Up or Down? Predicting 2023 Housing Prices Isn’t Easy

The Trouble With Predicting Housing Prices

The continual uptick in US home prices has been unwelcome and a cause of concern. Sustained near-record-high housing prices are challenging housing affordability, creating a constant cycle of homeowners waiting to sell because buying is too expensive and buyer competition for the too-few listings, keeping the prices up. These dynamics can’t continue forever, and real estate is a cyclical industry.

As experts watch the market data, some feel the market is ready to rebound, while others say it’s too soon to call.

What has been going on in real estate markets

The nationwide real estate existing home sale prices weren’t just a bear market; they were on a runaway train with 131 consecutive months of year-over-year pricing growth. That includes the runaway period of 2020 and 2021, where homeowners were setting price appreciations of over 40% in some high-demand markets.

That ended in February 2023 when the National Association of Realtors release showed median housing prices stayed stagnant. Since then, the nationwide median home prices have declined year-over-year, halting price growth.

After five months, July stopped the declining pricing growth with a 1.9% increase in median sale prices. That has led some in the industry to say the long-expected price correction is over.

High prices are challenging real estate activity

A price correction isn’t necessarily a bad thing. A lack of affordable housing can lead to an economic crisis, as people are unable to keep up with their payments and default on their mortgages.

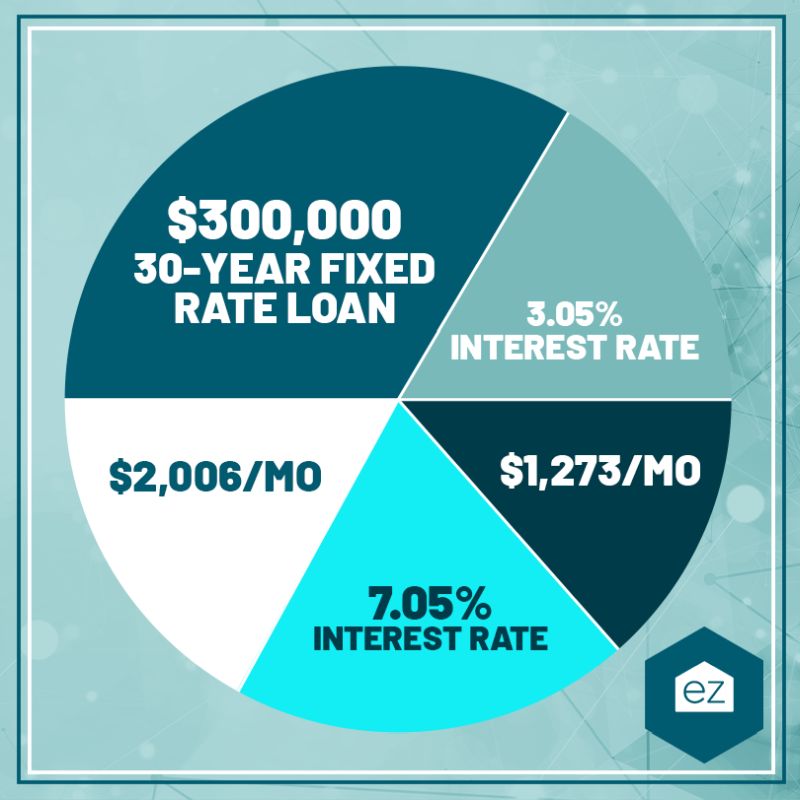

As we know, affordability has been reduced by mortgage rate hikes that now are at 20-year record highs. It’s been a tough change for home buyers accustomed to 2-3% interest rates two years ago.

Those same historic low rates are encouraging homeowners to stay where they are. Many homeowners secured these favorable rates before the recession loomed. The difference between their current payment and what they would pay for a new home is significant. It can be nearly $1,000 a month or more, discouraging them from considering a move.

As mortgage rates increase, so does the cost of borrowing. Under most scenarios, buyers become less likely to buy, reducing the demand for homes. Sellers have to adjust their pricing to encourage offers.

But that didn’t happen in the majority of real estate markets nationwide. Yes, the buyer pool did shrink, as reflected in home sales numbers down 36% from 32 months ago.

Yet, real estate markets stayed competitive. Sure, homeowners may not have received a dozen purchase offers with thousands over asking. Still, multiple offers weren’t off the table in many markets. Home prices hit record highs in over half of the nation’s markets.

What happened is the declining buyer pool moved along with shrinking inventory. That kept the months’ supply of inventory low, making it hard for buyers to find their first or next home and perpetuating our cycle.

Current conditions are concerning enough that the Federal Reserve is watching the US housing market. While its policy doesn’t directly impact housing, it trickles across the economy when buyers are financially challenged to purchase a home.

The sales price shift

However, the decreasing number of buyers may finally be catching up with the available inventory. That’s what the NAR data indicates on existing home sale median prices. The year-over-year price growth has been slowly shifting from record-setting double-digits down to single-digits, and finally, in February 2023, to 0%.

That kicked off the five-month consecutive year-over-year decline in pricing growth, suggesting the nationwide housing market was price-correcting. Or, perhaps, entering a housing recession.

What is behind the surprise rebound?

But home prices rose again in July, by 1.9% to $406,700. The surprisingly quick recovery indicates the housing downturn could be shorter and shallower than many economists anticipated.

The reason? Too few homes for sale. The housing shortage has been the trouble for a while now. Buyers cannot find homes, and it’s stressing affordability in many markets. In June 2023, the NAR housing affordability index, which considers family incomes, mortgage rates, and existing single-family home sales prices, reached its lowest point in nearly 38 years.

Delays in when people purchase their first home and lags in new construction have contributed to the housing crisis and where the real estate market is today.

Is the July price growth a blip?

Economists have been challenged to make their forecasts thus far. Before the year began, most felt housing prices would fall more dramatically than they have at this point in the year. Many have adjusted their predictions to reduce their drop in housing prices.

The $406,700 median price reported for July 2023 was that month’s highest median price on record. It was only the fourth time median prices exceeded $400K since the NAR began record-keeping.

Home prices will likely drop again, but housing economists and analysts concur that any potential market correction will be minimal. Homeowners, buyers, and investors should not anticipate price drops of the magnitude witnessed during the Great Recession.

Home pricing growth is unsustainable in the long run since most would-be buyers cannot compete. And when you get down to not enough buyers, something has to give.

This projection is not unfounded; the most recent US Consumer Price Index report revealed a modest acceleration in core inflation for May, highlighting the need for further measures to curb persistent inflationary pressures.

As interest rates, 10-year Treasury yields, and mortgage rates continue their ascent, an increasing number of people may be unable to afford a home.

What the future holds for housing prices

According to NAR Chief Economist Lawerence Yun, regions with high prices, like California, are particularly susceptible to a decline in property values. This is evident in expensive markets such as San Francisco in the Bay Area, where the median sale price dropped by 9.42% compared to the previous year, and in Oakland, which experienced a 6.3% decrease.

In the meantime, it’s clear that homeowners need to be prepared for more volatility in the housing market as we enter this new phase of the real estate cycle. With mortgage rates still high, there is likely to remain a certain degree of caution among buyers, and real estate agents, investors, and lenders will all need to adjust their strategies accordingly.

It’s yet another reminder that the real estate market is constantly changing. Still, with some foresight and planning, we can navigate these changes as best as possible.