Your EZ Guide to Idaho Property Taxes

Property taxes in Idaho constitute a significant source of revenue for local governments, including counties, cities, school districts, and other taxing districts. These taxes are levied on real property’s assessed value, including land, buildings, and improvements. As an Idaho homeowner, you’ll be responsible for paying your fair share. What does that mean for you? Learn about Idaho’s property tax system to understand how it will impact your home ownership.

How Idaho Property Taxes Rank

You may see some savings in your tax bill depending on where you’re moving from. Using the average effective property tax rate, Idaho residents pay 0.67%, ranking the state no. 14 for tax affordability as of 2023.

The average effective property tax measure assesses how much of a property’s value the owner pays in real estate taxes. It’s a way of accounting for the highly varied median property values and tax rate policies across the nation.

In Idaho, the median home value was $820,100, and the owners paid an average of $5,455.46 in property taxes. Like any state, those figures vary depending on where you live. As a rural state, it also depends on the size of your property. Idaho’s higher median home values reflect larger tracts of land.

How Idaho Property Taxes Work

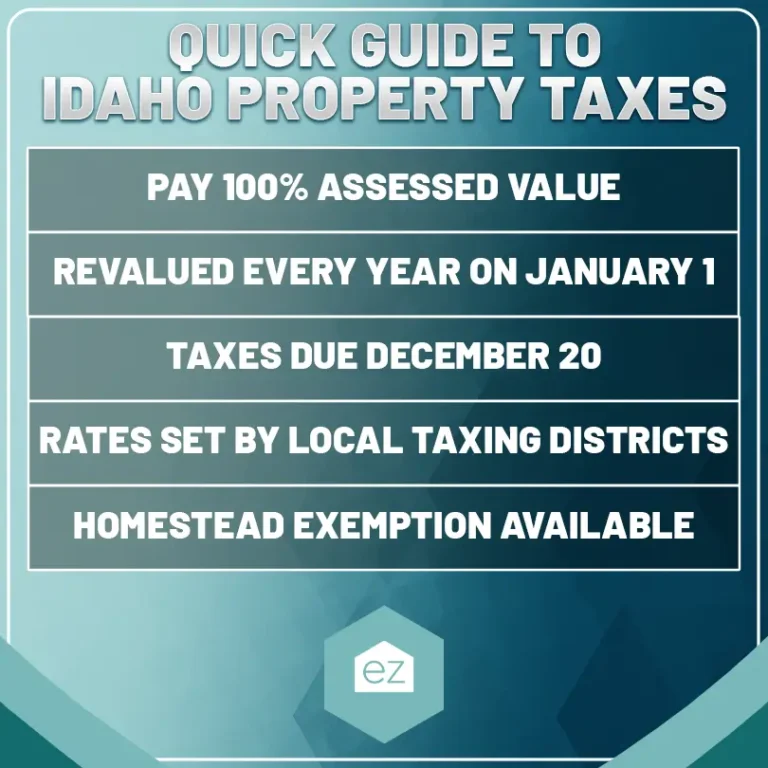

All property taxes in Idaho support local services. No taxes are paid to the state; the Idaho State Tax Commission exists to supervise the process and ensure the local districts comply with the state’s laws.

All homeowners pay property taxes, even on manufactured housing and farmland.

Each property will fall under multiple taxing districts. These are the individual units that provide local services. Your property could have a combination of tax districts for county, city, schools, sewers, fire, or libraries. Every district creates a budget to cover its services, so tax rates can change yearly.

Local improvements, changes in neighborhood property values, or additional structures that add value can influence your property’s value. Idaho has no restrictions on how much a property value can change from year to year.

It does limit tax rate increases in a roundabout way. Each taxing district can’t raise the property tax portion of its budget by more than 3% unless the voters approve it or if the taxing district has new construction or newly annexed areas.

Property tax bills in Idaho are typically mailed each November. The bill is due December 20, but you can pay in two installments: December and June 20 of the following year.

Late payments are subject to penalties and interest charges.

Assessment Process

The county assessor’s office is responsible for assessing the value of all taxable property in Idaho. Assessments are typically conducted annually, determining the market value of the property.

The market value is set as what a typical buyer would pay for that property on January 1 of a given year. The assessors determine this market value by weighing the property’s location, size, condition, and comparable area sales.

All properties are assessed taxes at 100% of market value, minus any exemptions. These qualifying exemptions vary across counties and by the individual taxpayer.

Property owners receive a notice of assessment each year, informing them of their property’s assessed value. If the owner disagrees with the assessment, they can appeal to the county board of equalization.

Idaho Property Tax Rates

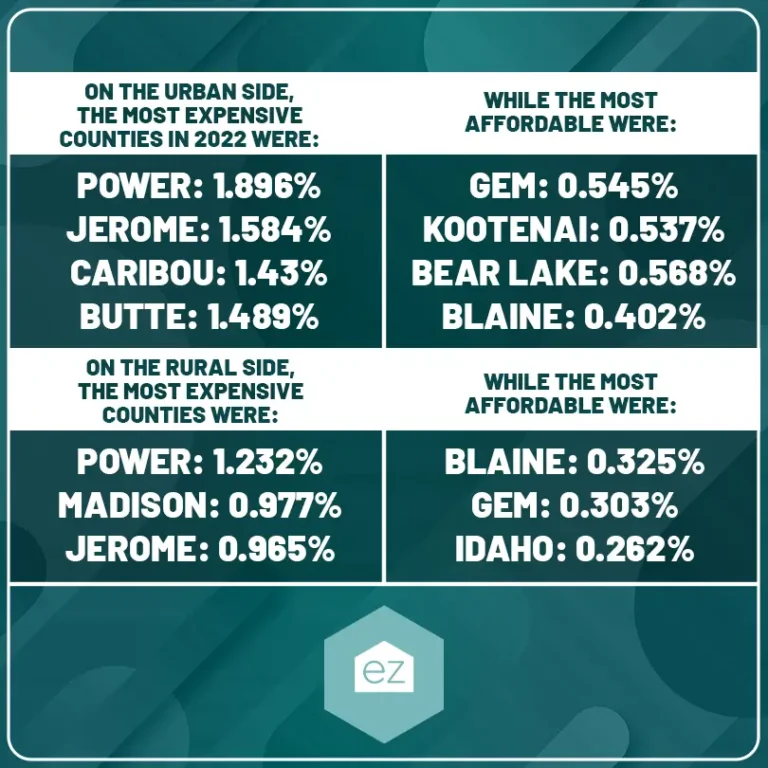

Every taxing district resets its tax rates based on the total assessed value of properties in its jurisdiction and operating budget. These figures swing each year because services, property values, and the number of owners vary. Given Idaho’s extensive rural areas, the state divides its general taxing totals into urban and rural rates.

Calculating Idaho Property Taxes

Once the assessed value of a property is determined, property taxes are calculated using the following formula:

(Assessed Value – Any Exemptions) × Tax Rate = Property Tax

The tax rate is expressed in terms of “mills,” with one mill representing one-tenth of one cent. Tax rates vary depending on the jurisdiction and the specific taxing districts in which the property is located.

Look to the county assessor’s office for your local tax rate breakdown.

Exemptions and Deductions

Idaho allows for exemptions and deductions that can reduce a property’s taxable value.

All exemptions must be applied for through the county assessor’s office. Any approved exemptions will stay in place until the ownership changes or you no longer use the home as a primary residence.

The general homeowner’s exemption typically exempts 50% of the home’s value plus up to one acre of land worth no greater than $125,000.

Another property tax reduction program is for those with lower incomes, 65 and older, disabled, widowers, or former POWs with a current homeowner’s exemption. The program requires reapplying every year by April 15, but it could lower the owed property taxes by up to $1,500.

Property tax deferrals are also available for those who meet income requirements ($58,304 or less in 2023) and specific conditions as outlined in the program guide. The taxes will still be owed, with interest, but can be repaid later. It does not exempt you from government fees and must be reapplied for each year by September 3.

Disabled veterans in Idaho also have a property tax option that applies to them and surviving spouses that could reduce taxes by $1,500. It has no income limit.

Appealing Property Taxes

You can’t change the tax rate; your only lever is to appeal the assessed value. If you disagree with the county assessor’s appraised value, you’ll first contact the assessor and ask to speak with the appraiser. They have specific steps to follow for a first-level appeal process.

You must file an appeal with the county’s Board of Equalization (BOE) by the fourth Monday in June. Most boards meet between that date and the second Monday in July to hear appeals. They will come to a determination.

If you still disagree, you can file an appeal within 30 days to either the State Board of Tax Appeals or the District Court.

Understanding Your Taxes

Without this revenue, your local Idaho government couldn’t fund essential public services such as schools, roads, law enforcement, and fire protection. The distribution of property tax revenue varies by jurisdiction, with each taxing district receiving a portion based on its budgetary needs. If you have further taxing questions, your local county assessor is an excellent place to turn first.

The information regarding Idaho’s property taxes and homestead exemption is only intended for general informational purposes. It should not be construed as legal, financial, or tax advice. While efforts have been made to ensure the accuracy and reliability of the information presented, laws and regulations regarding property taxes, exemptions, and eligibility criteria may vary and are subject to change over time.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate Information

Your EZ Guide to Arkansas Property Taxes

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information