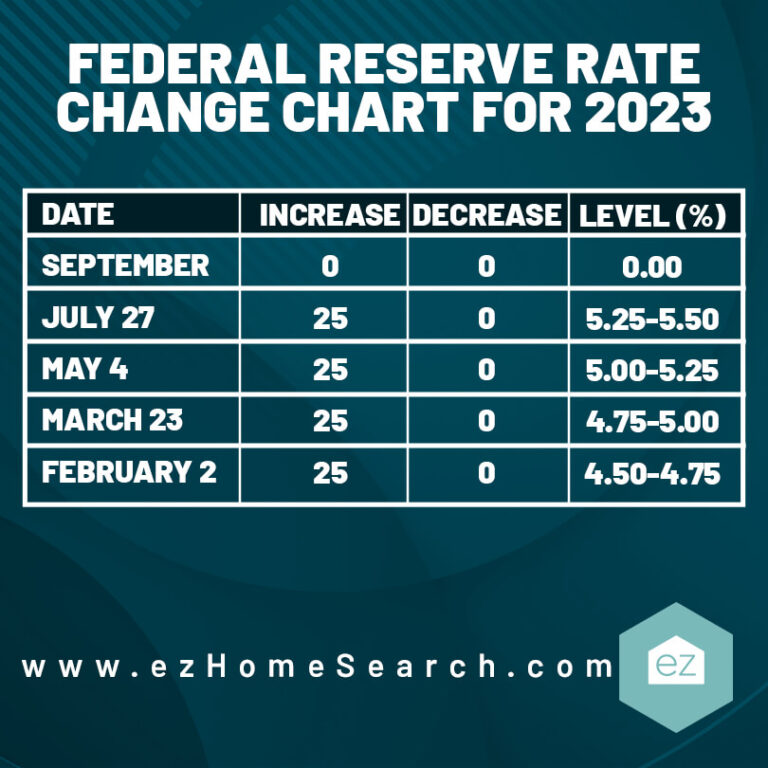

There had been fears the Federal Reserve would raise its basis points in the September meeting, as it indicated it might after the July 2023 meeting. However, the Fed held off on a rate hike. Chairman Jerome Powell said it wouldn’t be off the table for its next meeting if high inflation persists.

Despite a slight decrease, inflation remains above target, leaving room for the Fed to potentially raise rates and impact borrowing costs. Progress on economic indicators like gross domestic product (GDP), personal income, and unemployment may offer some relief on mortgage rates, but there hasn’t been enough change to date.

Any further rate hikes from the Fed could lead to continued mortgage rate increases in 2023. That’s because the mortgage industry tracks with the 10-year Treasury Yield and the bond market.

The Federal Reserve has two more rate-setting meetings for the year: November 1 and December 13. Both bear watching as they will set up how the housing market may perform in 2024.

Housing prices aren’t helping

Traditional economic sensibilities say as borrowing costs increase, maintaining the current sales activity requires sellers to adjust prices downward to keep buyers interested.

As home buyers know, this isn’t the case. Housing inventory is strained across the states and has dropped in sync with the shrinking buyer pool. That’s keeping pressure on housing prices. The one-two punch of appreciating housing prices and high mortgage rates is keeping more homes off the market, creating a continuing cycle for would-be home buyers.

Lower mortgage rates may not be good news

If mortgage rates do finally drop below 7% or even 6%, that might have the opposite impact on the local housing market. More buyers could jump on the more affordable rates, but with the supply of homes under three months in many markets, that would reduce the housing stock further. The National Association of Realtors reported a 3.3-month supply of inventory for August 2023.

In turn, because the market already had too few homes to start with, home prices would keep rising in response to demand. It could feel like the pandemic-era market all over again, with double-digit appreciation and above-asking offers.

Mortgage rates in perspective

If it makes you feel any better, 1981 was the worst year for mortgage rates, which averaged 16.6%. The all-time high was 18.63%.

However, given how half of today’s citizens were born on or after 1981, most home buyers have never experienced such high rates.

Most experts feel the rates won’t rise as dramatically high as this. Still, home buyers are feeling the pinch in today’s inflation era and with housing affordability a real challenge.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Mortgage News

April 2024 Mortgage Market Update

Mortgage News

Can A Reverse Mortgage Help You In Retirement?

Mortgage News

Mortgage Rate Update: Rates Increase In February 2024

Mortgage News