What The Latest Louisiana Flood Map Changes Means For Your Home

What The Latest Louisiana Flood Map Changes Means For Your Home

Recent data demonstrate that climate change impacts may be closer than many people think. The most dramatic effects will first be felt along the coastlines and low-lying areas, where the cost of flood damage could rise 26% simply due to climate change in the next three decades.

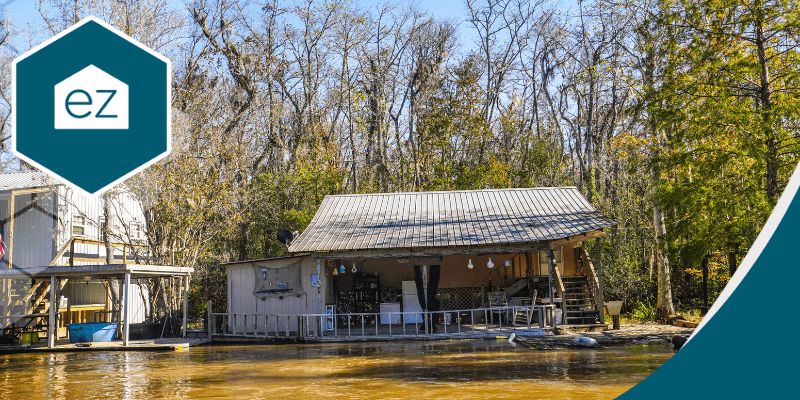

That’s particularly true in coastal regions like Louisiana and Florida, which are particularly vulnerable to flooding-related impacts resulting from the effects of climate change. And given how scientists are still learning about how coastlines and landscape features can affect flood risk, recently redrawn maps are surprising some homeowners who thought they were safe.

Louisiana is one of many states that has redrawn its maps to reflect new science and climate change threats. These maps are raising some alarms about inequity. Let’s dive into the latest Louisiana flood map changes, what they mean, and how they may impact homeowners.

Some Areas See Increased Flood Risk

Estimates of the annual cost of flooding in the US were about $32 billion in 2020, and it’s only expected to grow over the next three decades. But that’s a dynamic number susceptible to change due to climate issues and where the disasters occur. Floods can affect cities and neighborhoods differently based on existing infrastructure and preparations, disproportionately impacting one population over another.

For example, the Louisiana Illuminator’s analysis found that today’s flood risk is concentrated in impoverished communities, many of whom live in low-lying areas on the coasts or in the Appalachian Valleys. Those coastal vulnerabilities are of particular concern in Louisiana, where broad low-lying coastal areas are predominant and already experiencing the impacts of climate change with tides pushing further inland and land sinking.

There’s another element to pay attention to lower-income areas that typically don’t have higher-income regions’ flood protection. As the Louisiana Illuminator notes, poorer communities usually don’t invest in additional infrastructure that might help offer some protection. And as our population booms, less wealthy persons are pushed into less desirable tracts of land like low-lying flood plans. As a result, many homes in these areas may be subject to additional flooding risks that people in higher-income areas simply don’t have to worry about to the same extent.

New Louisiana Flood Maps

A press release from FEMA in 2022 highlighted new flood maps in LaSalle Parish, Louisiana. The purpose of these maps was to engage residents directly. FEMA recommended that residents look at the maps, find their homes, and determine whether they live in low-to-moderate or high-risk flood zones. The residents could then compare these zoning risks with their current flood insurance rates, as well as a Flood Insurance Rate Map with FEMA’s flood map changes viewer.

Updating the flood maps is essential for multiple reasons, one being that it helps residents discover if their flood insurance needs may be greater than their actual coverage. If homeowners live in a high-risk area, they may be able to inquire about the next steps to take to risk mitigation before it’s too late.

Flood Maps Change Insurance Pricing

FEMA’s intentions were good: more accuracy in the flood risk data could help people evaluate their risk. Inaccurate flood risk data could lead to inaccurate pricing for some homes by inflating their potential risk. A 2016 flood report in Louisiana, for example, highlighted some of the errors when gathering flood risk data in specific areas. That has the potential to make housing less affordable to homeowners who are already struggling to make ends meet. Conversely, it could underestimate a homeowner’s flood risk, meaning their coverage won’t fully cover their needs.

But insurers also use FEMA’s maps to evaluate which homes are high-risk and what to charge. The updates mean flood insurance costs could rise 122% in Louisiana, according to the latest data.

When slashing costs, people will drop flood insurance if they don’t feel flooding is a legitimate risk. If they found that they lived in a low-risk area, they might be inclined to drop flood insurance altogether, even though some risk of flooding still remains. Hundreds of thousands have dropped flood insurance because of price increases in response to FEMA’s updated maps.

The Uneven Impact of More Flood Risk Transparency

The issue of flood risk transparency is real for homeowners, given that even minor water damage can cost thousands to repair. A home can be wholly decimated down to the foundation in a significant flood event.

Homeowners need to know their environmental risks, including what kind of coverage they need. That’s particularly true in a high-interest rate environment, as homeowners have endured throughout 2022 and 2023. These higher interest rates drove up mortgage costs, leaving less margin for error in the average homeowner’s budget, which matters when purchasing comprehensive flood insurance.

And not carrying adequate flood insurance is a real risk in an era when flood damage may be on the rise, pushing homeowners into financial stress or poverty.

Given how the data showed low-income communities are more at risk of flooding, this has obvious implications for flood risk equity. People with higher incomes will have more money for appropriate flood insurance coverage. Meanwhile, people with less income will look for ways to cut back.

An update to the flood risk data showed some people in low-to-moderate risk areas were no longer “high risk.” Even some in high-risk areas still chose to let policies lapse because they simply couldn’t afford the dramatic price increase.

Flood Coverage Expanding

Flood insurance is usually an area private insurers have avoided because of the unpredictable and devastating losses. There is one note of good news, however. Even though the data suggested many people dropped flood insurance with the National Insurance Flood Program (NFIP), more private insurers are deciding to get into the market and offer coverage.

For homeowners who want peace of mind their investment is protected, investigate your flood risk based on Louisiana’s updated maps. You can even see what would happen in a 100-year-flood event, an occurrence as we see on the news is happening more frequently.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate News

New Laws Taken Action On Rising Squatting Reports

Real Estate News

White House Proposals Aim to Boost Housing Supply

Real Estate News

NAR Settlement Set to Reshape The Business of Real Estate

Real Estate News