Raleigh-Durham Real Estate Market Update

Year-End 2023: Affordability Challenges the Triangle

The Triangle real estate market kept pace with national trends throughout 2023. Fewer new listings and a shrinking buyer pool due to affordability challenges led to fewer overall sales. Yet people still need homes, which is why overall home prices show stabilization in Raleigh and Durham real estate.

Note: The Triangle Region includes the counties of Wake, Durham, Johnston, and Orange.

The Big Picture on the Triangle

Local home sales dropped 14.1% for the year. Just 35,723 homes closed in 2023. A large part was the housing affordability crisis, which reduced buying power by almost 4% for the Triangle region. Adjusting prices led to a median sales price of $400,000 for the greater Triangle region, but that was down only $2,000 from 2022.

The homes that did sell received about 99.4% of their list price and sold in about 44 days. That brought the monthly supply of homes to 1.9 months by the end of December 2023. It’s less than the 2.5 months at the end of December 2022. The Triangle Metro starts 2024 with a continued streak of low inventory, and affordability is the main story.

That’s probably why rural Orange County saw its median sale prices grow almost 5% over the year and why it had the best housing affordability index score. Buyers are being priced out of Durham and Raleigh. Chapel Hill and Hillsborough are part of Orange County.

Wake County

In the heart of the Triangle, the Raleigh metro reported new listings for the year declined 19%, and closed sales dropped 16.3%.

Wake County’s home price growth did slow. Prices increased just 1% year-over-year (YOY) to $474,900. Homes typically received 99.5% of their list price. Housing affordability slipped two points to 88; an index of 100 would be a balance between what buyers can afford and the local median home value.

The Raleigh area remains in high demand. That directly impacts its real estate market. While homes were on the market for a median of 43 days until the sale, the year ended with a 1.4-month supply of inventory.

Keep in mind Wake County covers the Raleigh city limits and suburbs like Holly Springs, Wake Forest, and Knightdale.

Durham County

Durham County closed in 2023 with a nearly 20% drop in new listings. Fewer homes for sale definitely contributed to the 20.7% decrease in closed sales, as did the higher interest rates in the fall months.

However, median sale prices show some stabilization with no change from 2022. Homes sold for $410,000 and typically received 100.2% of their list price. Notably, even though median prices did not change year-over-year, Durham’s housing affordability dropped by one point to 82. Among the Triangle Counties, it was the least affordable. Rising mortgage rates in 2023 likely contributed to the loss of affordability, given that the median sale prices did not change.

The county ended the year with a 1.5-month supply of homes, which was 25% less than the prior year.

Durham County covers the City of Durham, Research Triangle Park, and rural regions.

November 2023: The Triangle Needs More Listings

Continued high mortgage rates, lack of inventory, and rising prices contributed to nationwide home sales dropping to a 13-year low. October 2023 showed sustained housing affordability challenges in national reports. Did those trends play out in the Triangle real estate market?

Note that the Triangle region report includes 16 counties in central North Carolina, with the major cities of Raleigh, Durham, Chapel Hill, and Cary.

Greater Triangle Region

Low housing affordability has been the pervasive theme this fall, and the Triangle region played into that. The Housing Affordability Index (HAI) came in at 68, almost 7% less than October 2023. For perspective, an index of 100 would mean that local household median income was in line with what it would need to qualify for a mortgage under the current interest rates. Essentially, the Triangle’s household median income is 32% less than what it would take to buy a home based on our market’s median home price of $400,000

Speaking of median home price, it increased 1.2% year-over-year in October. Homes were on the market only 24 days before going under contract. The regional months’ supply of inventory did rise, but at 2.2 months, conditions still favored local sellers.

Wake County Real Estate

Raleigh, Apex, Cary, and Wake Forest are included in North Carolina’s most populous county, among many other suburbs. Home buyers searching here paid a median of $475,000 to buy a home in October 2023, just a 1.1% year-over-year (YOY) increase.

In good news, new listings grew 4%, but Wake County is still down 20% in this category for the year-to-date (YTD). That’s contributing to a decline in the monthly supply of inventory, which stood at 1.8 months. The housing affordability index dropped 7% to 56, making the County one of the least affordable to buy a home in the Triangle region.

Durham County Real Estate

The October 2023 median sale price of $420,000 represented a 6.7% increase from October 2022. Most homes were receiving very close to their list price during the month.

Inventory is not on the rise right now. If anything, it’s dropping, and the 7% fewer YOY listings aren’t helping. Like its neighbor, Durham County has a 20% drop in new listings for the year. Home buyers had 26% fewer homes on the market than the prior year, leading to a 1.8-month supply of inventory.

Durham’s housing affordability index dropped to 64, so homes were 11% less affordable than last year. The County’s metro areas include the City of Durham, Research Triangle Park, Oak Grove, and Bethesda.

Orange County Real Estate

Over in Orange County, which includes Chapel Hill and Hillsborough, there was some good news for home buyers. New listings increased by 3% from the prior year, and the monthly supply of inventory grew by 19%. But at 1.9 months, conditions still favor the home seller.

October home sales had a median price of $466,475, an increase of 10%, and most homes were going for above their list price. That meant affordability dropped further, at an index of 57, barely above Wake County.

Future outlook

More listings are part of the solution to improving real estate sales activity and stabilizing market conditions. All three major counties of the Triangle region need more homes for sale to meet buyer demand. That will rely on easing overall market economic conditions, including home interest rates.

August 2023: Inventory remains below two months across the Triangle Region

The big picture

New listings continue to struggle in the greater Triangle region, dropping 17% year over year. Even the under contract includes sales were also down, reflecting a persistent need for new homes to come onto the market.

This lack of new homes has not discouraged buyers, which is putting pressure on the local real estate market. The August 2023 median sale price rose to $407,990, even if it was an incremental 0.7%. And while hearing that the days of the market are up 31%, to put it in perspective, that’s just 21 days. So, the Durham market remains highly competitive.

Housing affordability remains a challenge but is improving, as the recent index shows that August 2023 was about 17% more affordable than the prior year.

The Raleigh-Durham metro covers Wake, Durham, Johnston, Orange Counties, and other surrounding communities. Its borders include the state capital Raleigh, Durham, Apex, Cary, Wake Forest, and other in-demand suburbs.

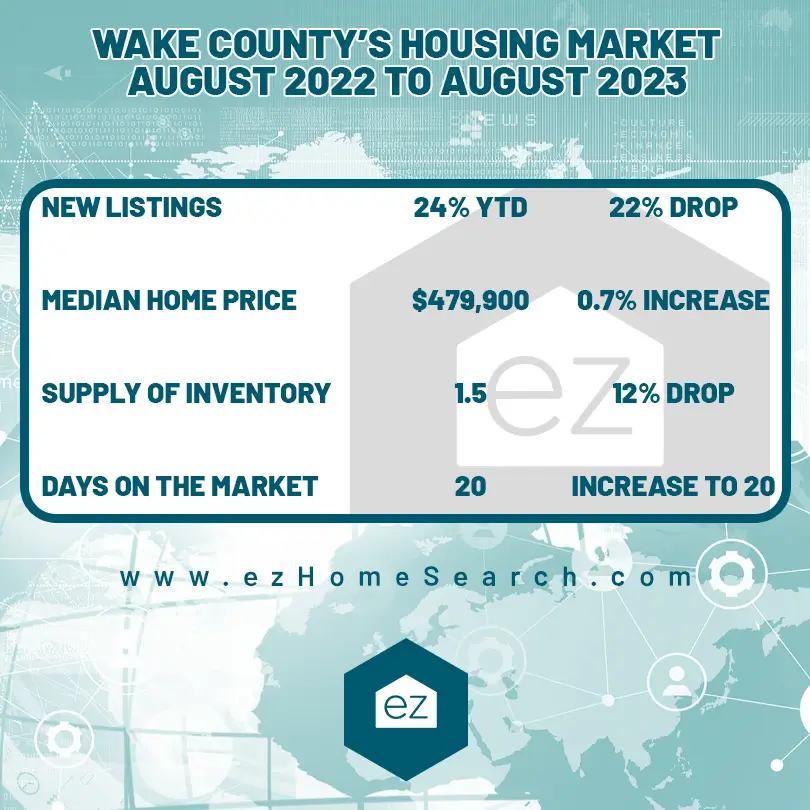

Wake County

Wake County’s housing market continues to struggle from the lack of new listings. From August 2022 to August 2023, there was a 22% drop. And that’s been persistent, as the market is down 24% year-to-date. Remember, Wake County includes the City of Raleigh, Wake Forest, Morrisville, Cary, Apex, and Fuquay-Varina.

Meanwhile, demand has not subsided, although it may be stabilizing. The recent median home price was $479,900, an increase of only 0.7% year over year. That coincides with the year-to-date increase of 0.8%. And where homes were receiving above list price a year ago, homes were more likely to receive at or just below their original list price this August.

Oh, the county ended with a 1.5-month supply of inventory, at a 12% drop. However, the days on the market did increase to 20.

Durham County

The story was much the same in Durham County, where new listings were down 24% year over year and 23% for the year thus far. However, it reported slightly more median price growth for August 2023, reaching $423,500. That was about 3% of August 2022. However, that wasn’t enough to pull up the year-to-date sales prices, averaging 2% under last year.

In a further sign of buyer demand, the days on the market were at 17. That was just two days more than August 2022. The Durham County real estate market had a 1.6-month supply of inventory. Durham County includes the namesake City, Research Triangle Park, and Braggtown.

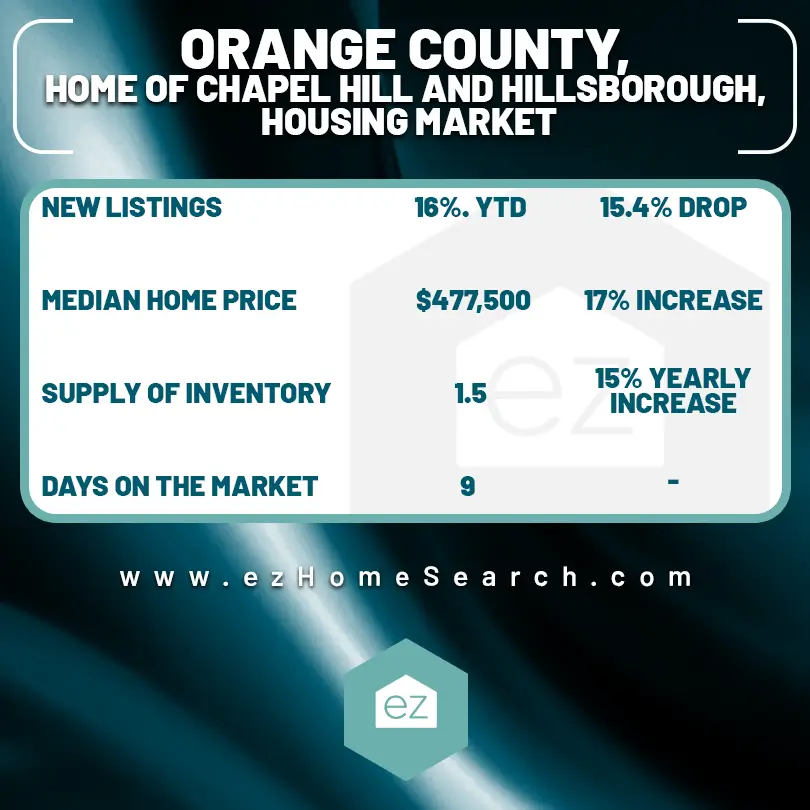

Orange County

In next-door Orange County, home of Chapel Hill and Hillsborough, new listings were only down 15.4% from August 2022 to now. For the year to date, they were down to 16%.

The median home price of $477,500 was an almost 17% increase. Home prices here are also up for the year just over 1%.

Orange County real estate remains highly desirable, as evidenced by its average in 19 days on the market and a 1.5-month supply of inventory. Even with such a low inventory, that’s a 15% yearly increase.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate News

White House Proposals Aim to Boost Housing Supply

Real Estate News

NAR Settlement Set to Reshape The Business of Real Estate

Real Estate News

2023 Reports Increased Demand for New Construction Homes

Real Estate News