EZ Guide to Maryland Property Taxes

Maryland residents, homeowners, and real estate investors owe property taxes every year. Knowing how the state and local jurisdictions levy taxes matters to your current and future budgeting. Taxes add thousands to the cost of homeownership, and it’s an expense that grows over time. Here, we break down Maryland property taxes. Get the highlights on how Maryland calculates taxes and how it compares nationally.

How Maryland Property Taxes Work

Maryland’s counties and cities depend on property taxes to make their budgets work. Without them, there won’t be public services, from libraries to road maintenance. Taxes are due every year for the coming fiscal year.

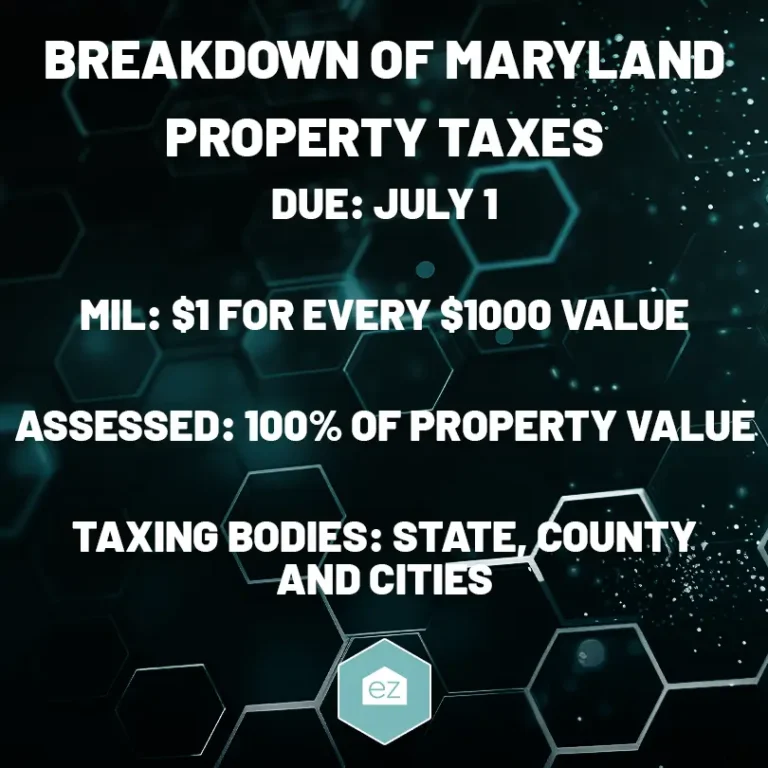

The annual property tax year starts on July 1. The state, its 23 counties, Baltimore City, and 155 municipalities issue tax bills for the coming year sometime in July or August. Depending on where you live, you could owe property taxes to the county and a city. On top of that will be taxes that fund Maryland’s school districts or special taxing authorities.

Tax Assessment Process

Property taxes in Maryland are based on the property’s assessed fair market value. The State Department of Assessments and Taxation (SDAT) conducts assessments triennially–every three years. SDAT divides each county into three reassessment regions and rotates the assessment calendar. That way, about one-third of a county’s properties are re-valued each year.

Trained appraisers review property sales, construction costs, and other factors to set the property’s value. SDAT tries using a combination of the sales approach and the cost approach when valuing properties. A lack of recent sales in more rural areas may make the cost approach the primary valuation method.

Any increases in the property’s cash value must be “phased in” over three years. Let’s say your property’s value increased by $15,000 in the recent re-valuation cycle. That means in the first new tax year, you’ll be taxed at $5,000 more, in the second year on $10,000 more, and finally the full $15,000 in the last year.

Property owners can request a copy of their property worksheet from their local taxation office anytime. It details the changes in neighborhood, land, and dwelling value.

Maryland Property Tax Rates

Maryland sets a few limits on how property taxes local taxing authorities levy taxes. Rate increases must be advertised and subject to public hearing, but maintaining or lowering rates do not.

Property tax rates are expressed in mils, where $1 equals every $100 in property value.

The state does charge a set property tax of 0.112 mils as of 2023.

Counties and cities set their own rates, which vary depending on where the property is located in Maryland. The taxing jurisdictions update their rates for the coming year by July 1; see the most recent tax tables for Maryland counties.

The state also utilizes “Common Yield Tax Rates,” where the state calculates what a county or city’s rate must be to equalize the tax base. The higher these rates, the higher the effective property taxes. If the jurisdiction wants to exceed the State Constant Yield Tax Rate, it must advertise its intent and have a public hearing.

Tax Breaks for Maryland Homeowners

Maryland does have many exemptions and credits to reduce the property tax burden. Some of the most common include:

- Homestead Property Tax Relief: If your primary residence’s value increased 10% over the prior year, you may be eligible for this program regardless of income.

- Homeowners’ Property Tax Credit: A relief program based on total gross household income. Taxpayers must file every year by September 1. Awards are on a sliding scale based on a ratio between the owner’s income and the annual property tax.

- Senior Citizens Tax Deferral: If their local taxing authority has adopted the program, people 65 and older can defer increases on their tax bill. The deferred taxes become a property lien due on the property’s transfer of ownership. There may be income restrictions and interest rates.

- Property Tax Deferral: In Montgomery County, the above senior citizen tax deferral program is open to homeowners of all ages who meet residency and income requirements.

- Veterans and Blind Persons Property Tax Exemption: Qualifying disabled veterans and their surviving spouses may be exempt from property taxes up to 100%.

- Required Home Improvement Exemption: Should a resident’s medical condition require improvements or changes to their home that would change its value, these updates would be exempt from taxation.

Read more about eligibility and filing requirements for these and other tax programs through the Department of Assessments and Taxation.

Maryland’s Tax Burden

While Maryland’s average effective property tax rate is 1.05%, note that individual counties can have much higher rates. This, plus your property’s value, affects your overall tax burden.

The average effective tax rate measures the percentage of property taxes the homeowners pay against the home’s value. It’s a more accurate measure as it accounts for the different home values and tax rates across Maryland.

The three Maryland counties with the highest effective property tax rates as of 2023 are:

[Graphic: All three of these bulleted sections below could be made a mini-graphic]

- Howard County: 1.29%

- Prince George’s County: 1.24%

- Baltimore County: 1.19%

If you looked at assessed 2023 tax rates alone, then the counties with the highest charge are:

- Baltimore City: 2.248

- Charles: 1.141

- Baltimore County: 1.100

For cities, the municipalities assessing the highest tax rates were:

- Luke: 1.5

- Pocomoke City: 1.1311

- Cumberland: 1.0595

Now, comparing Maryland’s 2023 median home value of $290,600, homeowners paid an average of $3,047.08 in property taxes. That helped Maryland rank 32nd in the nation for property tax rates.

Appealing Property Taxes

If you believe your property has been over-assessed, you have the right to appeal the assessment. Appeals must be filed within 45 days of the assessment notice. The focus is the fair market value, not the tax rate. That cannot be changed.

File an appeal online, by mail, or by attending a hearing. You’ll first have a Supervisor’s Level of Appeal, where you discuss the assessed value with an assessor. This meeting may be in person, in writing, or over the phone. The state will provide you pro bono with the property’s worksheet and area sales listings. Other property worksheets for comparable properties are available but at a fee. After this meeting, the tax authority issues a “final notice” stating the results of this appeal.

Should this step not bring the results you seek, the next level is the Property Tax Assessment Appeal Board (PTAAB). This appeal must be filed within 30 days of the “final notice” from the Supervisor’s Level. You can attend the hearing or make the appeal in writing.

The final appeal phase is to go through the Maryland Tax Court. File within 30 days of the PTAAB ruling. The decision made here is final.

Your Maryland Property Taxes

Hopefully, this information will help you better plan and manage property-related finances when living in Maryland. As always, check with the local taxing authority for updated and accurate taxing information. Take advantage of available exemptions and, if necessary, appeal opportunities to ensure your Maryland property taxes are fair and accurate.

This article is intended to be informational only. We recommend consulting with your taxation professional for advice.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information

Your EZ Guide to Idaho Property Taxes

Real Estate Information