Flood Zones: What You Need to Know

We’ve all seen the images on television: homes with water up to the windowsills or, even worse, the roof. After a significant weather event or during the spring snow melt, it’s not unexpected to see flood waters inside homes near the coast and rivers. But 41 million Americans live inside a designated flood zone and may not know it–including you.

It’s not scare-mongering. A Fannie Mae 2022 study revealed that 40% of homeowners inside a high-risk flood zone had no idea their property was in that zone. The same amount didn’t carry flood insurance on their homeowner’s insurance policy. Given how devastating flood damage can be to properties, millions are financially on the hook for their property losses.

With maps redrawn as scientists better understand the local factors contributing to flooding, your home may be inside a flood zone, and you don’t know it.

Understanding Flood Zones

A flood zone is an area identified as at-risk for flooding. The Federal Emergency Management Agency (FEMA) determines the risk based on factors such as elevation, water flow, and proximity to bodies of water. It then labels an area as high, moderate, or low risk of flooding based on its potential.

The purpose of designating flood zones is to help communities plan for potential flooding events and minimize the damage caused by them. They are why cities, counties, and states pass building ordinances requiring coastal and waterfront homes to be elevated a certain amount of feet.

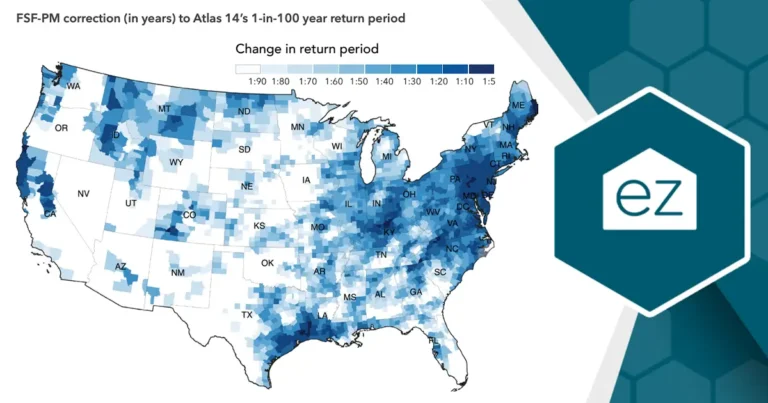

Flood maps are not static maps. They are regularly updated as scientists better understand how geographies and changing landscapes impact water flows. Land development also impacts how waters flow over surfaces, so new construction can influence maps, too. And as climate changes impact coastlines, new maps are being created. Louisiana updated its flood maps in 2023 to reflect its sinking coastlines.

Levels of Flood Zones

Some areas are designated Special Flood Hazard Areas, indicating a high risk of flooding during a 30-year cycle. At a minimum, these areas are subject to a 1% annual chance of flooding, often referred to as the “100-year flood” or “base flood.”

Flood zones are then categorized into different levels to indicate the severity of potential flooding. The key levels include:

-

Zone A: The most high-risk flood areas carry an “A” designation. The category is further subdivided to offer more specific data, for example, AE, AO, or AH, each indicating a different type of flood risk.

-

Zone B (or Zone X – Shaded): These areas have a moderate flood risk, meaning they fall between the 100-year and 500-year floodplain boundaries.

-

Zone C (or Zone X – Unshaded): These areas are at minimal risk of flooding as they are outside the 500-year floodplain.

-

Zone V: This designation is for coastal areas that, in addition to having a 1% or greater chance of flooding yearly, also face hazards associated with storm waves. FEMA estimates their chances of flooding within a 30-year cycle at 26%.

Keep in mind that living in a lower-risk zone doesn’t mean flooding is impossible; it only means that the risk is statistically lower. Refer to the most up-to-date flood zone maps to understand your property’s flood risk.

Why Flood Zones Matter

According to FEMA, just one inch of water in a home can cause up to $25,000 in damage. Unfortunately, flooding is the most common natural disaster in the United States. Living in a flood zone means your home is at risk, which can cause significant damage and financial loss.

Knowing the flood risk can help home buyers and owners make informed decisions about purchasing or renovating a home. If you want to buy a property or make renovations in a flood zone, you may need to take additional precautions or buy extra insurance to protect your investment.

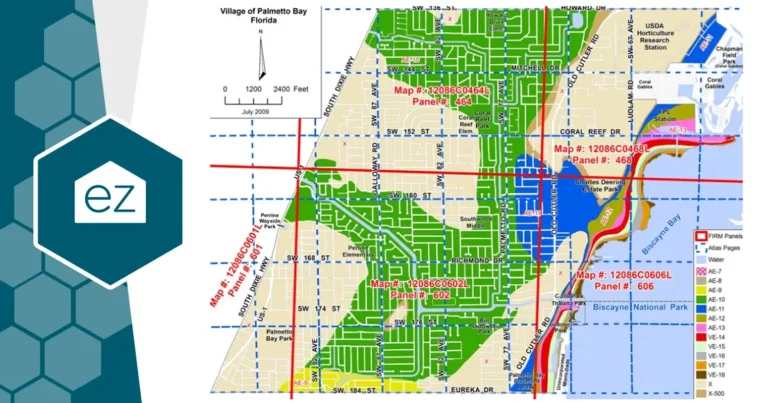

Flood maps serve another crucial purpose: to assess flood insurance requirements and accurately estimate policy costs. Insurance agents and lenders rely on FEMA’s maps to vet who requires coverage and how much risk they are underwriting. Flood Rate Insurance Maps (FIRM) influence mandatory building code requirements, floodplain management requirements, and flood insurance requirements. In fact, if the home is inside Zone A or V and the homeowner carries a federally backed mortgage, the owner must have flood insurance as a loan condition.

Where to Find Updated Flood Zone Maps

Flood zones change over time due to better analysis of weather patterns, landscape changes, and construction development. In conjunction with the National Flood Insurance Program (NFIP), FEMA releases updated maps periodically. For instance, in 2023, 54 flood maps spanning from New Mexico to Massachusetts were officially updated or revised.

Changing a map is a long process that includes input from engineers, floodplain administrators, and surveyors. All new proposed maps are open for 90 days for public review.

Access the latest maps in your community at its Flood Map Service Center. Here, you can search your address and see any past amendments to the flood risk.

Another resource could be your county or city’s building department, emergency services department, or a local floodplain manager.

Building in a Flood Zone

If you are considering building a new home in a flood zone, working with a reputable builder with experience constructing in these areas is essential. They should know the necessary precautions and design considerations to help protect your home from potential flooding.

Additionally, you may need to obtain permits or adhere to building codes specific to your flood zone. Generally speaking, new coastal properties often have elevation requirements. Low-lying inland areas could have particular rules about septic systems to protect water supplies in a flood event.

Impact on Your Homeowner’s Insurance

Living in a flood zone impacts your homeowner’s insurance requirements. Most standard policies do not cover flood damage. Flood insurance to protect your home and belongings is a separate purchase.

The cost of this insurance will depend on factors such as your flood risk, the value of your home, and the coverage options you choose. Luckily, FEMA’s National Flood Insurance Program (NFIP) covers about 90% of the flood insurance market. It is a public network of 50 insurance companies serving 23,000 communities. Homeowners also have private flood insurance providers that may provide some home coverage.

Living in a Flood Zone

Protect your home and financial well-being. As FEMA warns, no home is entirely “low risk” regarding flooding. Stay informed about updated flood zone maps, and make sure you have adequate insurance coverage to prepare for potential flooding events. Taking these steps helps you be better prepared and have peace of mind knowing that your home is protected.

Sources:

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Home Safety

How to Make Your Home Safe For Kids

Home Safety