Georgia Real Estate Market Update

December 2023: Declining sales activity brought on by lower inventory

Another year wound to a close in Georgia’s real estate market. The latest sales data from December 2023 indicates Georgia continued to have home sales activity concentrated in the greater Atlanta metro, with some outlying counties reporting some high sale prices.

Home Sales Down

Statewide, average home prices grew 3% year-over-year (YOY) to $266,821. Remember, averages can be skewed easily by having a home sale well below or above the typical going prices. Median sales prices would be more accurate, but that data point is currently unavailable.

Fewer homes sold year-over-year, which can also impact average sold prices. Overall, about 600 fewer home sales closed statewide in December 2023 than in December 2022. That aligns with national trends towards fewer closed sales, as inventory remains low and higher mortgage interest rates challenge affordability.

Georgia Home Sales Prices

As mentioned, multiple counties had no properties sold in 30 of its 151 counties during December 2023. Another 54 had 10 or fewer homes close. This is typical for Georgia, which has a defined dichotomy of very rural and agricultural counties and densely populated urban areas.

The average sold price of the 29 counties inside the greater Atlanta metropolitan area highlights this difference: buyers paid $431,216 here. Gwinnett County had the most closed homes with 539, followed closely by centrally located Fulton County at 514.

Vacation destinations post higher prices

However, high sales activity only sometimes correlates to high prices when you’re using averages. Take the most expensive average sold price for December 2023: rural Rabun County in northeastern Georgia. It had 21 listings and an average sold price of $926,581. The higher prices reflect the mountain and lakes region’s popularity as a vacation and retreat destination. It’s also a prime example of why average sold prices can be deceiving, as Rabun County’s median list price for December 2023 was actually $450,000.

The other two most expensive counties, Fannin ($755,444) and Glynn ($693,592), also reflect how having low closed sales figures, 38 and 25, respectively, in a highly desirable vacation destination can impact average sale prices. Fannin is another mountain county home to Blue Ridge and Morganton, while Glynn’s Sea Islands of St. Simons and Jekyll are prime oceanfront.

Meanwhile, the state’s most active county, Gwinnett, had an average sale price of $488,650 for its 539 closed sales in December 2023.

Looking ahead

Figures statewide and in the Atlanta core reflect a decrease in new and active listings. The need for more inventory trends with nationwide housing markets. It highlights how the state needs more listings to bring the Georgia real estate market closer to balance in 2024.

Fall 2023: Fewer Listings, But More Inventory

Fall has arrived in Georgia, with it, cooler real estate sales. The big theme for the third quarter of 2023 has been stresses on housing affordability and the lack of inventory. Here’s how that played out month-to-month in the Georgia real estate market.

July 2023

Home sales dropped 17% in July 2023 from July 2022. But that didn’t mean the median sales price dropped. The state finished with a median sales price that was 2.3% more expensive than the prior year: $358,000. Housing affordability declined, moving from a 97 index to an 84 index. Meanwhile, the monthly supply of inventory crept from 2.1 to 2.5. That’s still pretty far from six months, which is what experts considered a balanced real estate market.

August 2023

As the kids went back to school in August, the sales activity increased month-to-month but was down 12% year over year. Again, the median sales price crept up year-over-year (YOY), this time to $356,688. That was a 3.4% bump from August 2022. Housing affordability dropped by about 19% while the supply of homes increased to 2.6 months.

September 2023

The most recent month, September 2023, reported a 17% year-over-year drop in sales activity. And while the median sales price of $353,440 may be the lowest of the quarter, it was still 4% more than September 2022. Again, the monthly supply of inventory increased, closing at 2.8 months.

Georgia Year-to-Date Sales

As we look at year-to-date (YTD) sales in Georgia, the state simply has fewer homes for sale. New listings are down 12%, pending sales declined 14%, and overall closed sales shrank by 17.4%. Homes spent about 52% more days on the market–41 for the YTD. The median sales price increased 2.9% to $349,900.

New listings have been on the decline every single month since October 2022. It will take a lot more homes to improve the state’s housing affordability and sales activity.

As the year ends, Georgia’s sales prices tend to follow a seasonal trend, peaking in the spring and waning in the fall. So, we can expect month-to-month to see some lower sales prices, but that doesn’t necessarily mean they’re going to be more affordable year-over-year. There has been slight but persistent growth throughout the year.

The Georgia real estate market has shown a creeping increase in the months’ supply of inventory, which is now at its highest supply in a year. That shows the buyer pool is smaller, likely a reflection of affordability concerns. It has moved in tandem with the shrinking amount of statewide closed sales.

Mid-year look: July 2023 shows significant inventory drop

Georgia’s real estate market reflects the trends felt nationwide in the summer of 2023. The US is experiencing a slowdown in sales activity driven by affordability and housing supply stresses. Homeowners are staying in place to wait out higher mortgage rates. At the same time, buyers find appreciating homes and interest rates are pausing or delaying any plans to purchase a home. The result is a shrinking buyer pool moving at pace with the reduced inventory.

Georgia real estate in July 2023

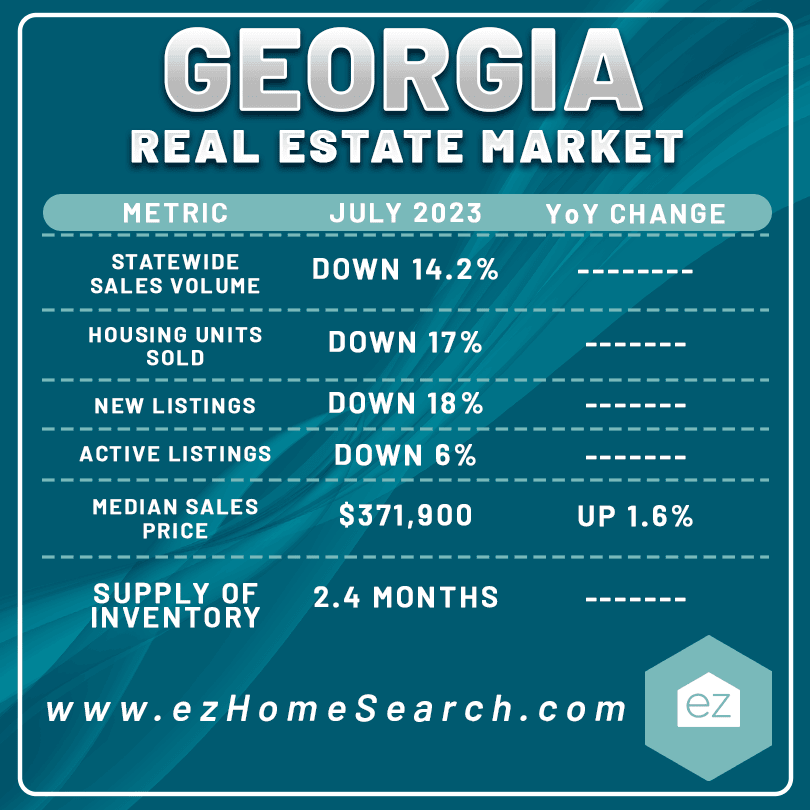

The latest data for July 2023 coming out of Georgia shows statewide sales volume was down 14.2% year-over-year. A big part of that is fewer housing units sold–about 17% less. That includes all residential real estate–single-family homes, townhomes, and condos.

Accompanying the sales pace slowdown is a market with almost 18% fewer new and 6% fewer active listings. Owners simply aren’t selling their homes. Each month this year, except January, has had fewer new listings than the prior year. Active listings were outpacing the preceding year until last month.

But median sales prices still bumped up 1.6% year-over-year to $371,900 for the state. That indicates the state is still in a seller’s market, with too few homes for the buyers looking and willing to buy in today’s conditions. Overall, Georgia had a 2.4-month supply of inventory in July 2023.

It’s notable that home prices tend to peak in the summer months in Georgia, so the coming months could see a reduction in home prices.

Month-over-month sales activity

Given the seasonality of real estate markets, year-over-year comparisons generally provide a better look at market conditions. Still, analyzing month-to-month can signal if sales activity is increasing or decreasing.

The numbers for June 2023 show July hit the brakes. The month-to-month sales volume tanked by 17%, units sold dropped 14%, and new listings dropped 8%. Even the month-to-month median sales price declined from June to July. However, the number of active listings did increase.

Most Active Georgia Markets

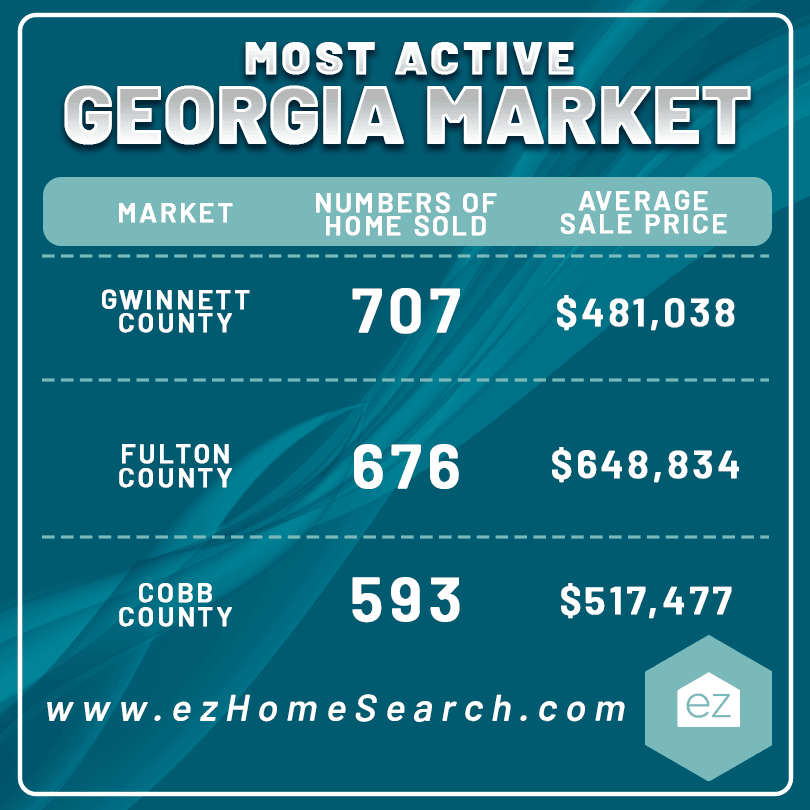

Looking at the monthly county breakdown, the Atlanta metro had the most real estate sales activity for July 2023. Gwinnett County in the northeast metro had 707 homes close at an average price of $481,038. Covering downtown up to Alpharetta, Fulton County had 676 closings at an average of $648,834. Cobb County, which includes the suburbs of Marietta, Smyrna, and Kennesaw, had 593 closings at an average of $517,477.

But Georgia real estate is a paradox. As active as the Atlanta metro is, that’s not consistent in the state. Large swaths of largely rural Georgia can lack activity. Some had few to no listings at all! Twenty-six Georgia counties had no home sales in July 2023, and another 17 reported one single-family home sale, like Turner County’s $29,000 home sale and Dooly County’s $73,000 sale.

Most expensive Georgia home markets

Based on average prices for July 2023, you’ll need the largest budget to buy a single-family home in Greene County, a rural area beside Oconee National Forest with Greensboro as its county seat. This area is about an hour south of Athens and had an average sold price of $1.7 million for its 23 listings. After that, rural Putnam County next to Lake Oconee had an average sold price of $807,046 with 37 listings. Forsyth County in the Atlanta metro had 235 sold homes with an average sold price of $676,652.

The thing about averages is they are easily influenced by outlier sales, especially when you have a small number of sales, like in Greene and Putnam County. That’s why median home prices are a better indicator of what’s available in a market. Find a local Georgia real estate agent who can provide you with the latest market information and homes, or search what’s listed in Georgia today.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate Information

Your EZ Guide to Arkansas Property Taxes

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information