Is 2024 Your Year To Buy a Home?

Fewer people bought homes last year, but not because the desire to buy isn’t there. The overarching economic fluctuations definitely influenced what happened in housing. Everything got more expensive, causing a pullback on spending as the government tried to tamp down on inflation. As a result, year-over-year total housing sales were down 7.3% nationwide as of November 2023, and housing affordability tanked.

Will this continue into the New Year? Experts weigh in on when the current housing market sales slow down and if 2024 is a better year to buy a home.

Will Housing Affordability Rebound?

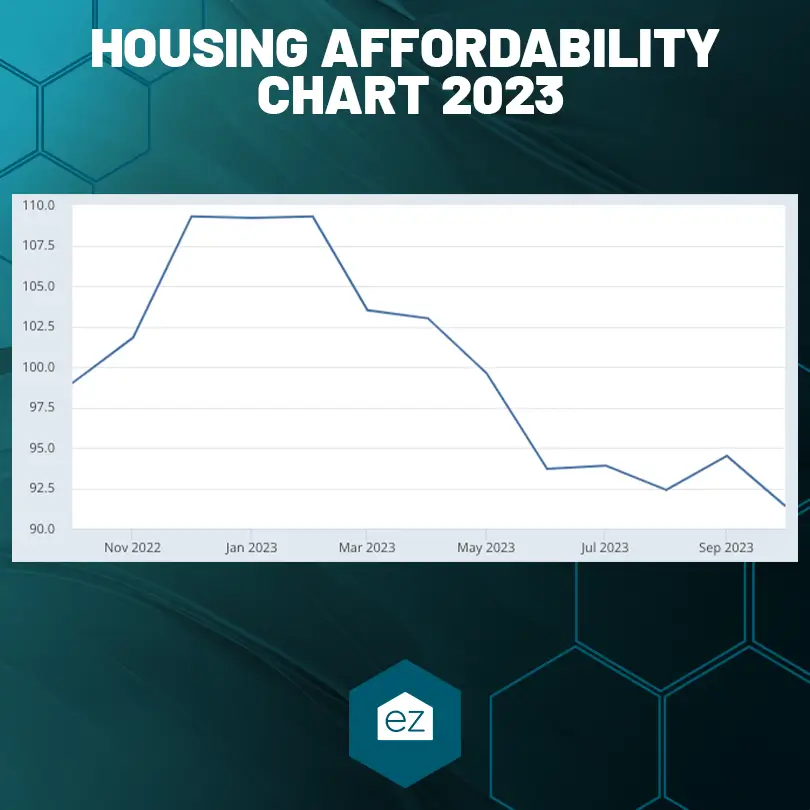

If Americans can’t afford the homes, they won’t buy. That makes affordability key to changing the current housing market, as home affordability in 2023 reached its lowest mark in decades. If 100 is a balanced market, then buying a home was 9% less affordable by October 2023.

There are three levers to watch to see if housing affordability will improve in 2024:

Mortgage Rates

After maintaining a tight fiscal policy, the Federal Reserve finally looks poised to bring some relief to consumers. It declined to raise its basis rate in the final meeting of 2023 and indicated it may consider lowering the rate in 2024.

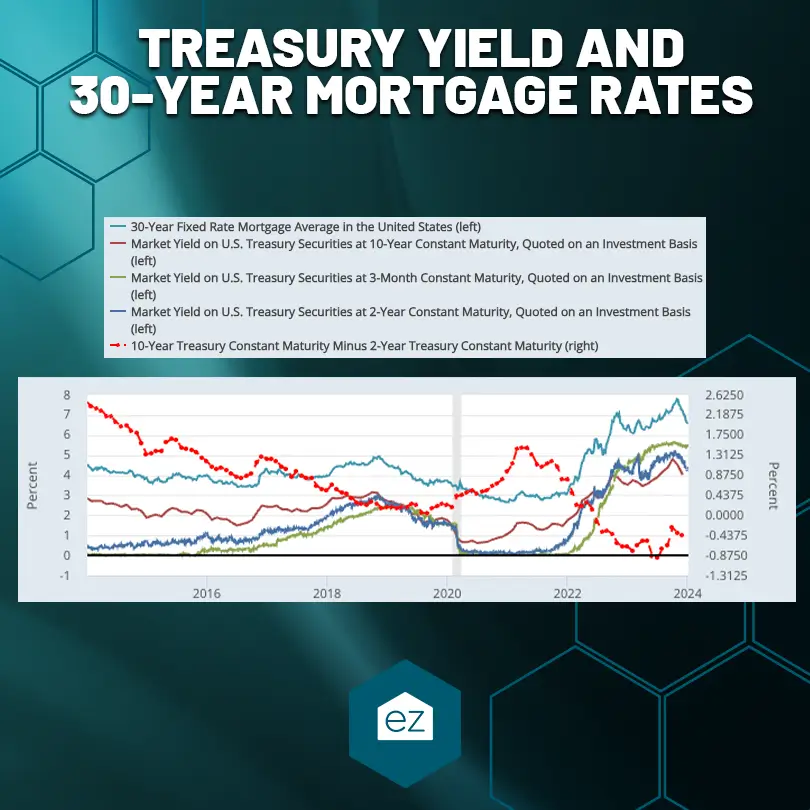

Where the Fed sets the basis rate trickles across the economy, but watch the 10-Year Treasury Yield for housing as it influences mortgage rates. In the coming weeks, a lower basis rate would help lower the rates lenders offer. In the last eight weeks of 2023, the Treasury Yield was trending downward, and generally, mortgage rates followed suit.

Even a 1% drop could save homebuyers hundreds on monthly mortgage payments. It would increase their buying power and bring more buyers off the sidelines.

Bankrate’s Chief Financial Analyst Greg McBride predicts 2024 will maintain a high interest rate environment. Still, the signs are pointing to all consumer loan rates easing through 2024. His prediction is for home loans to land around 5.5-6% by the year’s end.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), has a different take. He predicted an average 6.3% 30-year fixed mortgage in 2024 and that the Fed will lower its basis rate four times.

Housing Inventory

Two factors are at work for housing inventory. The market nationwide needs more existing homes to be listed, but homeowners aren’t moving. It’s the “lock-in effect,” where homeowners hold their attractive 2-3% interest rates. But if mortgage rates move away from their 7-8% high marks and closer to 5-6%, they may decide that’s enough improvement to list their homes.

The second is increasing the available housing inventory through new construction. There’s some good news on this front, as privately owned housing starts were up 14% in November 2023. Building permits were also up 4%. Together, it’s a sign that new construction is on the rise. To keep construction on new housing moving that way will take managing labor and material costs and some mortgage rate relief.

Median Housing Prices

This factor is trickier, as nationwide median home prices have sustained their growth through 2023. Homes are now listing at 1% more than their 2022 pricing peak. Some regional markets saw phenomenal growth, like 21% reported in Coconut Grove, a Miami suburb.

Experts anticipate pricing growth will continue. It boils down to basic supply and demand. While fewer homes sold in 2023, the available inventory was still well below the demand for homes. Demand causes the prices to stabilize or grow. So even though fewer people were buying homes, those searching still faced extremely low inventory and some competition for the existing homes.

It should be good news for buyers. More listings would temper the price gains because more homes for sale would make the listed homes less competitive.

There’s only one hitch: all the prospective buyers left waiting over the last few years because of the high mortgage interest rates, slow wage growth, and higher prices. Should incomes increase and mortgage rates ease, the number of buyers hunting for a home could also increase. That would erase any advantages from inventory increases and grow median housing prices.

For that reason, median housing prices are likely to keep growing in 2024, even at a modest rate. Experts are conflicted about where median home prices will go because it largely depends on how many people decide to take advantage of lower mortgage rates. Some call for a 0.2% nationwide pricing drop, while others say prices will fall closer to 1.7%. Others see stabilization or moderate pricing gains of 1-3%.

Pricing growth is highly regionalized, likely to be concentrated in southern metro markets where demand remains high or the Midwest, where affordability attracts Americans.

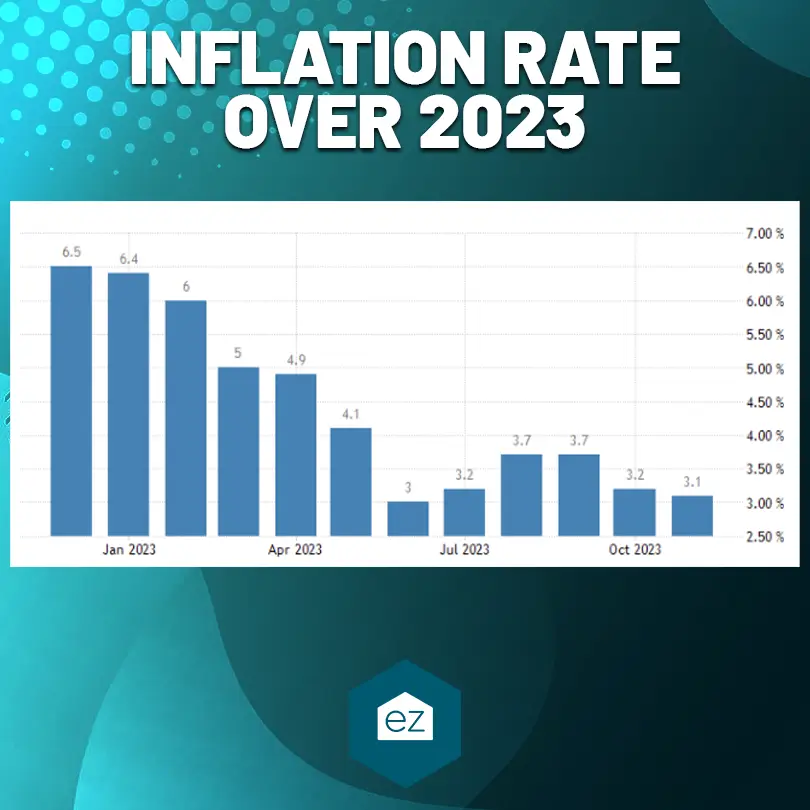

Improving Inflation Is Good News

A few other economic factors bear watching is that 2024 is an excellent time to buy a home. Inflation is easing and bringing down the cost of goods and services. Consistently lower inflation would encourage the Federal Reserve to relax its fiscal policy, making affording loans on all products that much easier.

Because of lower inflation, the gross domestic product (GDP) is expected to grow 1.3% by the end of 2024.

Wage growth is another important factor, especially when measuring median household incomes against housing prices. Most Americans don’t make enough to afford median-priced homes. If housing prices can’t budge, then incomes will need to rise to fill in the gap. Average annual wage growth is anticipated to reach 3.5% this year.

The way of think of 2024 is a “soft landing.” Don’t expect dramatic economic changes, as with 2020 and 2021. Instead, inflation, pricing, and economic growth changes will be slow and measured.

Buying a home in 2024

Whether home buying is in the cards is really a game of wait-and-see. Generally, anticipate slightly more homes to come to market. Affordability will improve, but not by much. If a home purchase is in the cards for you, be ready to be patient, as inventory will still be low in many high-demand markets. Keep an eye on all these factors as the year progresses.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Buying a Home

Conforming Loan Limits: A Guide for Homebuyers

Buying a Home

What to Know About Termites In Your Home

Buying a Home

What to Know About Spray Foam Insulation

Buying a Home