Florida Real Estate Market Update

February 2024: Spring Sales Start Off Steady

Spring showers usually bring more than wildflowers to Florida. Home sales activity also picks up as our friends from the north come southbound looking for vacation, part-time, or full-time homes. They join those already on a hunt for their Florida dream home. The February 2024 report from the Florida Realtors indicates a small uptick in home sales while pricing growth stayed strong.

Single-Family Home Sales

The month reported 2.2% more homes closed year-over-year, a modest growth for the start of the “busy” season. However, buyers paid 5.1% more for single-family homes, to the tune of $415,000. Those homes received 96% of their list price.

Home buyers did take more time to buy, with the time to contract growing from 43 to 47 days. The median time to sell also increased in step.

Buyers should feel encouraged as more listings come to the market. The 28% year-over-year (YOY) increase was welcome and helped grow the existing inventory to 37%, bringing the months’ supply of inventory to 3.9 months.

Townhomes and Condos

This market segment saw its closed sales drop 2.5% YOY. Still, demand remained, as median sale prices reached $325,000, or 3.2% more than last year.

Overall, homes in this category moved slower this month. The median time to contract was 35% more than February 2023, and the time to sell increased by 22%. New pending sales were down nearly 5%. In another sign of a slowdown, the months’ supply of inventory was 6.3 months. That’s what experts consider balance, and it was 97% greater than last year.

This slowdown in sales, plus 30% more new listings, helped the active inventory grow by 73%. Home buyers hunting for a townhome or condo had over 55,000 options awaiting in Florida this spring.

Looking at past trends, closed sales do tend to be down in February but then rise in March. What makes this month a little different is that pending sales are down. Usually, this is a sign of future sales activity. If pending sales are down, there may not be as noticeable a spike in March sales for townhomes and condos.

However, inventory is now aligned with early 2020 levels. The number of choices available to buyers in this market segment should encourage them.

Florida Metro Areas

Punta Gorda, Ocala, and The Villages had the most dramatic growth in closed sales numbers for single-family homes. The first saw a 46% YOY uptick in properties closing. But the most pricing growth was in Sebastian-Vero Beach, where the $425,000 median price was 17% more than last year.

The townhome and condo market is interesting. Although Homosassa Springs reported 90% growth, it only had 19 closed sales. Miami sold the most townhomes and condos, but the 2,663 transacted units were 4.6% less than in 2023. Crestview-Fort Walton Beach-Destin had the highest median sale price at $585,000.

Year-End Report: Home Sales Slowed In 2023, But Florida Stayed In-Demand

The Sunshine State weathered the economic and housing market downturn than many markets nationwide. Still, it wasn’t exempt from the slowing sales activity. Here is how the Florida real estate market performed in 2023 based on the year-end housing report.

Florida keeps growing

Florida added 365,205 new residents, the second-highest growth in the nation. That amounts to 1,001 new people each day. Its 1.64% growth rate was only behind South Carolina. New York remains the top state people moved from. Population growth influences the real estate market as it increases demand.

Closed sales decline

Closed single-family home sales dropped 10.3% year-over-year (YOY) and were at their lowest mark over the last five years. That means fewer homes sold than before the pandemic rush. December alone had 4% fewer YOY sales.

Condos and townhome sales decreased 16% YOY, which was also its lowest level since 2018.

Part of the reason for the decline in sales is related to the higher interest rates. It caused homeowners to pause or change their purchase plans. High demand also kept the state stuck in a housing shortage; even though it had fewer buyers, the desire to live in the Sunshine State remained high, as evidenced by the high migration rate.

Active inventory increases

The good news for home buyers is that active inventory grew throughout the year statewide. The available single-family homes for sale actually increased by almost 18% from where the year began. Condos and townhomes had nearly 53% more homes on the market.

Still, keep growth in perspective. The overall inventory is still below pre-pandemic levels. Florida is still planted firmly as a seller’s market.

December 2023 ended the year with a 3.1-month supply of single-family homes and a 5.1-month supply of condos and townhomes. That’s the most since 2022.

Median prices rise

Demand will keep median home prices elevated in Florida. For 2023, single-family homes increased by 3.8% to $410,000. Condos and townhomes had a median of $330,000, up 6.5%.

“We expect to see continued improvement in the rate of sales as we go forward in 2024,” said Florida Realtors® Chief Economist Brad O’Connor, Ph.D. “Now that mortgage rates have likely peaked, there’s a good possibility of the Fed starting to cut rates in the coming months.”

Keep in mind these numbers reflect the whole state. O’Connor pointed out that inventory is back at pre-pandemic levels in some local Florida housing markets. Some have shown more price stabilization, while others are still growing.

Quarter 3 2023: Florida Needs More Homes for Sale

Sales activity typically lags a bit in the fall months in Florida, which has a highly seasonal real estate market. It can also be impacted by the hurricane season. Any landfall brings sales to a halt, depending on where storms go. Despite these factors, what we see in the Florida real estate market during the third quarter continues the trends noticed in 2023 for the nation.

Single-family homes

Even though Florida was the top place for people to move in 2022, and its desirability remains high, sales activity is slowing. About 3% fewer single-family homes sold this quarter than last year.

Even though fewer homes sold, the demand is enough that median sale prices increased by 1%. Homebuyers spent $414,000 for a single-family home in the state.

In more evidence that sales activity is slowing, the median time to contract increased by 70% to 27 days, while the time to sell was 23% more at 70 days. And even though about 10% fewer new listings came on the market, the monthly supply of inventory is now at 3.2 months. Keep in mind that a balanced market is considered six months.

Home sales are down by 12% for the year-to-date (YTD), and the median sale price stood at 1.3% more to $410,000. New listings are down by 15%.

Condos and townhomes

Over in the Florida condo market, closed sales were also down by about 6% year-over-year. But, the housing affordability challenges of buying single-family homes are increasing interest in condos, often seen as a more affordable form of home ownership. The increased demand pushed year-over-year median sales prices up 5% to $320,545.

Florida’s condo market now stands at a 4.1-month supply of inventory. The median time to contract was 31 days. In the quarter, we added 2% more new listings, the first time the year-over-year figures have grown since the second quarter of 2022.

Even with the increased activity this quarter, more is needed to make significant gains in the year-to-date sales activity. Condos and townhomes had 19% fewer sales so far compared to 2022. The median sales price, though, was up 4.9%, still around that $320,000 figure. New listings still lagged behind at 7.8% beneath last year’s pace.

Where homes are moving

Looking at the state’s metropolitan statistical areas, there are clear regions where homes are more in demand and are selling.

The clear winner in single-family homes is The Villages, which had a 25% bump in closed sales activity. It also had 19% growth in condo sales, leading in the state for those properties.

Its neighbor, the Ocala MSA, followed closely with a 21% increase in closed single-family home sales. The third busiest MSA was North Port-Sarasota–Bradenton, with a 12% increase in closed sales. What all three have in common is they are high-demand retirement destinations.

On the other side of the coin, the Pensacola and Fort Walton Beach-Destin MSAs had an 18% reduction in home sales activity. Gainesville MSA sales dropped 16%. All these are in northwest/Panhandle Florida. It’s unclear if Hurricane Idalia, which moved through this part of the state in August, brought on this reduction or if it is an ongoing regional trend.

The most expensive single-family home market, Naples MSA, had a median price of $770,000. Homes in the Sebring MSA were the most affordable at $266,250. Fort Walton Beach-Destin had the top condo market with a price tag of $604,000, while Sebring won affordably honors again with a median price of $161,500.

Moving forward

It will take a significant number of new listings to make a real difference in the Florida real estate market. Without more homes and condos for sale, sales activity figures will continue to lag as the greater real estate market deals with affordability challenges nationwide. That’s been brought on by sustained high mortgage rates and year-over-year significant price appreciation.

Q2 2023: Available listings shrinks; but a reduced buyer pool keeps prices higher

Florida remains an in-demand real estate market as people seek its many perks: no state income tax, waterfront living, theme parks, tropical weather, etc. Even as real estate markets nationwide grappled with shrinking buyer pools, inflation concerns, and rising mortgage rates, people still wanted to buy homes in Florida.

That demand clearly influences the market dynamics reported in the second quarter of 2023. The data for single-family and townhomes had minimal year-over-year changes to its median home prices. Here is the breakdown for Florida in Q2 2023.

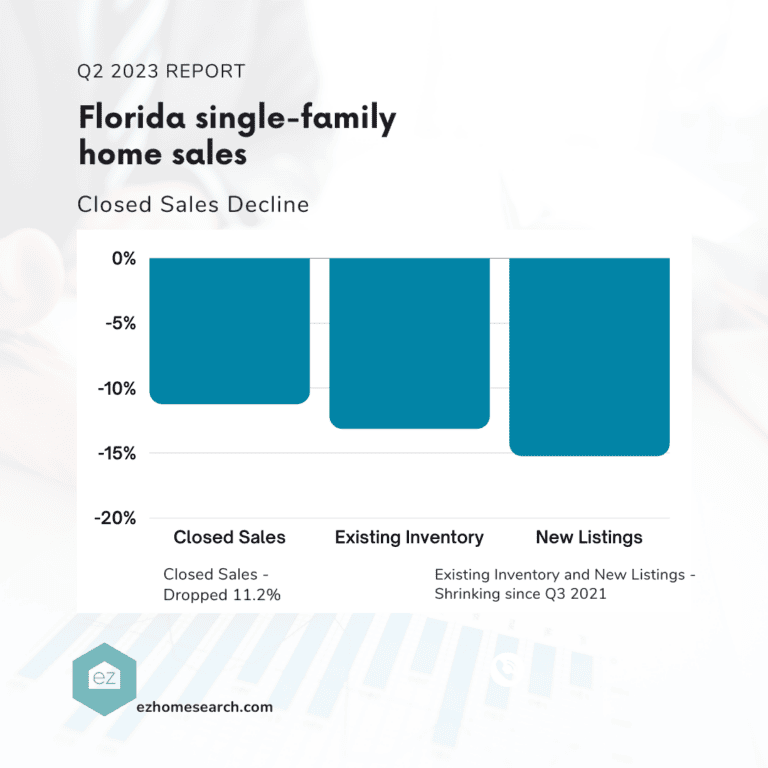

Florida single-family homes

Like many markets nationwide, closed sales declined. In Florida, they dropped 11.2% for the quarter. But that reduction in closed sales is in part because inventory, both existing and new listings, were also down. Statewide inventory has been shrinking since Q3 2021.

The months’ supply of inventory did increase, but fewer buyers were house shopping since persistent appreciation made affordability a challenge. Nonetheless, a 2.8-month supply of homes still heavily favored home sellers. It’s a signal the dwindling buyer pool is moving in tandem with the decreasing inventory.

The median time to contract was up 222%, but let’s put that in perspective: it grew from 9 days to 29 days and remained under a month. That’s more aggressive than Q1 2023 when the median time to contract reached 41 days, its highest in three years.

These dynamics of fewer buyers but fewer homes are behind why median home prices aren’t dropping. If anything, they’re stabilizing. The median of $418,000 was a bump of $1,000 from Q2 2022 and a new quarterly record high for the state. Florida home sale prices have been relatively stable since this time last year, hovering at or just above $400,000.

Even as prices continue inching upward, the reduced inventory and closed sales meant the statewide sales volume fell 12.5% to $44.7 billion for the quarter. The number of closed sales was down in every price point category for single-family homes. But there is a sign of hope for buyers waiting in the wings, as the active inventory at the end of the quarter was up 14% year-over-year. And there are Florida markets where home prices are falling.

Florida townhomes and condos

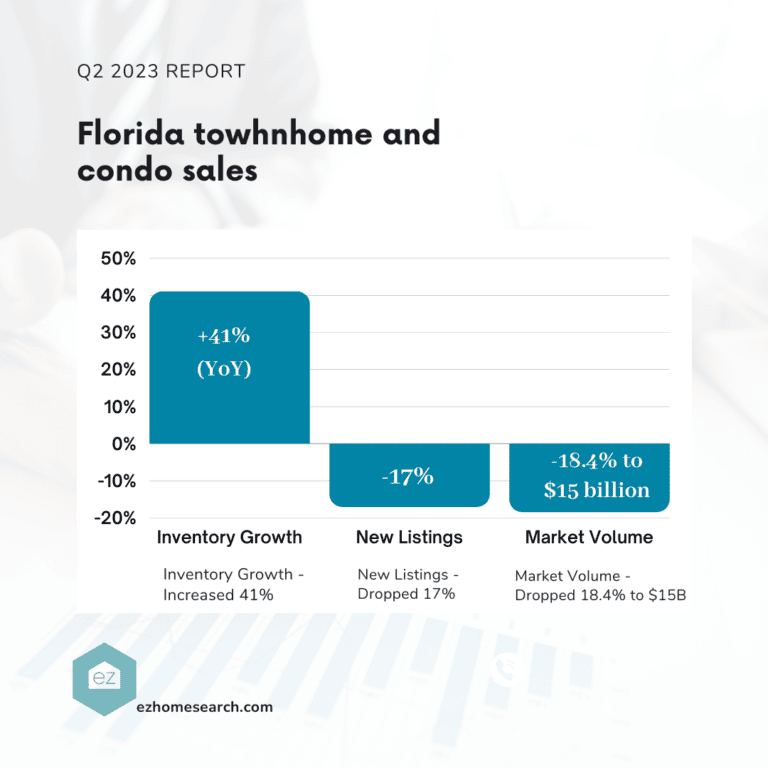

Retirees and vacation homeowners drive Florida’s robust townhome and condo market, giving the state more listings in this category. For Q2 2023, the inventory grew by 41% year-over-year. However, new listings remained low and dropped 17%. Lower inventory meant the market volume decreased by 18.4% to $15 billion in closed sales for Q2 2022.

This sector had the most balancing, now reaching a 3.6-month supply of inventory. That still puts the market in the seller’s favor but signals winds of change. Median sale prices were up 2% to $325,000, a new quarterly market high for this segment. The median time to contract jumped from 11 to 30 days.

Like single-family homes, its median sale prices have been relatively stable and above $300,000 since last year. Its inventory was also on par with Q1 2023.

Florida real estate information

Learn more about Florida’s housing market with data from the Florida REALTORS. See the state’s latest listings on EZ Home Search.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate Information

Your EZ Guide to Arkansas Property Taxes

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information