Virginia Real Estate Market Update

March 2024: More Homes Hints At Optimism From Sellers and Buyers

Virginia homebuyers are showing cautious optimism, as evidenced by the state’s sales activity. In February 2024, there was a notable 3.5% increase in closed sales compared to the same period last year, despite the slight rise in nationwide interest rates over January 2024. This positive shift in the market should inspire confidence in potential buyers and real estate agents alike.

Inventory Increases

Statewide, the real estate market is showing signs of improvement, with 16,000 homes for sale, a significant 10% increase compared to the same time last year. This boost in inventory can be attributed to a surge in new listings. It’s the largest increase since summer 2021. This should provide some relief to the low inventory situation and reassure potential buyers about the growing options available.

Why are owners listing now? There’s hope that economic conditions are improving and that interest rates will start to come down. Additionally, homeowners have been holding on for over three years now with little improvement in mortgage rates or price appreciation. The wait hasn’t gained them any relief on either metric, so some are adopting the “marry the house, not the rate” mantra.

The increase in new listings should bolster the incredibly low inventory present around Virginia. Nonetheless, it’s so low that many markets will stay competitive for a while. The months’ supply of inventory stands at 1.9, where six months is considered balanced. Markets have a ways to go before balance is achieved. Homes were on the market for a median of 15 days to contract–just about two weeks.

Median Prices Show Demand

Pricing shows that this is the case. February 2024 median sales prices increased by $14,500 to $384,576 year-over-year. Many homes sold at or near their list price across all price levels.

Some Virginia counties showed significant change. Removing all counties and cities with fewer than ten sold homes, the counties with the most reduction in median sales prices were:

- Giles County, 10 homes, $123,138, -94%

- Pulaski County, 23 homes, $156,000, -44%

- Waynesboro City, 21 homes, -32%

Meanwhile, home prices increased the most in:

- Mecklenburg County, 18 homes, $248,950, 54%

- Martinsville City, 10 homes, $194,750, 53%

- Nottoway County, 12 homes, $191,475, 52%

The highest median prices remain concentrated around the northern Virginia metro and the DC area. Falls Church homebuyers paid a median of $1,115,500, which was 41% more than in February 2023. Rappahannock County, Fairfax, and Alexandria rounded out the highest-priced markets for the month.

Top Counties For Sales

Fairfax County, the City of Virginia Beach, and Chesterfield County were the busiest for sales activity. Fairfax alone saw nearly 700 closings in February 2024. All three areas are part of high-demand metros among home buyers. Fairfax and Chesterfield Counties are far enough out of the city to be more affordable than the urban cores.

Virginia Real Estate 2023: Sales Drop As Prices Grow

Nationwide home sales declined by double digits in 2023, with fewer sales and fewer listings but higher prices. Virginia Now that 2023 has wrapped up, the numbers show the Virginia real estate market followed lockstep. How closely did the state housing market match the trends? We have a breakdown of the state’s real estate year in 2023.

Fewer homes sold

Reduced affordability, high mortgage rates, and low listings combined to cause a steep drop in closed real estate transactions. For 2023, Virginia’s housing market reported a 20.1% drop in sold homes. That amounted to over 24,000 fewer homes sold in 2023 than in 2022.

The Virginia Association of Realtors noted it was the state’s lowest sales activity in a decade. Regionally, Shenandoah Valley, Northern Virginia, and Hampton Roads had the most slowdown in their sales activity.

The need for new listings contributed, as 16.5% fewer homes came to the market. It circles back to the greater economic factors: homeowners who don’t have to move won’t. In the face of mortgage rates that broke the 8% mark by the fall of 2023, many chose to stay put and kept their 2-3% mortgages.

Increasing closed sales rates will be harder without more existing and new homes. Virginia ended 2023 with a two-month supply of inventory. Even though it was more year-over-year, it’s still well below the demand for housing.

A competitive market drives pricing

That same demand helped Virginia’s median sales prices grow by 4% for the year. Homebuyers paid $390,000 for a home, about $15,000 more than in 2022.

Homes are still selling quickly across the state’s real estate markets, particularly in those that are more affordably priced. Among these were the Greater Piedmont, Danville, and Lynchburg regions. Some markets did not see prices grow for the year, but these were rare. Among them are markets in western Appalachia regions, rural central Virginia, and Northern Shore counties.

Buyers paid about 99.3% of the list price. Even though the statewide year-end median price was $390,000, the share of homes sold in the $400-$600K price bracket grew while the $200-$400K price bracket declined. That hints that buyers can Virginia homes to cost more in 2024.

In another testament to the lack of housing but high demand, the median days on the market statewide for December 2023 was 17–a day less than December 2022.

More listings needed

In December 2023, the Virginia real estate market reported its first increase in active listings in nine months. It will take a sustained increase in listings to make a real impact. At the big-picture level, experts are hopeful that improved interest rates will encourage sales activity in 2024. They do not expect a dramatic turnaround but a gradual increase in new listings as buyer confidence and housing affordability improve.

Quarter 3 2023: Median prices march upward as sales slow

Virginia’s real estate market continued its trend of declining listings but rising home prices. This mirrors what was reported in other states during the third quarter. Declines were brought about due to housing affordability challenges, which kept the buyer pool smaller. Higher mortgage rates persisted, with the national market hitting new multi-decade highs late in the quarter.

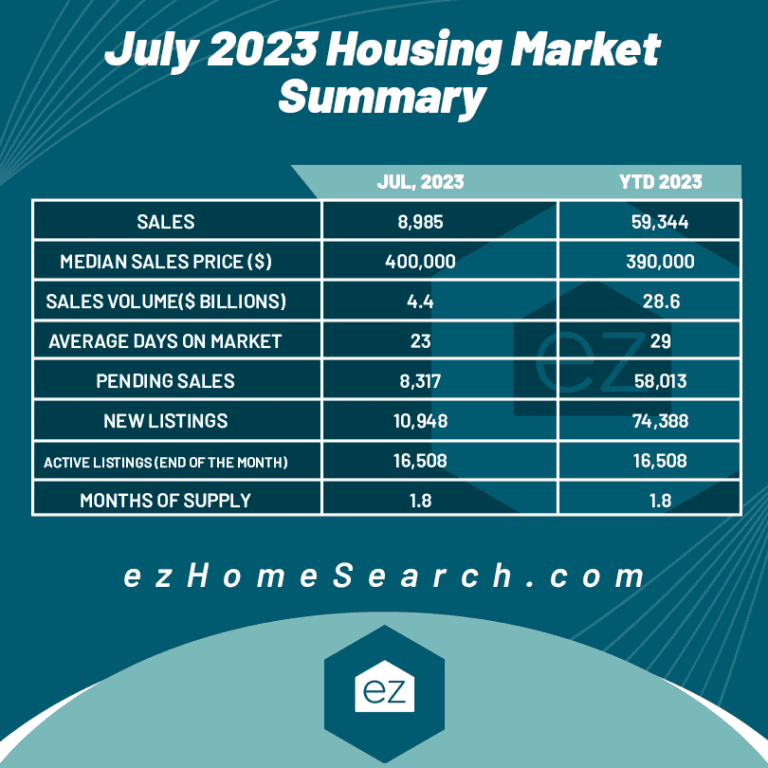

July 2023

Sales price growth continued, now rising to $400,000, representing 4% growth from July 2022. Median home prices have increased for the last five consecutive years in July. A few areas did see sale price declines, such as Arlington, Abington, and Westmoreland County.

The number of listings continued to drop and fell 18% year-over-year. Closed sales are down 20% YOY. South Central Virginia was the only region to have an increase in home sales.

The month finished with a 1.8-month supply of homes, a 4.9% increase from July 2022. Homes spent an average of 23 days on the market statewide.

August 2023

The median sales price was maintained at $400,000, but it was a 7% YOY pricing gain. Homes spent a median of eight days on the market, three fewer than in August 2022. The Lynchburg MSA had the most substantial price growth for the month.

Total listings dropped 9% YOY, dropping the sales activity for the month by 19%. The months’ supply of inventory reached two months. Virginia Realtors said this was the slowest August sales month since 2014. Sales activity slowed the most in the Shenandoah Valley.

September 2023

The median sale price of $380,000 may be lower than the prior two months. Still, it represented a 4.15% YOY increase for Virginia home sales. Five years ago, the median home was $292,5000. Homes are now over $100,000 more expensive than before the pandemic.

Home prices did shift downward in some areas. In far western Virginia counties like Lee, Wise, and Buchanan, some parts of the Eastern Shore, and around Lunenburg.

The trends persisted, with 8% fewer listings on the market. The 24% increase in months’ supply of inventory brought the market statewide to 2.1 months. Most homes spent a median of ten days on the market, three less than in September 2022.

Moving forward

As the month ended, mortgage interest rates were at 23-year highs. That impacted home sales across Virginia. Affordability is expected to stay a challenge as the fourth quarter rolls in; in October, the trend of fewer homes sold and increasing median prices continued based on Virginia REALTORS figures.

Mid-Year 2023: Fewer homes, fewer buyers, but rising median prices

What’s happening across the nation in the summer of 2023 is also happening in the Virginia real estate market. By mid-year, the Old Dominion State’s overall residential and closed sales volume were down, tempered by higher mortgage rates, fewer owners willing to sell, and a smaller buyer pool.

However, the shrinking buyer pool was moving in tandem with the reduced inventory, which kept pressure on sales prices. For that reason, Virginia was largely a seller’s market in July 2023.

Statewide sales numbers

The July 2023 market reported year-over-year home sales tanked by almost 21% and were down 23% for the year-to-date (YTD). It didn’t help that new listings declined 20% for the month and 22% for the year-to-date. Active listings were in a similar state, down 19% for the month and YTD.

However, the Virginia REALTORS® noted that June and July do typically see a drop in total home sales, with a rebound usually starting in August.

But the current low inventory resulted in a 1.8-month supply of homes. Residential properties spent a median of 23 days on the market in July. At an average of 29 days for the year-to-date, Virginia firmly stands as a seller’s market despite the slower sales pace.

Home prices back that up. With low inventory but sustained demand, most sales achieved 101% of their list price. The median price rose 4% year-over-year to a solid $400,000. Sales prices were up 2.6% to $390,000 for the YTD.

Virginia regional look at real estate

The most significant slowdowns in sales activity happened in the Chesapeake Bay (28%), Shenandoah Valley, and Richmond (27%) regions. Only South-central Virginia had more year-over-year home sales for July 2023.

Median prices grew in about 60% of the reporting regions, with Central Virginia (8.3%) and New River Valley having the most significant YOY growth.

Northern Virginia had the most dramatic drop in active listings (42%), stressing further an already highly competitive market.

Looking forward in the Virginia real estate market

The persistent and continued increases in mortgage rates are expected to keep overall home sales down across the state. In July 2023, 30-year fixed interest rates achieved a 20-year high during one reporting week, showing these mortgage rates aren’t going anywhere for as long as the Federal Reserve keeps with its fiscal policy to fight inflation.

Being a buyer is tough, as the local markets can be very competitive because of the reduced inventory. But it’s also challenging for the home seller since they are often looking for their next home. Homes are selling, but without more inventory that makes it easier to find their next home, many owners see the best course of action is to stay put. High interest rates discourage homeowners from selling unless they absolutely have to.

That will keep new and active listings down, delaying relief for homebuyers, who need more inventory in Virginia to encourage competition and stabilize rising median home prices.

Start Your Home Search

Casey McKenna

Share this Post

Related Articles

Real Estate Information

Your EZ Guide to Arkansas Property Taxes

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information