Your EZ Search Guide to New Jersey Property Taxes

Taxes are a fact of owning a home. The monies raised support the local community services, funding libraries, schools, snow removal, and emergency services. That doesn’t mean the tax burden is equal everywhere. Before buying a home in New Jersey, familiarize yourself with how its property taxes work and your tax burden.

New Jersey Property Taxes Are Expensive

Bad news for prospective New Jersey homeowners. The state is dead last when it comes to low property taxes. To flip that on its head, the state has the highest average effective tax rate of all 50 states and the District of Columbia.

Effective tax rate measures how much the owner pays in taxes as a percentage of their home’s total value. The average effective tax rate nationally was 0.99%. In New Jersey, homeowners paid 2.23% of their home value, which amounted to an average $8,597 dollars in 2023. The state’s median home value was $384,700, so more expensive homes may have owed even more.

How Property Taxes Work in New Jersey

Property taxes, or ad valorem taxes, are based on the property’s value. The standard in New Jersey is based on the market value. The state defines that as what a knowledgeable buyer would pay for that property if it was sold on October 1 of the pretax year assessment period.

All counties assess property taxes at 100% of the assessed value. The local county, municipality, and school boards determine the owed tax amount- the millage rate.

New Jersey taxing districts

The state is divided into 566 taxing districts. An equalization program ensures each taxing district is treated equitably within its county. This means county government operations and school funding costs are distributed proportionally. Each New Jersey county has specific equalization tables that demonstrate the breakdown.

No property taxes go to the state, although a statewide Division of Taxation ensures all taxing boards stay compliant with the state’s regulations. The Division also assists with tax relief programs.

New Jersey tax rates

Taxes are typically expressed in “mills.” For New Jersey, this rate is $1 for every $100 of taxable assessed value. In other words, if your property is valued at $400,000, and the tax rate is 0.02440, your property taxes will be $9,760.

To gauge where your tax burden may fall, see the 2023 general property tax rates. This lists the various taxing districts in New Jersey. The amounts vary widely; Atlantic City’s 2023 tax rate was 1.55, while Vineland’s was 1.094.

Payment schedule

Most taxing districts collect property taxes every quarter. The cities and counties expect payment on February 1, May 1, August 1, and November 1. The Tax Collectors set up different ways of accepting payment, from ACH withdrawals to online portals. Check with your local taxing authority on how they collect property taxes.

Property Tax Exemptions

Relief may be available for homeowners facing a high property tax burden through specific deductions, exemptions, and abatements. Whether or not you qualify first depends on if these programs are available in your local municipality. But among the possible programs are:

- $250 deduction for senior citizens and disabled persons

- $250 veteran deduction

- 100% disabled veteran property tax exemption

- Active military service property tax deferment

- Renewable energy system exemption

- Automatic fire suppression system exemption

- Five-year exemption and abatement

- Urban enterprise zone property tax abatement

Property Tax Revaluation

New Jersey is vested in making sure the property tax burden is equitably distributed. For that reason, it runs a revaluation program. Counties and municipalities decide when to undertake a revaluation. Deciding on the “when” depends on the time since the last revaluation, zoning changes, and economic fluctuations. The Division of Taxation must approve the county or city undertaking a revaluation.

The state uses the “Director’s Ratio” or the Average Assessment-to-Sales Ratio to see if sold market prices align with the estimated market value. When property sold prices fall outside 15% of this value, it signals that the area may be under-assessed.

When a revaluation occurs, properties are physically inspected inside and out. The process usually takes just a few minutes.

The taxpayer should receive a mailed notice of the new appraised value between November 10 and December 31.

Appealing Property Tax Values

Should your property be revalued and you disagree with the new amount, you have a right to appeal.

New Jersey breaks down the tax appeal process. Note that the burden of proof of the true market value lies on the homeowner and not the taxing official. All appeals must be filed by April 1 or within 45 days of receiving the notice. Three counties have a different deadline: Burlington, Gloucester, and Monmouth.

Least and Most Expensive Tax Rates

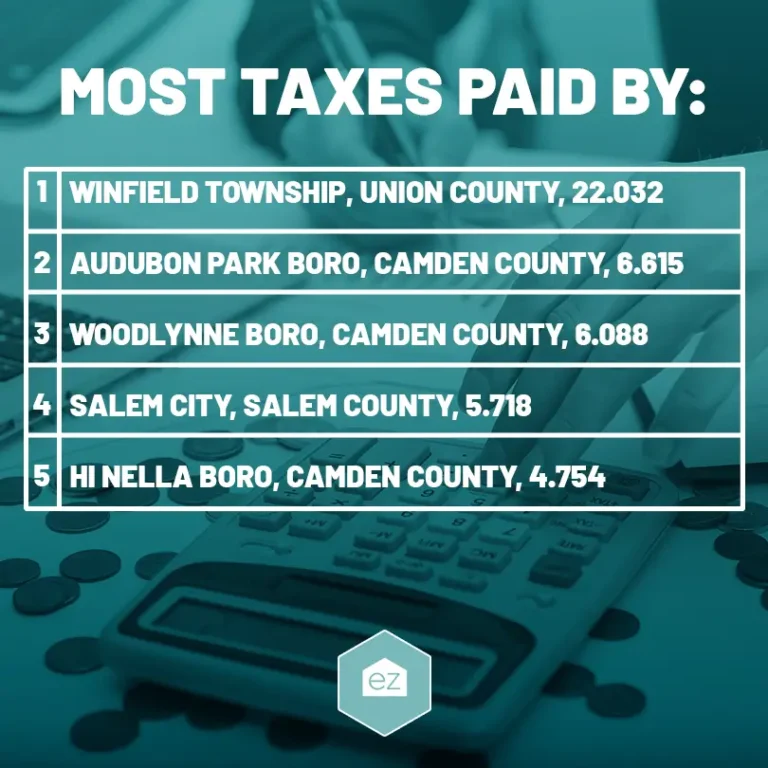

Using the general tax rate, which is the figure assessed to local homeowners, the most expensive taxing districts in New Jersey are:

- Elizabeth City, Union County, 31.43

- Winfield Township, Union County, 22.032

- Union Township, Union County, 21.669

- East Brunswick Township, Middlesex County, 11.502

- Scotch Plains Township, Union County, 11.421

The lowest general tax rates were in:

- Loch Arbour Village, Monmouth County, 0.385

- Deal Boro, Monmouth County, 0.46

- Sea Girt Boro, Monmouth County, 0.501

- Spring Lake Boro, Monmouth County, 0.503

- Avalon Boro, Cape May County, 0.609

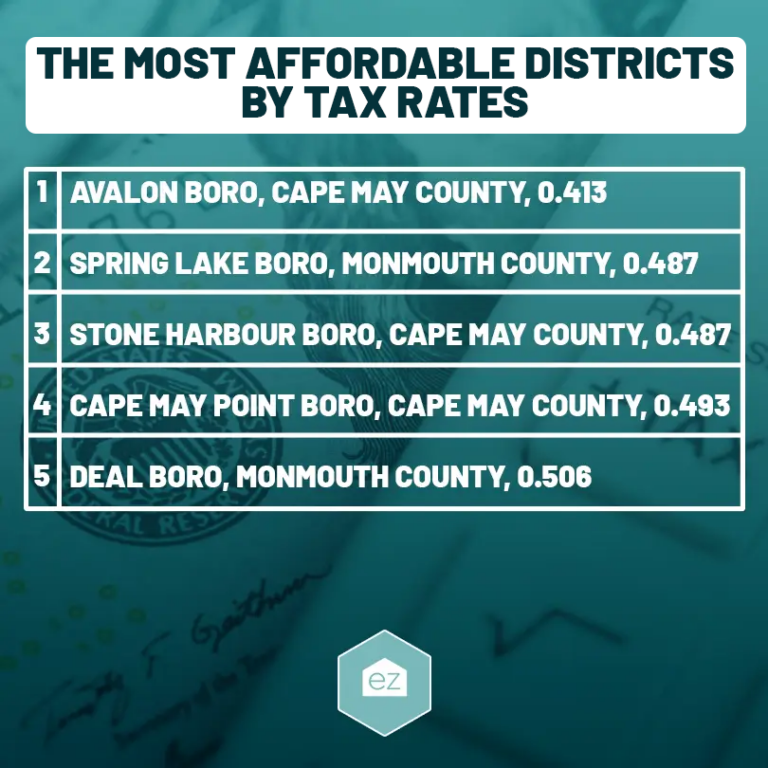

But general tax rates only paint one picture of an area’s tax burden. The median value of local homes matters. A community can have a lower tax rate. However, if the median home values trend higher, the local homeowners could still pay a significant amount in property taxes. The effective tax rate considers how much owners pay relative to their home values. By that metric, the most affordable districts were:

While the most taxes were paid by:

New Jersey Delinquent Property Taxes

If you fail to meet the quarterly property tax payments, you first have a ten-day grace period. After that, owed property taxes start to accrue an interest penalty. That’s 8% for up to $1,500 owed and 18% for anything over $1,500.

Taxes that still aren’t paid by the year’s end could have a 6% year-end penalty.

Any time property taxes remain unpaid, the taxing authority issues a tax sale certificate. The state sells these certificates in an auction once every year. These tax certificates can accrue interest for their owners. That holder can eventually foreclose and take possession of the home if the homeowner doesn’t pay off the tax certificate within the redemption period.

Understanding Your New Jersey Property Taxes

As you can see, New Jersey’s property tax system is complex. This blog is not intended to be specific taxation advice. Do consult with a certified public accountant or tax professional for updated information and advice.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information

Your EZ Guide to Idaho Property Taxes

Real Estate Information