Jacksonville FL Real Estate Market Update

February 2024: Market grows closer to balance, but high prices remain

Northeast Florida’s overall real estate market reported a 7.4% increase in the median sales price. Homebuyers paid $364,995 for a Jacksonville metro single-family, condo, or townhome despite a 7% drop in closed sales from February 2023.

Jacksonville metro inventory increases

All the stats show sustained activity in the local housing market. The median days on the market dropped to 35. However, a 57% increase in new listings helped bring the total market active inventory to 7,928. Area buyers now have a months’ supply of inventory of 4.4 months, signaling more choices.

One of the significant challenges facing Jacksonville homeownership–similar to other metros nationwide–remains housing affordability. The index rated 72 for February 2024; 100 would signal a balance between what buyers can afford and an area’s median home prices. This index rating was 10% less than February 2024. It shows the impact of sustained high home prices and mortgage rates on local buyers’ ability to purchase a home.

Note: The greater Jacksonville metro includes Duval, Putnam, St. Johns, Baker, Clay, and Nassau counties.

Duval County real estate

In the consolidated City of Jacksonville, homes were slightly more affordable than the metro median at $325,000. That was an 8.4% increase year-over-year and an 8.3% increase month-to-month.

Buyers paid a median of $345,990 for single-family homes and $259,950 for condos.

Like the nation, closed sales activity declined, as did the median days on the market (DOM) and the home affordability index. Buying a Jacksonville home was 12% less affordable this February than the previous year.

Listings rose, giving the city a 4.1-month supply of inventory (MSI). This 73% increase from last year correlates with a 47% rise in new listings.

Here’s how home sales fared in some of Jacksonville’s top neighborhoods based on February 2024 data:

- Southside: Median sale price $306,000/ 20 DOM/ 4.1 MSI

- Riverside/Avondale: $439,000/ 35 DOM, 5.3 MSI

- Fleming Island: $441,000 / 19 DOM/ 3 MSI

- West Jacksonville: $177,950/ 47 DOM/ 7 MSI

- Jacksonville Beach: $675,000/ 8 DOM/ 3.7 MSI

The winter and early spring are typically busier sales months in Florida, and listings tend to increase in response. Jacksonville’s active inventory will need to be increased much more in the months ahead. Median sale prices also tend to trend upward in these higher-demand months.

November 2023: Jacksonville Supply of Homes Grows

The latest data released by the Northeast Florida Association of Realtors shows Jacksonville-Duval County is running slightly counter to the nationwide trends of that time. Combined October 2023 market figures demonstrate reduced median sale price while new listings, active inventory, and monthly supply keep growing. Take a closer look at what’s happening in the Jacksonville real estate market.

Note that the City of Jacksonville has a consolidated government with Duval County. However, the county has independent towns, like Atlantic Beach and Jacksonville Beach.

Single-family home sales

Jacksonville’s single-family homes show their median sale price dropped 3% to $320,000 year-over-year (YOY) and almost 4% from the prior month. Affordability remains challenged despite the price drop, partly because mortgage rates reached new multi-decade highs in October.

New listings increased incrementally by 0.3% YOY, but we’ll take it in these tight market conditions. Plus, it was almost 7% more homes than September 2023. The region’s active inventory stands at 2,422, which is up 6% YOY. The monthly supply of inventory keeps growing and now is at 3.2 months. Conditions still favor the seller, but the Jacksonville real estate market is moving towards balance.

Townhomes and condos

Jacksonville townhomes and condos reported an increase in their median sales price. Home buyers spent $263,995 in October 2023 on these properties, which spent a median of 32 days on the market before a contract. New listings increased by 12.5% YOY but were up only 0.5% over September 2023. Like the single-family home market, it had a 3.2-month supply of inventory.

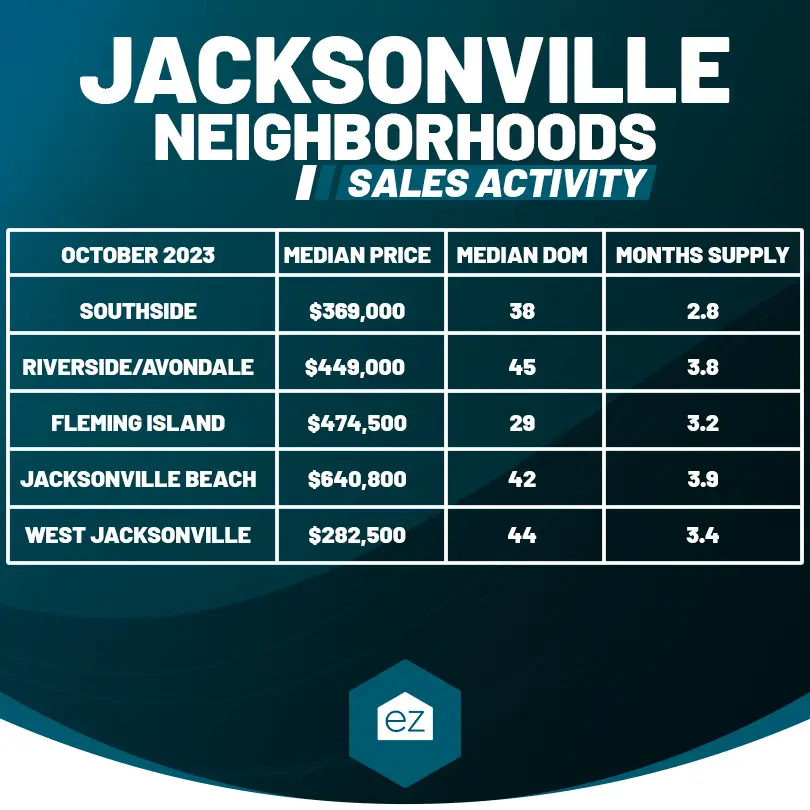

The breakdown

Here’s where real estate prices and sales activity stood for some of Jacksonville’s neighborhoods.

Big picture

Year-to-date, the Jacksonville real estate market reported stabilizing median sale prices. At $305,000, it was down just 0.3% from 2022. Homes were spending more days on the market despite new listings being down 7.5% for the YTD. Fewer homes were closing over the list price compared to 2022.

Looking at the greater Jacksonville metro, which includes St. Johns, Baker, and Nassau Counties, with cities like Ponte Vedra Beach and Fernandina Beach, the median sale price was $360,000 for October 2023. The metro carried a 3.5-month supply of inventory.

It will take time to achieve balance, but the October figures suggest Jacksonville is moving that way. However, homes here are more affordable than the state and national medians, which may drive up interest in buying a Jacksonville home.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information

Your EZ Guide to Idaho Property Taxes

Real Estate Information