Is Getting a Home Mortgage Still Too Difficult?

Given the state of the current market, those shopping for homes are equally challenged to find the absolute best interest rates they can. Mortgage rates are creeping up on the 8% mark. Home affordability is already stressed; paying hundreds more monthly isn’t helping.

Naturally, sales activity is down, and so are home loan originations. As of September 8, 2023, home loan applications dropped to their lowest levels in 28 years, based on Mortgage Bankers Association (MBA) data.

Approval rate down to 50% after last recession

Home loan approvals were already trending downward over the last decade. Part of that was the regulation change after the Great Recession. Before that, looser underwriting practices led to loan approval rates above 65% and as high as 73%. After the Dodd-Frank Act, loan approvals dropped and hovered just over 50% nationwide.

Rate of Rejection Up

The rejection rate for credit applicants reached its highest level since June 2018. According to the Federal Reserve Bank of New York’s June 2023 survey, nearly 22% of applicants are being turned down. And it’s not just one type of loan that’s being affected – rejections have gone up for auto loans by 14%, mortgages by 13%, and credit card limits increased by almost 31%.

At the start of the year, major lender Wells Fargo said it would pull back home loans for 2023. The firm was one of the nation’s top lenders, originating 143,000 loans in 2022.

Fewer low-amount loans approved

It wasn’t the only big-name bank scaling back its home loan offerings. And if the banks aren’t entirely dropping mortgages as an offering, they have restricted what they are lending. Loans aren’t just costly for the applicant; the fees are a way for the banks to profit, too. With loan volume dropping, the trend has been to focus on larger (and thereby more profitable) loan amounts.

As a result, home buyers are finding it challenging to find a mortgage lender for loans of $150,000 or less. From 2018 to 2023, 38% of mortgage lenders did not issue even one loan for under $150,000, according to a Pew Charitable Trust survey.

That matters for home buyers trying to buy homes in markets with priced homes well below the national median home price of $406,000.

These home buyers are left turning on alternative financing options, which are much riskier than government-backed and highly regulated loan products. Alternative financing also comes with higher interest rates, further challenging affordability for these buyers.

State with the Highest Approval Rates

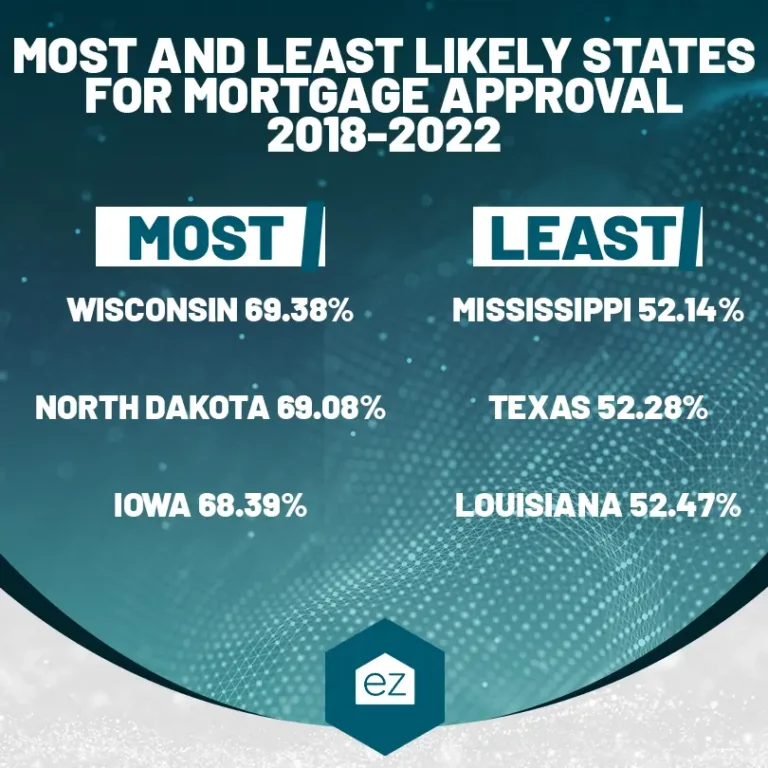

National Association of Realtors (NAR) data from 2018-2022 shows there are states where home loan approvals are more likely. At the top of the list was Wisconsin, where nearly 70% of mortgage applications were approved. All states had approval rates above 50%, but Mississippi was the least likely to approve applications (52.14%).

For 2022, the data tracks in the same way. Buyers in Wisconsin, North Dakota, and Iowa were more likely to be approved for a home loan. Meanwhile, Texas, Louisiana, and Mississippi had loan approval rates below 50%. In Mississippi, only 49.89% of home loans were approved, with an average interest rate of 5.14%.

For those that are extending credit and home loans, the hoops to jump have increased. Tightening regulations translates to asking for more documentation from the home buyer, especially for products like home equity loans or refinancing.

Lagging income increasing rejection

Why are applicants being rejected? The Consumer Finance Protection Bureau says insufficient income has been a top reason lenders denied a loan application. Seeing as how monthly mortgage payments increased 46% in twelve months from December 2021 to December 2022, that makes sense. Wages and income haven’t kept pace with rising housing costs.

Lenders sometimes utilize what is called the 28/36 rule. This guideline helps determine how much of your income goes towards housing expenses and other debts. Ideally, your mortgage, property taxes, and insurance should be less than 28% of your gross monthly income. And when it comes to total debt, including your mortgage, credit cards, and auto loans, it should not exceed 36%. Lenders want to make sure you can comfortably afford your housing costs.

Given how much interest rates are adding to monthly mortgage payments and that wages aren’t keeping pace with inflation growth, it’s not a surprise that loan approval rates are down.

Updated November 2023

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Buying a Home

Conforming Loan Limits: A Guide for Homebuyers

Buying a Home

What to Know About Termites In Your Home

Buying a Home

What to Know About Spray Foam Insulation

Buying a Home