At-Risk Generation: Older Adults Face Housing Challenges

They’re the largest demographic group of homeowners, with 75% owning homes. They have the most home-buying power. But the baby boomer generation–those 65 and older–are facing a serious challenge as they live longer, healthier lives: a need for affordable and accessible housing.

It’s hard to believe that the generation with the most purchasing power and homeownership rates faces a housing challenge. But, the study on older adults from the Joint Center for Housing Studies out of Harvard University sheds light on a looming crisis. The main question is: can baby boomers afford the increasing costs of medical care and the housing they need to live comfortably in their golden years?

The state of homeownership in aging America

In the 2023 survey of home buyers, the average age of a repeat homebuyer was 58 years, just seven shy of the retirement age. Some 70% of buyers did not have a child under 18 in their home. And 19% of home purchases were senior-related housing, such in age-restricted communities or assisted living complexes. It suggests that these older buyers are positioning themselves for retirement.

Other numbers back that up, such as:

- 11.2 million households in 2021averaged 65 years or older

- The number of households headed by someone over 80 is expected to double by 2040.

- In 2021, 80 percent of older adults lived alone or with a spouse.

Understanding why this puts the baby boomer generation at risk of a housing crisis requires looking at multiple factors.

Retirees live on a fixed income

The nature of retirement means relying on savings and benefits to cover personal needs and wants. That’s where “fixed income” comes into play. Retirees must live off their savings for the remainder of their life–a timeline that no one knows for certain. By one estimate, baby boomers have a life expectancy of 79 years.

That’s much longer than to the estimated 63 years old when they were born. It’s great that people are living longer, but the problem for boomers is that many haven’t saved enough to cover their living costs as they age. Over a quarter have saved less than $100,000. Even more distressing? The Insured Retirement Institute found that 45% of boomers have no retirement savings.

Incomes also drop off as the individual ages. In 2022, the median income for households 65 and older was $50,000. But for those 80 and older, it was $37,100. This happens for reasons such as fully retiring, reducing their workloads, or losing a second income due to widowhood.

Costs keep rising

Retirees may have a fixed income, but the cost of living doesn’t stay fixed. Single-family homes appreciate at an average of 3-5% annually. Food costs, not factoring in dining out, rose 5% from 2022 to 2023 alone.

Personal healthcare spending increased an average of 4.8% annually from 2014-2020. But as people age, they need more medical care. The per-person personal health care spending by persons 65 and older was $22,356 in 2020. That’s 2.5 times more than the working-age adult–$9,154.

Each year a person remains living, their expenses keep increasing even if they remain healthy. Add in a medical challenge, and the cost of living for that year will rocket upward dramatically, draining savings even further.

Healthcare challenges

We may be living longer, but the US Centers for Disease Control and Prevention (CDC) warns that we’re not necessarily living healthier. From 2002-2013, high cholesterol, hypertension, and obesity all increased in adults aged 55-64. Half were living with high cholesterol and hypertension. All of this group is now over 65.

The number of complex medical care needs is also rising. Take Alzheimer’s disease, whose number of diagnoses could triple by 2050 to 14 million people.

By 2060, over 98 million Americans will be over 65–nearly one out of every four citizens. By the time they reach 80, around 30% will experience challenges with daily independent living.

Other studies found most older adults will need some long-term care services later in their life, for an average of three years. That quickly becomes costly. The National Investment Center for Seniors Housing and Care (NIC) found that in 2021, the median cost of assisted living was $63,000. Only 13% of households could afford this average. However, the services included and the actual cost varied widely across the country. Add in specialized care, and costs increase.

Ongoing income gaps

Income inequality is an ongoing societal challenge. The older generation hasn’t been exempt. Rising mortgage debt indicates that even those who own a home may have less equity than previous generations. Seniors have used their homes’ equity to cover upgrades that keep them at home as they age in place or to pay for major medical bills.

Unfortunately, the divide in income and the potential to save becomes more pronounced when broken into racial and income demographics. Homeownership has a 19-point gap between over 65 white households and black-identifying households. Older black and Hispanic groups also have high rentership rates, at 37% and 34%. And their median household income is 80% less than that of white, older adults.

What We Are Facing Right Now

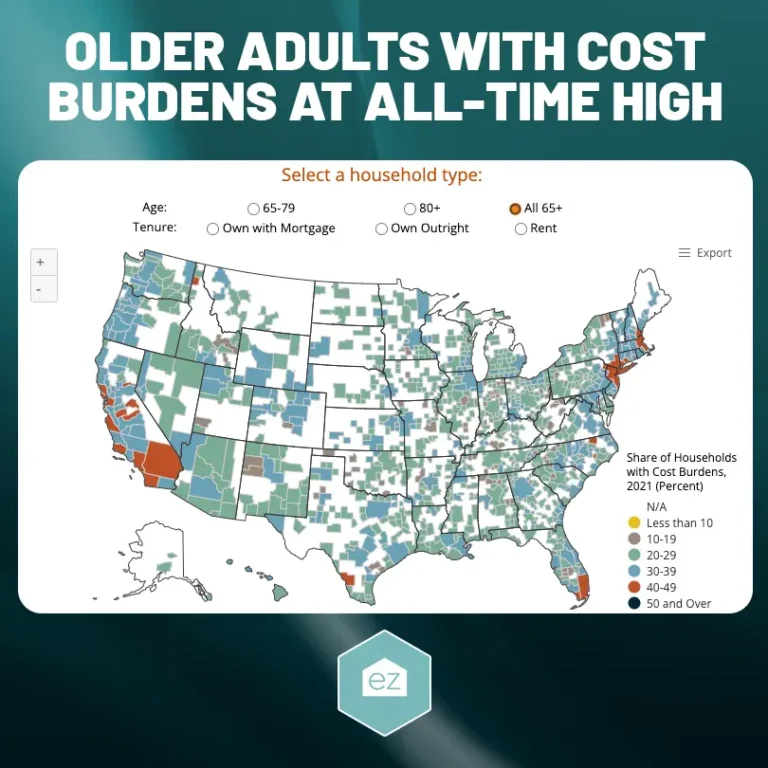

Baby boomers are increasingly cost-burdened. In 2021, 11.2 million adults spent over 30% of their income on housing costs. That was an all-time high. Even more challenging is that many spend over 50% of their income on housing. Homelessness is also increasing.

Boomers’ needs increase with age. These include support for daily living and daily self-care like bathing and dressing. Yet only 14% could pay for a home health aide to visit daily to help with self-care tasks.

Even older adults capable of independent living find benefits in housing that supports their needs. These include single-level living or accessibility features such as ramps, brighter lighting, or wide spaces.

Meanwhile, the income inequality gap continues to widen. It’s more pronounced as you look to break down different demographics. African-American homeowners have a median home equity of $123,000 compared to home equity of $270,000 for Asian, multiracial, or other identifying homeowners. Home equity can be an asset to finance upgrades to make a home more accessible for aging in place.

Those with the lowest incomes are most likely to struggle to afford housing and medical care, even with government programs providing help. However, even moderate-income seniors may struggle to pay for their care and keep a roof over their heads.

That increases the demands on federal housing and medical assistance programs. The funding for these is limiting, resulting in only a third of seniors receiving the benefits they qualify for. NPR chronicled the story of a man who waited five years for a federal housing voucher. He was homeless in between.

What Aging America Needs

The Harvard University study proposes a multi-pronged solution is needed to address the current and future needs for senior housing. These include:

- Expanding programs that finance home renovations to help keep baby boomers in their homes longer. Massachusetts is an example.

- Zoning changes to allow more apartment-style buildings and affordable housing to be built. The data shows that the number of older persons turning towards living in multifamily buildings increases as they age to cut down on maintenance and increase cost savings.

- Increase diverse household configurations for house-sharing, cohousing, or accessory dwelling units (ADUs).