Who Bought and Sold Homes in 2023

With housing affordability shrinking in 2023, the national real estate market saw some incremental changes in who was buying and selling homes. The profile mostly remained similar to prior years: older buyers were likelier to buy or sell homes. In a market struggling with affordability, they stood in a stronger financial position. However, first-time home buyers are slowly making gains, even if they are getting older before purchasing. Take a look at the profile of home buyers and sellers in 2023 to see how the market adapted to a reduced sales year.

Who bought homes

The top reason people bought a home in 2023 was simply the desire to own a home. That was the reason given for 26% of home buyers and for 60% of first-time buyers.

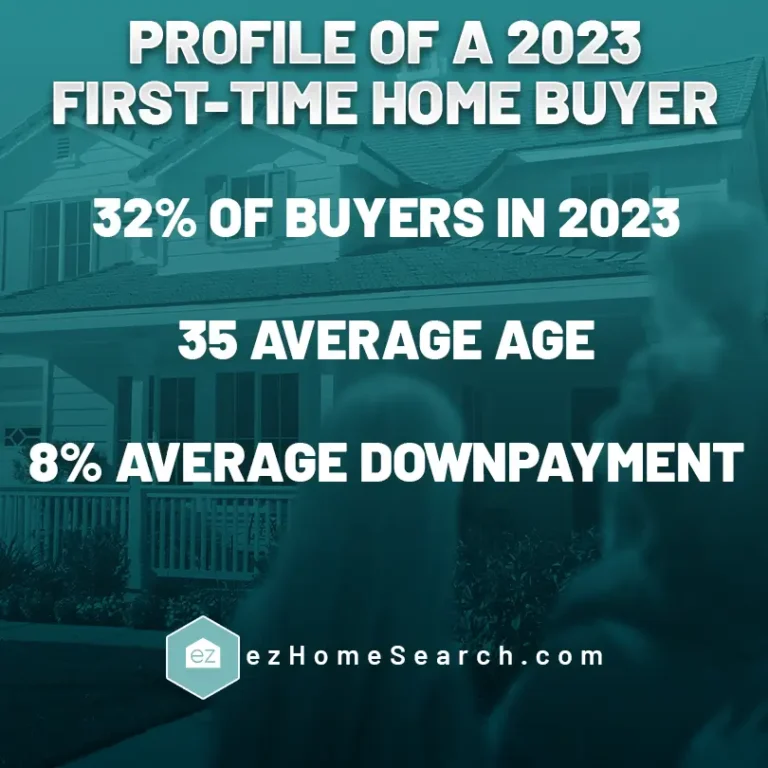

More first-time home buyers dipped their toes into the home-buying market in 2023, but it’s still far below the average since record-keeping on the metric began. Still, they made up about one-third of all buyers last year. These home buyers had an average age of 35 years old.

Fewer married couples are buying homes together, but they are still the demographic with the most purchasing power. Nearly 60% of buyers were married, compared to 9% of unmarried couples, 19% of single women and 10% of single men.

Most homebuyers did not have a child under 18 in their home. It’s the highest share ever recorded for this metric. So most homebuyers in 2023 were childless, but the figure doesn’t show why, whether there were more young professional couples, older families buying together, or a baby boomer with an empty nest.

The median income of home buyers also grew from $88,000 to $107,000. Part of that shift lies in how 2023’s affordability challenges caused lower-income buyers to delay their purchasing plans. The market nationwide also had about 20% fewer homes sold, shrinking the total buyer pool.

How buyers purchased a home

More homebuyers rely on self-searching the internet first to find homes for sale. Only 20% decided to contact a real estate agent first, but those who used one found their real estate agent to be a useful information source. In 89% of the transactions, buyers used a real estate agent or broker to purchase their home. Around 43% went with a referred real estate agent, while 13% used the same agent they did in the past.

Even with mortgage rates climbing in 2023, financing remains vital to the home purchase process. Around 80% of home buyers sought financing for their transactions. First-time buyers typically put down 8% for a down payment. These buyers said saving up enough was one of the hardest parts of the real estate process. Many respondents indicated they made financial sacrifices to make up the down payment. Nearly one out of four first-time buyers used a gift or loan for the down payment.

Meanwhile, repeat buyers averaged 19% for their down payment. Most of this came from personal savings. For repeat buyers, 53% used the sale of their prior residence to help with the down payment.

What they bought

Existing homes, particularly single-family homes, made up the vast majority of transacted real estate. Just 13% of buyers purchased a new home. Some of that relates to the lagging amount of new construction compared to existing real estate. Those who did buy into a new construction home cited a desire to avoid renovating a home to match their needs or taste or the potential maintenance issues of an existing home.

A typical purchased home was about 1,860 sq ft, built in 1985, with three bedrooms and two bathrooms. Around 47% of the homes purchased were in suburban communities. Buyers said they anticipated being in their homes for about 15 years.

As a sign of how America is growing older, the number of senior-related homes bought increased to 19% from 7% the prior year. This includes buying into a 55+ community or an assisted-living type housing arrangement. Another 14% bought a multi-generational home. The cited reasons were a combination of families looking to care for aging parents or help their young adult children who lacked the assets to buy a home independently.

Most home buyers bought within 20 miles of their existing home. It’s a departure from 2022, when the median distance moved was 50 miles. However, historically most people have bought a home within 15 miles of their current address. It’s a shift back towards a more normal buying pattern.

The number one factor for homebuyers was the neighborhood’s quality. Of course, that definition of “quality” differs among buyers, but common factors would be low crime rates, access to amenities, and commute times. Other heavily weighted reasons for buying included its convenience to family and friends and affordability.

Who sold their homes in 2023

Most home sellers were 60 years old, the same figure as 2022. Almost one in four of these homeowners cited a desire to move closer to their family or friends as their primary reason for moving. Other top reasons included the home being too small or a change in the family situation.

While buyers may think they will stay in the home for 15 years, most only lived there for 10 years. This has been typical over the last decade.

Sellers opted to buy bigger in 39% of the purchases, while 33% downsized their homes.

About 89% relied on a real estate agent to help them sell their home. Their choice of real estate agent most often came from a friend, neighbor, or relative who had used the person before. If not a referral, then the seller’s agent was the same person who helped them purchase it in 46% of the instances. Only 7% decided to do a for sale by owner, which in many cases was to someone they already knew. This figure was at an all-time low in 2023.

Most homes were on the market for a median of two weeks and received a median of 100% of their list price.

The National Association of Realtors (NAR) gathers this data for the 2023 NAR Profile of Home Buyers and Sellers from a 129-question survey sent to buyers who purchased between July 2022 and June 2023. It does not include investors or vacation properties.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information

Your EZ Guide to Idaho Property Taxes

Real Estate Information