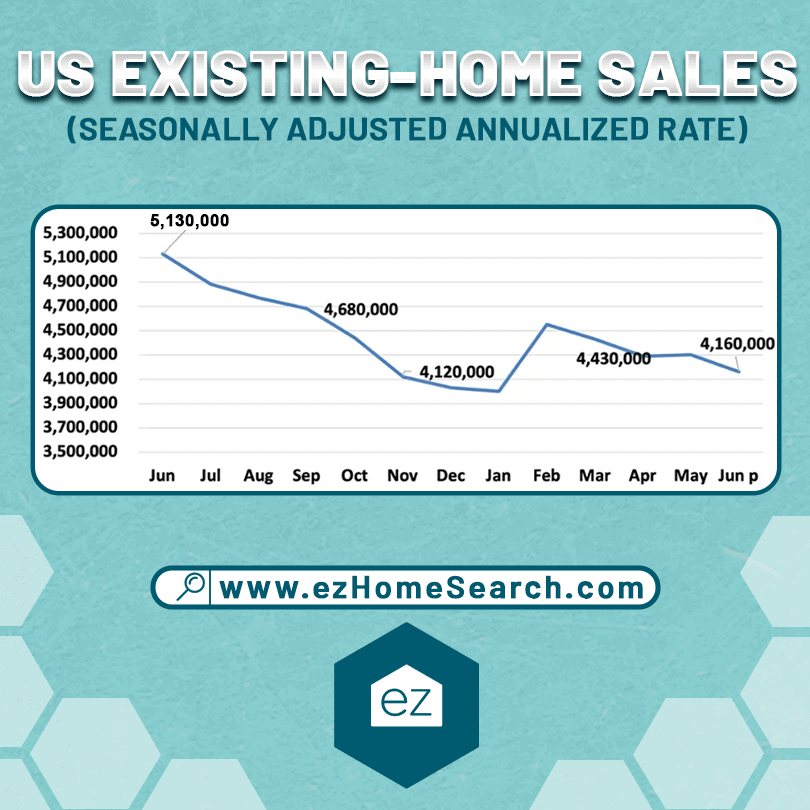

House Sales Plummet To Lowest Level In A Decade

It’s no secret that mortgage rates are at their highest, and people are paying way more for houses than they were two years ago. Homeowners spent almost $1000 more a month toward their mortgages than they were in 2021. With mortgage rates hovering around 6.81-7.09%, and affordability stressed, houses simply aren’t selling like they used to. In fact, the current pace of sales is slower than during the early days of the pandemic.

Experts have a few ideas about why a home sales slump is happening and when we can expect to see more “For Sale” signs across the country.

Mortgage rates and the rise of accidental landlords

Only 1% of homes across the country are being sold. A big reason why is homeowners who are locked into lower mortgage rates know what a deal they’ve got. Even families who are eager to sell their homes are choosing to wait, hoping for mortgage rates to drop or inventory to increase.

This is referred to as the “locked-in” effect; people can’t afford to move into a new home so they stay put, and sellers aren’t willing to move so they too stay put, creating pressure on both sides of the market.

Those who find themselves with no other option but to move are finding themselves with a new title: accidental landlords. This term refers to homeowners who want or need to move but don’t want to let go of their current low-interest mortgages.

Instead, homeowners opt to rent their properties instead of selling. As for whether they’re profiting or not, that’s a case-by-case basis.

Some homeowners who bought luxury properties in 2021 and locked in those low-interest rates are renting their homes on sites like Airbnb and making a profit. In Fortune, LA-based real estate agent Mackenzie Stone discussed how she bought a luxury property in 2021, locked in a 3% interest rate, and now rents the property on Airbnb and makes two or three times the monthly mortgage rate.

Josh Dudick, the CEO and founder of wealth and investment website Top Dollar, is another example of an accidental landlord. Dudick had a vacation home in the Hamptons and was contemplating selling it, but chose to rent it out instead to avoid paying capital gains taxes. He also didn’t like the idea of losing the low mortgage rate he locked in when he refinanced at a 30-year fixed rate below 3%.

Now, Dudick makes enough in rent to cover his monthly mortgage payments and then some. And the icing on the cake: the value of the home, which he originally purchased for more than $1.5 million, has doubled.

There are thousands of stories like this from all across the country: accidental landlords that are renting instead of buying because they are priced out of the market. Many experts agree that a fixed 30-year mortgage with a 3% interest rate is one of the best assets a modern homeowner can have.

But not everyone is in the green renting their home and potentially their next home. Some are simply covering all their expenses and waiting out the market.

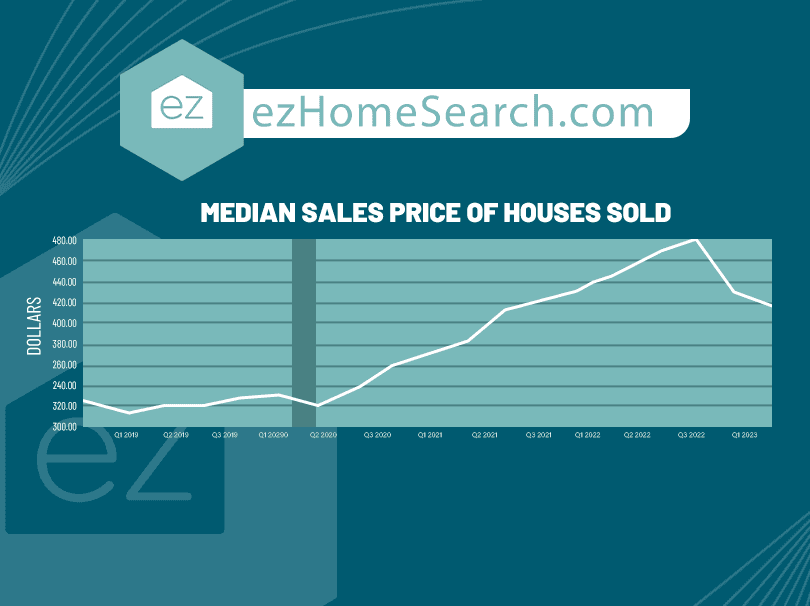

Double-digit appreciation

Not have mortgage rates more than doubled since 2020, but the increase in home prices is significant. Home prices are up 40% since the pandemic, Even families who can afford to let go of their lower rate mortgages are struggling to find homes within their budget.

Lagging supply

Add to this the disruptions in supply chains across the country that have made it harder for construction companies to get building essentials, resulting in higher construction costs that are passed down to the buyer. And the supply of new construction, while it was making up ground, is still lagging far behind the demand for housing.

The classic high-demand, low supply cycle also contributes to rising home costs, especially in the suburbs.

Large suburban homes are still in high demand

Two generations are driving the market when it comes to bigger suburban homes. The first is millennials, who are either buying their first homes or buying their first investment properties. This group of buyers is looking for a combination of urban amenities and more room to spread out. They’re also eco-conscious buyers, and newer suburban homes give them the energy-efficient and eco-friendly features that they’re looking for.

The second group of buyers driving demand are baby boomers. These people are looking to downsize from the home where they raised their family into a smaller, more manageable home in the suburbs. This group wants something convenient, comfortable, and community-oriented.

The demand for homes in the suburbs is high, but these are the homes that nobody is willing to part with. During the pandemic, larger homes in suburban neighborhoods were a hot commodity, as people were looking for homes with home offices, spaces to homeschool, and bigger yards. Now, those same families are holding onto their low-interest rates and are less eager to let go of that.

Predictions for the second half of 2023

Experts predict that if mortgage rates hover at the 6.5-7% range, or go higher, there will be minimal to no change in home sales as we move into the second part of the year. Danielle Hale, chief economist at Realtor.com, predicts “the number of homes for sale to decline this year and continue to be a damper on home sales.” She added that the low inventory of homes across the country is leading to higher home prices, making housing affordability even more challenging to obtain.

For now, some experts are looking for signs that the US real estate market is heading into a new phase. Lawrence Yun, chief economist at NAR, acknowledged that even though we’re not in full-force recovery mode in terms of the housing market, the housing recession is over. And while remaining optimistic, Yun agrees with experts that home prices will remain high and that adding more homes to the market is the best way to make home-buying more affordable for the masses.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate Information

Your EZ Guide to Arkansas Property Taxes

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information