Your EZ Guide to Arkansas Property Taxes

Part of your annual homeowner expenses is paying property taxes. Although the states have different taxing policies, all fund public services through property taxes. Arkansas pays for road maintenance, libraries, and schools through property taxes. Learn how property taxes in Arkansas work and how they compare nationwide.

About Arkansas Property Taxes

Before beginning, know that Arkansas taxes all “real and personal property,” with “real” referring to real estate (homes and land) and “personal” being cars, boats, RVs, trailers, and the like. For the purposes of this article, we focus on real property taxes. However, in your Arkansas tax bill, you will see line items for personal property.

The state does not have a property tax, but local counties and cities collect to fund their public programs. Because of this, assessment methods and rates depend on where you live. At the state level, a tax appeals commission and a Tax Division of the Public Service Commission ensure local taxing districts follow statewide policies.

Your property tax bill may decrease in Arkansas, depending on where you’re coming from. Compared to other states, it ranked no. 13 for property tax burden as of 2023, with one being the least paid. That makes the state on the lower side. Arkansas residents paid 0.64% of their home’s value in taxes. This metric is the “average effective property tax rate.”

On a median home value of $179,800, Arkansas homeowners paid $1,154.52 in 2023 in property taxes.

Taxes are also paid retroactively. That means you pay for 2024 property taxes in 2025. The delay means county offices are often processing two tax years at the same time.

Assessment Process

The county assessor’s office typically conducts the property valuations. Counties are required to appraise all real estate to fair market value every 3-5 years. For example, Benton County assesses every three years, but Scott County reassesses every five. See the upcoming Arkansas reappraisal schedule. The assessors use January 1 as the fair market value date.

When Amendment 79 passed in 2001, it limited homestead property value increases to no more than 5% a year. For non-homestead properties, it limited increases to 10% a year. Should the assessed property’s value growth exceed 5%, the tax assessment can increase the value in subsequent years until it reaches the appraised value. Let’s say a property value grew 8% since its last appraisal. The taxable value would increase 5% in the first post-valuation year and 3% in the second post-valuation year. The valuation would hold steady until the next valuation.

State law requires assessors to visit the properties in person to verify any building improvements to the structures on the land. They do not go inside the home but may measure structures outside. Your property value depends on size, location, improvements, and market trends.

After the re-valuation, property owners receive a notice indicating the updated property value.

Calculating Property Taxes

Arkansas property taxes are assessed on 20% of a home’s value, which is known as “taxable assessed value.” For a home valued at $200,000, the taxable assessed value is $40,000.

Individual taxing units decide on their tax rates, also called millage rates. A property could fall into a county, city, and school district taxing unit. The Quorum Court must approve any changes to the millage rate.

One mill equals one-tenth of one cent. In other words, you pay $1 for every $1,000 of taxable value. The millage rate varies by county and by municipality within the county.

Say your local tax rate is 50 mils. On the same $200,000 home, you’d calculate taxes as $40,000 x .05=$200.

Arkansas county taxes have a 21-mill maximum cap. It breaks down into 5 mills for general government, library operations, and bonded indebtedness and 3 mills for library capital improvements and roads. Cities are capped at 20 mills, with the same breakdown, except they can also charge a mill for police and firemen’s pensions. School districts have no maximums but have a minimum 25-mill levy to fund their operations.

Voters must approve all tax rate changes.

Arkansas Tax Rates by County

Remember, tax rates change each year, and taxable values can shift depending on the county’s valuation cycle.

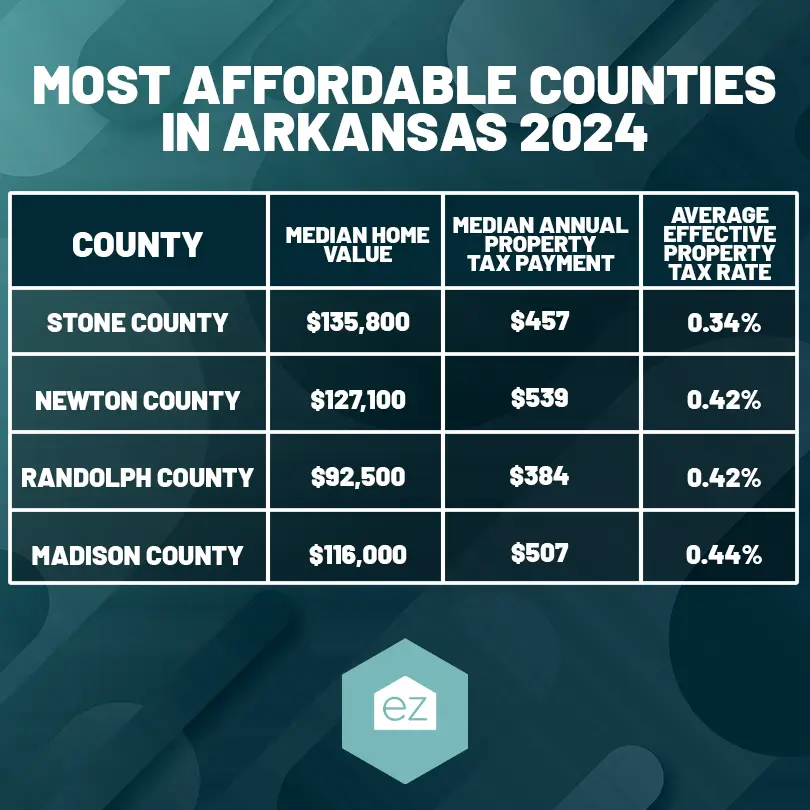

As of 2024, the most affordable Arkansas counties, according to the average effective tax rate, were:

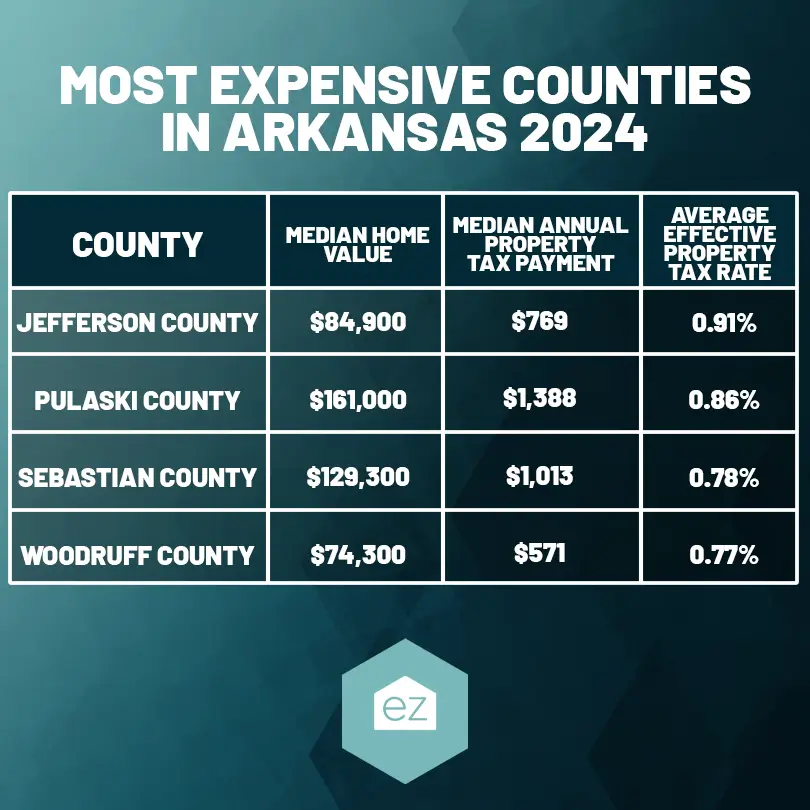

While the most expensive were:

Exemptions and Credits

A homestead exemption reduces the assessed value of Arkansas homeowners’ primary residence. The credit applies to real property taxes on a primary place of residence. It is for $425 as of 2024. Should the property tax bill be less than $425, the homeowner is not given the excess as a credit.

The Tax Freeze program is for residents 65 and older or individuals with a social security disability. It “freezes” the property’s taxable value in perpetuity or until the home is added onto or ownership transfers.

Payment and Deadlines

The local taxing authority must send property owners their tax bills by July 1. Arkansas property tax payments are accepted starting in March of the following year and are fully due by October 15. The state does allow for installment payments. Taxes can be paid online, in person, at the county courthouse, or by mail.

Failure to pay property taxes on time may result in penalties and interest charges. The property eventually appears in a tax sale if these are not paid.

Appeals Process

Arkansas property owners can appeal their property assessments if they believe the valuation is wrong. Each county has an appeals board or commission responsible for reviewing tax assessment appeals.

The appeal filing deadline is usually within a specified period after receiving the new assessment notice. Look to the mailed notice for county-specific instructions on how to file an appeal.

Usually, the first step is an informal review with someone inside the appraisal department to verify the information on the county’s rolls. The review can also determine whether you qualify for exemptions or look at comps.

If the informal review does not yield the results you believe are due, you’ll start a more formal appeal process. These often begin with appealing to the local county Board of Equalizations. Appeals are more likely to succeed if you can present comparable property data showing a change in value.

Resources

Contact your county assessor’s office for specific information about property taxes in your area. Remember, rates change yearly while the valuation is 3-5 years. Arkansas’ Property Tax Center has a portal directing you to counties for payment and further information.

Information provided here is for general informational purposes only and should not be taken as tax advice. Please consult with a qualified tax professional or the appropriate government agency for specific tax guidance tailored to your circumstances.

Questions about Arkansas property taxes? Learn how the state’s taxation assessments and rates are calculated and the payment structure.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information

Your EZ Guide to Idaho Property Taxes

Real Estate Information