South Carolina Real Estate Market Update

Q1 2024: Spring Showers Higher Prices in South Carolina

Demand is still present in South Carolina, as evidenced by pricing growth and fewer days on the market. Nonetheless, home sales activity decreased for the quarter. The market report shows a combination of a desire for Palmetto State living but a pullback from the sustained high-interest rates.

Home Sales Are Down

South Carolina reported fewer homes sold in the first part of the year. This shows that market conditions are still tight for buyers in the Palmetto State. Year-to-year closings were down 1.35%. The final numbers show that the most in-demand markets were near big cities or South Carolina’s vacation spots. In particular, Hilton Head Island reported 15% more closings than the prior year.

Western Upstate also had double-digit sales activity, at 13.1% over the first quarter. For the most recent reporting month, March 2024, both markets were the only regions that reported positive sales.

Pricing Growth Continues

Median sale prices are still rising. The first quarter reported 6.5% in pricing growth, bringing the median to $330,000. All markets except Cherokee County saw their median prices increase. This market saw prices decline across all three months in the quarter.

Otherwise, most markets saw their median prices inch upward. In March, Central Carolina had a 51% jump in its median prices, from $159,000 to $240,000. That partly reflects the fewer homes for sale in that region. Having some more closings or a big sale close can sway its pricing.

After that, Sumter/Clarendon County, Western Update, and Aiken reported double-digit monthly pricing increases. They are among the quarter’s top increases, a testament to the demand for homes in these parts of the state.

Median prices remain highest in Hilton Head, Charleston Trident, and Beaufort. All three are waterfront and desirable neighborhoods among part-time and full-time residents.

Days On Market Shifts Down

Home prices are rising and fewer homes are selling. But, the overall days on the market did decrease by two days. That means conditions aren’t changing much for buyers and sellers. Homes were on the market an average of 72 days until sale.

Looking only at March 2024, the time until sale was mixed across the state. Sumter/Clarendon had a 15-day increase in its days on the market, from 53 to 68, while Central Carolina’s days dropped 25%, from 143 to 108.

The fastest moving markets were Charleston Trident (37), Spartanburg (46), and Piedmont Region (47.) For all three, this was slightly faster than March 2023.

February 2024: South Carolina Home Sales Activity Picks Up Steam

After several sluggish months of sales, the number of closed sales in South Carolina picked up. Closed sales for single-family homes, condos, and villas increased by almost 8% year over year for February 2024. This is a boost from the prior month when home sales kept the downward year-over-year trend.

More homes sold

Several South Carolina metros reported double-digit increases in the number of closed sales, driving the jump in activity. Hilton Head Island led the way with an almost 25% year-over-year jump in sales activity. On its heels was a 20% spike in Spartanburg and a 15% increase in greater Columbia.

The increase wasn’t equal statewide, as a few regions saw no change. Greenwood, the Pee Dee region, and Sumter/Clarendon County reported fewer sales than last year. Nonetheless, it’s a promising start to 2024 home sales.

Median prices increase

Last year maintained a steady but persistent upward trajectory in median home prices. That continued in February, as the state reported a 7.5% year-over-year gain. That brought the median home price of all residential real estate to $328,000. Every reporting metro had gains in median prices except for the Central Carolina market, where home prices fell 20% to a median $190,000.

The top-priced real estate markets continue to be Hilton Head at $524,500, Beaufort at $406,000, and the Charleston Trident at $407,235.

Even though those were the state’s most expensive median prices, they weren’t necessarily the fastest growing when it came to sales price gains. Cherokee County actually had a 28% year-over-year growth in its median home prices. Hilton Head home prices increased 11%, while the Western Upstate gained 9%.

Fewer days on the market

Statewide, the average days on the market until sale fell by three days to 73. Most South Carolina real estate markets declined in the average days until purchase.

The market with the most significant change was Greenwood, where the days on the market fell by almost 30%. Spartanburg, Charleston Trident, the Piedmont region, and greater Columbia were the fastest-selling markets. All three fell under 50 days, or just under two months on the market.

All the numbers in the February report signal home buyers are searching for South Carolina homes. That’s despite February 2024 posting slightly higher mortgage rates than the month prior. Spring can be busier, especially in the more retirement or vacation-driven cities. Some of the higher-priced and sales-active metros demonstrate this.

South Carolina Real Estate: Year End 2023

Slowdown in Sales and Stabilizing Home Prices

Now that 2023 has wrapped up, we see South Carolina’s real estate market moved towards stabilizing during the year. Fewer buyers led to reduced home sales, longer days on the market, and less dramatic pricing growth.

The December home sales report shows sales in South Carolina decreased by 14% in 2023. Overall, 80,078 homes, condos, and vias closed during the year. Every single market had a decline in sales activity.

While fewer homes were sold, home prices continued to appreciate. The statewide average in pricing increases was 2.9%, bringing the median price to $325,000.

Homes were also on the market for more days before they sold. During the year, South Carolina homes went 65 days on average before sale, a 35% increase over 2022.

Markets with the most change in sales activity

Some regional markets saw a drastic drop in their sales activity during 2023. Leading the charge was Cherokee County, where home sales declined by 21%. But sales activity was also down in the Piedmont region by 18% and in Greater Augusta by 17.9%.

Spartanburg reported the least change in home sales activity, where only 1.3% fewer homes were sold. Following was Beaufort, where sales activity was down 5%. The Western Upstate region reported a drop in closed sales of 6.3%.

Homes were on the market for the fewest days in the Charleston Trident, which reported an average of 34 days until sale. The Piedmont region and Spartanburg were very close to this benchmark, and both reported an average of 35 days until sale. On the other end of the spectrum, the Hilton Head area homes were on the market and averaged 149 days until sale.

Markets with the most change in median prices

Only one region reported a year-over-year decline in 2023 median sale prices. Home prices declined 1.8% to $375,000 in the Piedmont region.

Every other market reported gains in sales prices for 2023, although some of those markets saw very minimal appreciation. Among those are Central Carolina, with 0.3%, and Aiken, with 0.6%.

However, double-digit pricing growth was reported in Greenwood, where the cost of homes increased by 10.6% year-over-year. Home buyers paid a median of $240,000 for the year, making this market incredibly affordable.

The market with the highest median prices goes to the Hilton Head area, which ended the year with a median of $516,500. This represents an 8.4% increase over 2022.

Homes were at their most affordable in Central Carolina. There, homes had a median price of $190,000.

Looking Ahead

South Carolina’s real estate market is positioned to continue these trends. As mortgage rates are anticipated to decline slightly and stabilize, sales activity could increase this year. That will influence how much prices will grow during 2024.

November 2023: South Carolina Maintains Median Home Price Gains

As the year wound to a close, the South Carolina real estate market stayed the course. Nationally, housing faced pressures from low inventory sustained high mortgage rates, and fewer buyers. That played out statewide and in regional South Carolina housing markets.

Big Picture On South Carolina Homes

The most recent South Carolina Association of Realtors data release for November 2023 shows statewide sales activity sustained a year-over-year decline. A 5% fewer homes were sold that month than in November 2022, and home sales activity is down 14.2% for the year-to-date (YTD). Homes are also spending more time on the market, now listed for a median of 62 days. That’s barely over two months.

But enough buyers are searching to keep housing prices inching upwards. Palmetto State home buyers paid a median $324,318, or 1.2% more than last year, for their South Carolina home. As the state’s median home price is below the national median of $387,600, the state is attracting attention from out-of-state buyers looking for affordable housing.

Sales Activity in South Carolina Real Estate Markets

Only two South Carolina markets saw positive sales activity: Spartanburg and Coastal Carolinas. The latter saw sales increase by 4% year-over-year. (YOY) But sales activity is barely down in Hilton Head, just 0.3%, and Charleston Trident at 1.3%.

Year-to-date sales activity is down in every single regional market except for Aiken. Despite not growing YOY in November, South Carolina’s horse country has reported a 16% increase in year-to-date sales.

Median Prices in South Carolina Real Estate Markets

Every single regional market reported year-to-date median price gains.

The most expensive markets remain the same, showing these areas are desirable because of their coastal access. Hilton Head home buyers paid $550,000, up almost 12% YOY, and Beaufort home buyers paid $415,000, up 12% YOY. Charleston Trident was third at $399,408, a 0.2% price drop.

But the market with the most pricing gains was inland. Homes in the Pee Dee region went for 15.4% more than last year but had an affordable median price of $225,000. On its heels was the Sumter/Clarendon County region, where prices increased by 13%.

Greenwood has the most year-to-date median price gains, although it lost ground in November 2023. Prices here are up 9.1% YTD.

Pace of Sales

Homes sold the fastest in Charleston Trident, where they were on the market a median of 33 days before sale. Even then, it was slower than last year’s pace of sales. Homes are staying on the market longer in each South Carolina region, which aligns with what’s reported nationwide.

Looking forward

The pace of sales is likely to remain low in the upcoming December release. As the year closes, South Carolina housing is on-trend with the nation. That’s fewer sales but slightly increasing prices as homes linger on the market. Some South Carolina local markets are highly active in the spring months. Interest rates are expected to moderate, so seeing how this plays out in the coming months will be interesting.

Q3 2023: Sales activity keeps slowing as prices stabilize

It’s been an unusual three months. Nationwide, the mortgage interest rates approached 8%, and the Federal Reserve maintained its fiscal policy of higher basis points to fight inflation. Home buyers and current owners found affordability and inventory challenged, slowing overall sales activity as market conditions drag on.

A statewide look at South Carolina real estate

The Palmetto State’s home sales activity in the third quarter of 2023 mirrors the nationwide trend. Year-over-year activity dropped 12%, while year-to-date (YTD) home sales were down 16%. The reporting data includes all residential real estate: single-family, condos, and townhomes.

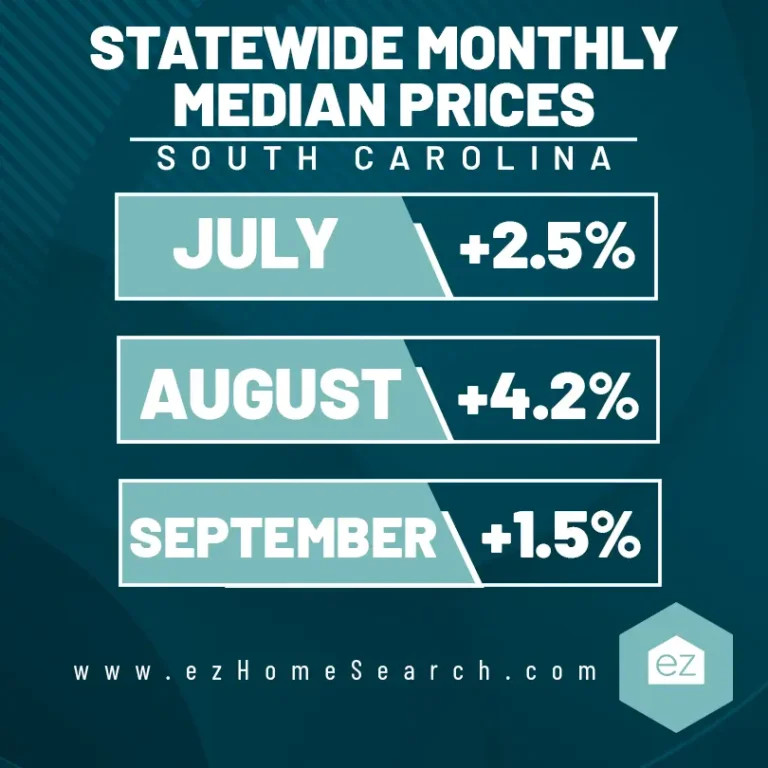

Despite slowing sales, people are buying real estate in South Carolina– enough that it’s keeping home prices stable. Buyers paid a median of $330,000 for the quarter, 2.5% more than last year. For the YTD, the homes had a median price of $325,000.

Homes are lingering on the market longer, about 36% more days than in the third quarter of 2022. Most homes were listed 61 days before the sale.

South Carolina’s most expensive real estate markets

Nearly every regional market reported sales price gains in the third quarter, except Central Carolina, Piedmont, and Greater Columbia. But their price declines were very slight, with Central Carolina having the most negative change at 2.4%. That market also was the state’s most affordable for real estate, with a median price of $200,000.

Meanwhile, Hilton Head Island reported double-digit pricing gains. Spartanburg was almost there, with a 9.4% increase in its median sales price. Hilton Head Island took the title of the most expensive South Carolina real estate market, with a quarterly median price of $510,000. Over $100,000 less than Hilton Head, the Charleston Trident was runner-up with a median sales price of $405,000, and Beaufort commanded a median price of $398,000.

Where homes are selling in South Carolina

Even though home sales decline statewide, that’s not the case for every market. Two areas reported positive sales activity: Beaufort and Hilton Head Island. Both markets are waterfront, with Beaufort in particular gaining some accolades in recent months as an excellent coastal small town.

Homes lasted the fewest days on the market in the Piedmont Region–just 26 days for the quarter and September 2023. But, homes moved fast in the Charleston Trident, too, at 29 days. Even though those are brisk sales paces, all regional markets but two saw their days increase, something that matches nationwide sales trends. Homes are simply staying on the market longer as the buyer pool shrinks.

South Carolina real estate information

Dive into South Carolina’s housing market with data from the South Carolina Realtors or a local real estate agent, who can provide pinpointed insights on where activity is going. See the state’s latest listings with EZ Home Search.

Q2 2023: Homes keep appreciating; South Carolina is in demand

In a recent housing market analysis by CNBC, South Carolina ranked second in the nation for having a strong housing market. That’s defined as one where homes are moving but are still relatively affordable despite the continued challenges brought on by limited supply, inflation, and higher mortgage rates.

South Carolina’s affordability score of 0.68 fell below the “balance” benchmark of 1, showing the market had fewer homes than the market needed to meet buyer demand, but that’s a common scenario across the nation right now. The state also started 2023 with a 23% price appreciation and had one of the higher new housing starts ratios per 1,000 residents.

Look at how South Carolina real estate is doing as we pass the halfway point for 2023.

Statewide look at South Carolina real estate

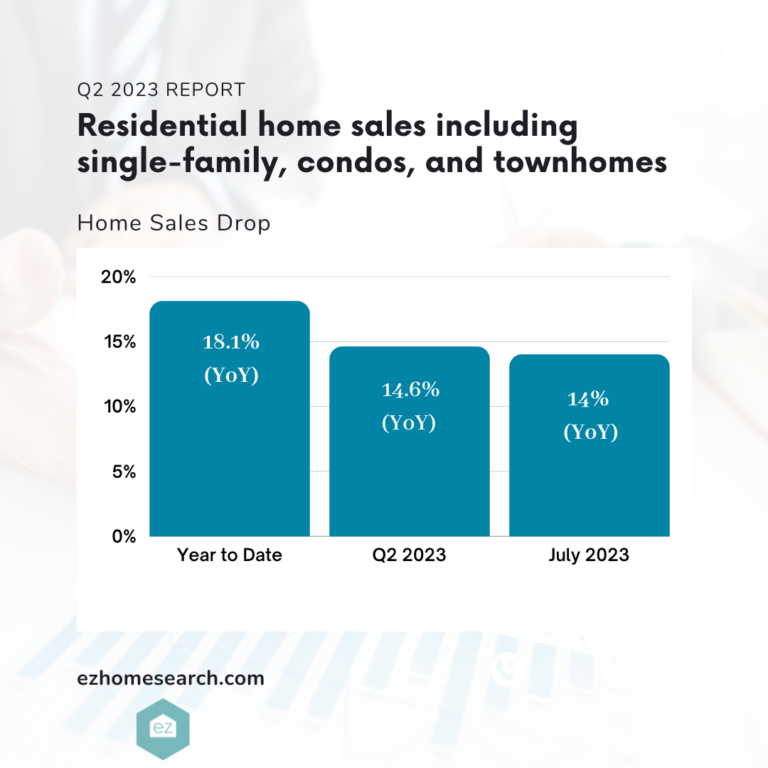

The Q2 2023 report on all residential home sales–including single-family, condos, and townhomes–showed the number of homes sold dropped 14% year-over-year for July 2023. It’s a persistent trend, as sales were down 14.6% for the quarter and 18.1% year-to-date.

Behind this drop in closed sales is a combination of too few homes to meet buyer demand and a slowing sales pace as affordability declines. Proof of slowing sales lies in the days on the market. Granted, the days on the market were historically low during 2022, but a 51.2% year-over-year increase is still a notable slowdown. Homes were listed for an average of 65 days in Q2 2023, or just over two months.

Despite this slowing of sales, median sale prices continued their upward growth, albeit slower than in prior years. Statewide, South Carolina median sale prices in Q2 were at $330,000 for all real estate, a 1.5% bump year-over-year. Year-to-date was $325,000, a 3.2% increase.

The most expensive markets in South Carolina

Some areas in South Carolina are more attractive to buyers than others, as shown in the regional price reports. For Q2, nearly all markets but two showed some price gains.

Central Carolina had the most significant growth at 9.6%. Still, with a median price of $205,000, it’s highly affordable compared to the national median of $402,600. Spartanburg was on its heels with a 9% price appreciation and a new median list price of $285,000.

But the markets with the highest median sale prices were Hilton Head ($520,000), Beaufort ($404,990), and Charleston Trident ($400,000). All three markets are notably waterfront, historic, and densely populated.

Conversely, the most affordable markets in Q2 were the Pee Dee Region ($203,900), Central Carolina, and Sumter/Clarendon County ($240,000).

Where homes are selling in South Carolina

Every single regional reporting MLS had a drop in year-over-year sales activity. But the slowdown in sales was more dramatic in some regions.

Central Carolina may be one of the lowest-priced markets, but it also had the fewest sales in Q2 2023. The 87 closed sales were a 21% drop over Q2 2022. This may change in the next quarter update, as the most recent month (July 2023) reported a 3% increase in sales activity.

However, it’s not just the more rural regions with sales slowing. The Charleston Trident had a significant slowdown of almost 18%, even though it closed 5,404 sales. Greater Augusta also reported a sales drop of 17% to 2,242.

Beaufort had the least amount of change. With 819 closed sales in Q2 2023, its pace slowed just 1.3%, and it was up 3.7% for July 2023. Spartanburg and Western Upstate were also consistent, with a respective 2.6% and 2.8% fewer sales from the prior year.

Start Your Home Search

Casey McKenna

Share this Post

Related Articles

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information

Your EZ Guide to Idaho Property Taxes

Real Estate Information