Federal Reserve Fall Update Brings Mixed News for Mortgage Rates

It’s mixed news for those tracking the Federal Reserve and the 10-year Treasury Yield. At its latest committee meeting held November 1, the Federal Reserve decided to hold steady to its 5.25-5.5% basis rate for federal funds. It was a unanimous decision with implications for mortgage rates.

The good and bad on the basis rate

On the one hand, it’s good news. Holding steady means the Federal Open Market Committee (FOMC) believes its fiscal policy is working to tamper inflation. In place since July 2023, its current rate is the highest held since July 2011. Lifting to a higher basis rate would have impacted the 10-Year Treasury Yield, already at decade highs, and trickled over to the mortgage industry in the coming weeks.

But it’s not the relief consumers wished for as the year ends. Economists and watchers hoped the 3.9% inflation rate reported in September 2023 would encourage the Fed to drop the basis rate by at least 0.25 points. It peaked at 9.1% in June 2022, according to the Consumer Price Index (CPI).

Now, rates for various loan products–not just the housing industry–will remain elevated through the rest of 2023.

The Federal Reserve has kept its basis rate steady in three of its last four meetings. It raised the rate four times in 2023.

Job market growth behind “wait and see” approach

The Federal Reserve indicated it’s not above raising the rates again, as it feels its monetary policy may not be making enough headway on inflation. That’s because September’s strong job growth showed payrolls and employment expanded. This typically leads to more spending and, in turn, higher inflation.

“We haven’t made any decisions about future meetings,” Jerome Powell, Federal Reserve Chair, said after the November meeting. “We’re going meeting by meeting. We’re asking ourselves whether we’ve achieved a stance of policy that is sufficiently restrictive to bring inflation down to 2% over time.”

The final meeting for 2023 will take place on December 12-13.

The mortgage industry remains stressed

Every industry has been impacted by the rate increases, but the real estate market is especially hard-hit. While the Federal Reserve Rate doesn’t directly affect the mortgage industry, the ripple effects do. Mortgage rates track with the 10-Year Treasury Yield.

Yields on the 10-Year Treasury Note hit 4.99% in October, a 52-week high. These levels haven’t been seen since 2007. Higher Treasury Yields translate to increased borrowing costs for businesses and individuals.

As the yields soared higher, so did mortgage industry rates. In October 2023, the rates on 30-year fixed-rate mortgages reached 23-year highs, topping at 7.79% with government-backed lender Freddie Mac.

Currently, year-over-year mortgage rates remain elevated and at multi-decade highs. Consider how, at the end of 2021, the mortgage industry averaged a 3.11% interest rate.

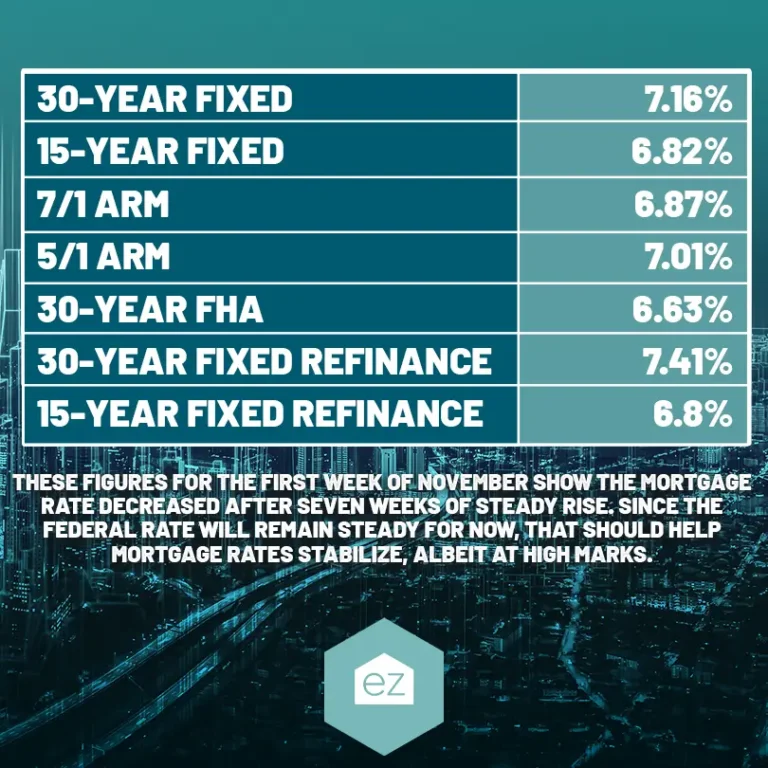

As of November 8, the national average mortgage rate on various loan products stood at:

30-year fixed: 7.16%

15-year fixed: 6.82%

7/1 ARM: 6.87%

5/1 ARM: 7.01%

30-year FHA: 6.63%

30-year fixed refinance: 7.41%

15-year fixed refinance: 6.8%

These figures for the first week of November show the mortgage rate decreased after seven weeks of steady rise. Since the Federal rate will remain steady for now, that should help mortgage rates stabilize, albeit at high marks.

Housing affordability challenged

Higher mortgage rates and soaring price appreciation mean many real estate markets face housing affordability challenges. Even though price appreciation as measured by the Freddie Mac House Price Index (FMHPI) was at 2.88% as of July 2023, it doesn’t erase how home prices jumped 18% in 2021. Regionally, this figure varies widely.

The one-two punch of appreciation and sustained high mortgage rates are stressing the housing industry, which has addressed the Federal Reserve in an open letter. They posit that further raises to the basis rate will tip the industry into a crisis.

Will mortgage rates increase in 2024?

Whether mortgage rates will climb or fall for 2024 remains to play out. The economy is still generally volatile, and the Federal Reserve is seeking further pullback in economic growth. It still considers inflation high.

For now, most industry experts believe that mortgage rates will rise.

“With rates in the mid-to-upper 7s to start October, 8% is a more realistic possibility than it had seemed just a few weeks ago,” noted Chief Economist Danielle Hale to Mortgage Reports. “Even a helpfully low inflation reading is likely to mean mortgage rates remain well above 7% in the month ahead.”

Numerous variables can shape the choices of prospective home buyers. Mortgage rates carry significant weight in this decision-making process. Buying now is less feasible for many who want to own a home, as wage growth hasn’t kept pace with housing appreciation.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Mortgage News

April 2024 Mortgage Market Update

Mortgage News

Can A Reverse Mortgage Help You In Retirement?

Mortgage News

Mortgage Rate Update: Rates Increase In February 2024

Mortgage News