Charlotte Real Estate Market Update

January 2024: Bump in New Listings Good News for Buyers

As the new year got underway in high-demand Charlotte, the first market report had some good news for prospective home buyers. Listings are on the rise, and that means more choices. Look at how an inventory increase impacted closed sales activity and Charlotte home prices for the month.

Charlotte MSA Listings Increase

Closed sales started the year with closed sales 5.4% down in the greater metro area. The metro includes outlying counties like Union, Rowan, and Lincoln, plus the central counties of Mecklenburg and Gaston.

But things could be turning around, as the number of new listings increased 8.7%. More homes would be good news for buyers and help stabilize regional price growth. Overall, the median sale price of $380,655 was down 1.1% year over year (YOY), but average sale prices increased 7.8%.

Home sales activity will likely be on the lower side as the year kicks off, as pending sales are down 1%. The metro starts 2024 with a 1.4-month inventory, the same as January 2023.

City of Charlotte Prices Fell

Charlotte accounted for 636 of the metro’s 1,794 closed sales in January 2024. That’s almost 8% fewer sales than last year. Median sale prices followed the greater metro’s small decline, dropping 1.5% to $385,750.

New listings increased by 6%. However, pending sales are down 3.3% to start the year. That indicates that closed sales activity will likely be lower in early 2024. Contributing to this is a general lack of homes for sale, as the city ended January with a 1.2-month supply of inventory. Most homes were on the market 38 days until the sale, which was four days less than last year.

Where homes are selling

Outlying metro regions had the most increase in closed sales activity for the New Year. Among these were Gastonia (14.3%), Rock Hill, SC (23.2%), and Statesville (24%). Incredibly, Cornelius had a 68% increase in sales activity, but when the total homes sold was just 42.

Regarding pricing growth, Waxhaw led the way with a 54% bump in pricing. Home buyers paid a median of $790,000, up 52% from the prior year. After Waxhaw in the southern metro, Kings Mountain reported a 45% price increase, with a median sale price of $279,000. Lake Wylie was next, with a 23% price increase to $635,000.

Perhaps the biggest news across the Charlotte region was the increase in new listings–up 10% from last year. Suburbs like Kings Mountain saw a 134% bump in homes coming to market. Even Uptown Charlotte benefited, with a 120% YOY increase in new listings. Nearly every market had more homes coming to market, with some exceptions in the suburbs of Indian Trail and Tega Cay, SC.

November 2023: Low Supply Keeps Pressure on Pricing

October brought challenges to the nationwide real estate market, mostly regarding affordability. The Charlotte real estate market reflects what other major metros are experiencing: slow sales, increasing supply but limited listings, and rising median home prices. Take a closer look:

Charlotte’s big picture

Home sales in the greater Charlotte metro dropped almost 14% in October 2023, the latest reporting period. It’s been brought on by sustained low listings, but a shrinking buyer pool contributes. Mortgage rates hit new multi-decade highs in the month, further stressing home affordability.

But there are some signs of stabilizing conditions. At $380,000, the median sale price didn’t change year-over-year(YOY). The year-to-date (YTD) home price is down just 0.3%. Home prices have been hovering near this mark all year.

Without more homes for sale, the Charlotte real estate market remains stressed and favors the sellers. The monthly supply of inventory declined slightly to just 1.8 months. Homes were also on the market for fewer days YOY, at 79.

Mecklenburg County

Moving into Mecklenburg County, the heart of the Charlotte metro, conditions mirror the greater region. Home buyers spent a median of $435,000, a 2.3% increase year-over-year (YOY). The days on the market until sale dropped to 77, and the supply stood at 1.5 months. The market needs more listings, but 4% fewer came online than October 2022. Mecklenburg’s YTD median home price stood at $425,000, with 22% fewer listings than the prior year.

Mecklenburg was not the highest-priced metro real estate market in October. That honor goes to Union County, which posted a median sale price of $466,000. Union County is southeast in the Charlotte metro and home to suburbs Indian Trail, Wesley Chapel, Unionville, and Monroe.

City of Charlotte

Drilling down into the City of Charlotte, we see much of the same: a 1.5-month supply of homes, fewer new listings, and about 78 days from list to close. Median sale prices increased 3% YOY to $417,225. This figure has been nearly consistent all year.

Charlotte suburb prices

Looking at Charlotte’s suburbs, the real estate market reported:

| Median Sale Price | DOM to Close | Supply | |

| Davidson | $706,000, up 7.3% | 104 | 1.7 |

| Concord | $382,000, up 10.7% | 71 | 1.6 |

| Huntersville | $537,500, down 7% | 75 | 1.1 |

| Kannapolis | $287,488, up 8% | 68 | 1.7 |

| Matthews | $440,000, down 0.5% | 62 | 1 |

| Fort Mill | $470,000, up 3.3% | 76 | 1.3 |

| Gastonia | $294,950, up 2% | 80 | 2.6 |

Future predictions

Stabilizing the Charlotte real estate market will be more challenging without more homes on the market. Homeowners aren’t willing to list in this high-interest rate environment, so new listings will likely remain lagging. As 2024 begins, the current conditions will persist for some time as the markets nationwide find a balance in demand and pricing.

August 2023: Inventory stays low, putting pressure on the prices

As summer waned, activity in the greater Charlotte metro for August 2023 mimicked the nationwide trends. New listings continued to decline, tempering year-over-year growth and sales activity. Still, eager buyers kept the Charlotte real estate market competitive, leading to year-over-year price growth.

The big picture

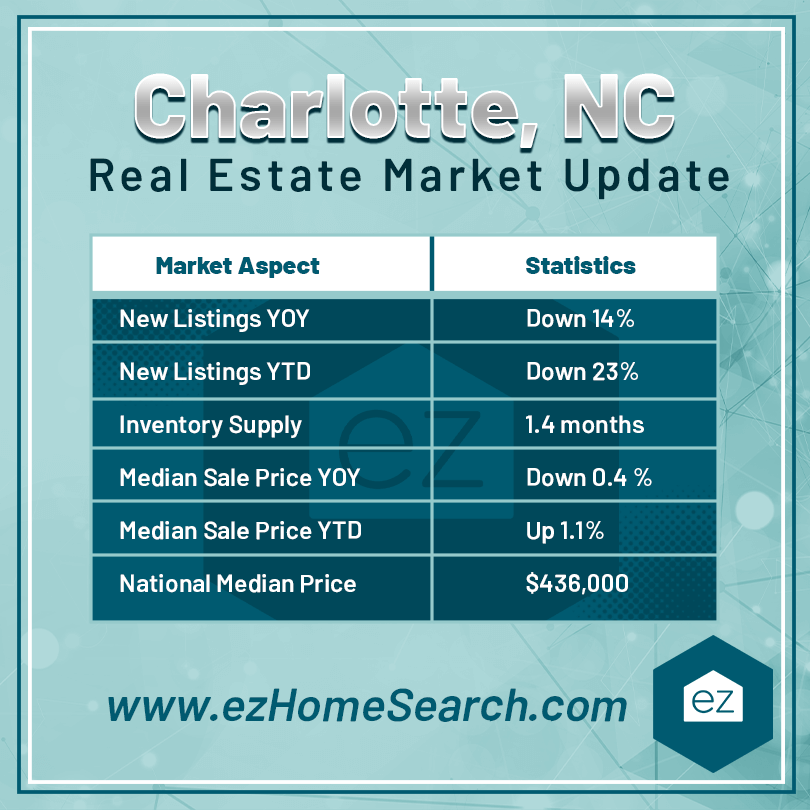

New listings dropped almost 14% year-over-year (YOY) in August 2023 and were down 23% year-to-date (YTD). That followed a drop in pending and closed sales, bringing the months’ supply of inventory to 1.4 months.

Even though fewer buyers are looking for homes due to the overarching economic environment, the reduced inventory still isn’t enough to meet market demand. For that reason, home buyer pressure remained, which was why the year-over-year median sale price only declined 0.4%. At $400,000, the Charlotte real estate market was below the month’s national median sales price of $436,000. The year-to-date median home price was up 1.1%. Homes were on the market 27 days until sale and 82 days to close.

The Charlotte MSA includes seven counties in North Carolina and three in South Carolina, with Mecklenburg County at the center. Among the cities in the report are Concord, Cornelius, Gastonia, and Tega Cay, SC.

Where median sale prices are rising

Uptown Charlotte had the highest YOY price growth, at 49% to $542,207. It also had a 61% jump in new listings, bringing the month’s inventory supply to 1.5 months.

Second in line was Cornelius, with a median sales price of $635,000, a 25% increase from August 2022. New listings were down 31%, but the months’ supply of inventory remained the same.

Matthews had a 21% price increase to $567,500. Its months’ supply of inventory stood at 1.1 months.

Inventory remains low

Sustained declines in new housing inventory and pending sales constrain the Charlotte metro housing market. Only two markets had their inventory grow–Uptown Charlotte and Statesville. All other communities reported declines, with Waxhaw seeing the most significant drop at 33%. Seven municipalities had reductions of over 20%, including Huntersville, Gastonia, and Concord.

New listings were persistently low on the county level, too, with only Iredell in North Carolina seeing an increase.

The reduced inventory is influencing closed sales in the Charlotte real estate market. Lincolnton had the highest reduction in YOY sales activity, with a 58% drop. However, five markets did have sales growth. In Fort Mill, sales grew 40%, while Statesville had 24% more activity. But in most Charlotte metro markets, sales did report double-digit declines for August 2023.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate Information

Your EZ Guide to Arkansas Property Taxes

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information