Charleston Real Estate Market Update

February 2024: Spring Brings Flourishing Sales Activity

Spring has sprung in Charleston, for as early spring flowers bloomed, so did sales activity. Nearly every tracked number showed growth for February 2024.

Home buyers benefited from an increased inventory of homes for sale and a 6.4% bump in new listings for single-family homes. But that doesn’t mean the market isn’t competitive. Homes were on the market an average of 9 days less than last year, showing the market’s moving. A median sales price jump of almost 10% backs up that activity. Buyers paid a median of $610,000 for a Charleston County home. For townhomes and condos, they paid a median of $400,000.

Let’s break down performance in Charleston neighborhoods.

Downtown

One of the high-demand Charleston neighborhoods, the single-family sector saw a 37% drop in median sale prices while condos increased 57%. Single-family homes had fewer new listings, but the overall inventory remained stable year-over-year (YOY). Buyers paid a median of $1,397,500. Townhomes and condos doubled new listings, had a 15% increase in overall inventory, and benefited from a median sale price now at $879,000.

Upper Charleston Peninsula

Single-family homes reported a 67% increase in inventory, but given its smaller neighborhood borders, that amounts to 30 homes for sale. Median sale prices pulled back slightly YOY to $680,000, while days on the market increased 44% to 101 days. This area only had six townhomes and condos for sale, and the median price of $307,000.

Lower Mount Pleasant

Fewer new listings and a 24% drop in active inventory may have influenced median sales prices in Mount Pleasant. At $920,000, buyers paid 2.7% more than last year for a home in this suburb section. Townhomes and condos had the opposite happen, with a 94% jump in new listings and a 30% increase in inventory. Median sale prices grew 52% to $589,000.

James Island

Both housing types reported median sales price growth, at 12% for single-family homes and 16% for townhomes/condos. Their new listings and overall inventory also increased from last year. The biggest change was a decrease in single-family homes’ days on the market, which moved from 48 to 25. Buyers paid a median of $592,500 for a James Island home.

West Ashley

Single-family homes are moving here, with inventory and new listings down. Buyers paid 7.2% more year over year (YOY), with the median price now at $485,000. Townhomes had the opposite reaction, with buyers paying 10% less year over year, at $318,500. Townhome and condo inventory increased by 189% and new listings by 175%.

Greater North Charleston

Both market segments increased their overall inventory and new listings. That didn’t stabilize single-family home price growth, as buyers paid 18% more YOY to $336,125. Townhome/condo prices went the other direction, declining 15% to $237,450.

Charleston Real Estate Market

Early indicators suggest a busy spring. The data shows that it could be the right time to buy a townhome or condo in some local neighborhoods. Keep exploring local real estate with a knowledgeable Charleston real estate professional.

November 2023: New Listings Not Enough To Counter Demand

In the latest market update, something new happened in Charleston County: new listings increased for single-family, townhomes, and condos. How did that impact the rest of the Charleston real estate market sales activity?

Single-family home sales

Despite 5.4% more listings coming to the market in October 2023, it had minimal impact on the total listings year-to-date (YTD). There were 16% fewer homes listed for sale thus far.

But demand is still present. We know this because the median sales price increased 4.7% YOY to $640,000. Charleston homes for sale spent an average of 26 days on the market before selling.

Single-family home inventory remains low and fell another 12% as area homeowners opt not to sell in the tight market conditions. High interest rates and the lack of inventory are motivating locals to stay in place.

Charleston townhomes and condos

New listings increased 9.1% YOY, but like single-family homes, are down significantly YTD. Sales prices increased by 6.1% to a median of $400,000. Counter to single-family home sales, the days on the market decreased to 23 from 26. Available Charleston condo inventory increased by 4.4%.

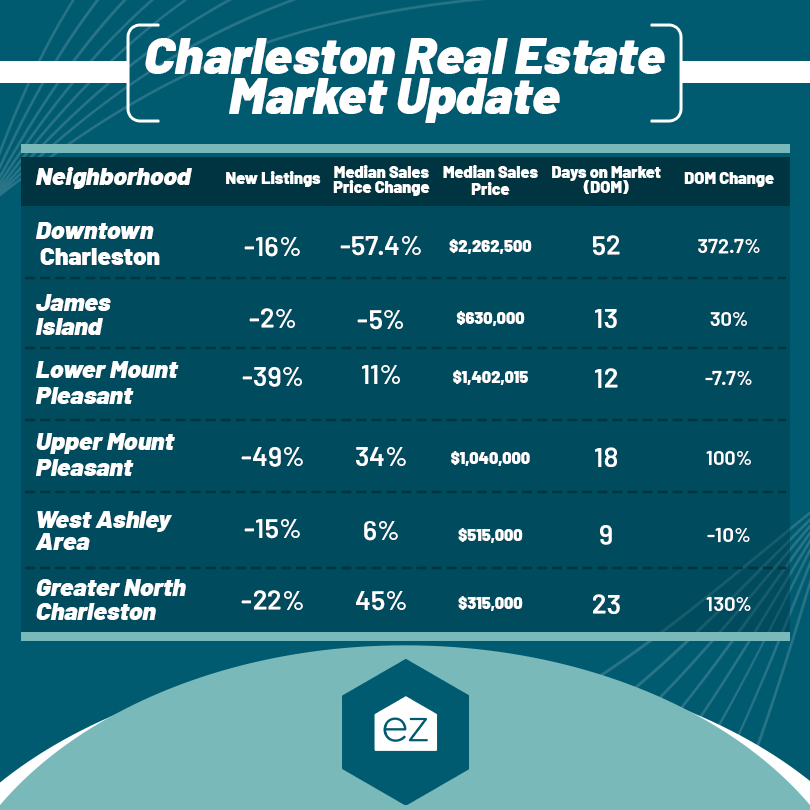

The breakdown

As for how home sales went in some of Charleston’s most popular places to live:

| October 2023 | SFH Median Price | T/C Median Price | SFH DOM |

| Downtown Charleston | $1,035,000, Down 29% | $1,132,500, Down 19% | 26 |

| West Ashley | $532,768, Up 17.1% | $335,000, Up 12% | 20 |

| James Island | $615,000, Up 5.1% | $320,000, Up 9% | 11 |

| Upper Charleston | $850,000, Up 4% | $910,000 | 19 |

| Lower Mt Pleasant | $1,152,500, Up 38% | $468,000, Up 9% | 48 |

Big picture

Affordability remains the primary challenge across the Trident, with October’s data showing the index has reached new lows. Over the last twelve months, the housing affordability index has dropped 19.1%. It fell 8.7% in October 2023, the lowest amount in any prior month. Charleston is not alone, as housing affordability is a challenge nationwide.

More homes will need to come to market to help stabilize prices, but the Trident maintained a 2.1-month supply of inventory, the same as last October.

Charleston’s high-demand waterfront markets continue commanding prices well over $1 million. These include Downtown, Folly Beach, Kiawah, Sullivan’s Island, Lower Mount Pleasant, and Isle of Palms. More affordable prices are inland in Greater Summerville, Greater North Charleston, Hollywood, Ravenel, and Meggett.

July 2023: Inventory stays low as prices show stabilization

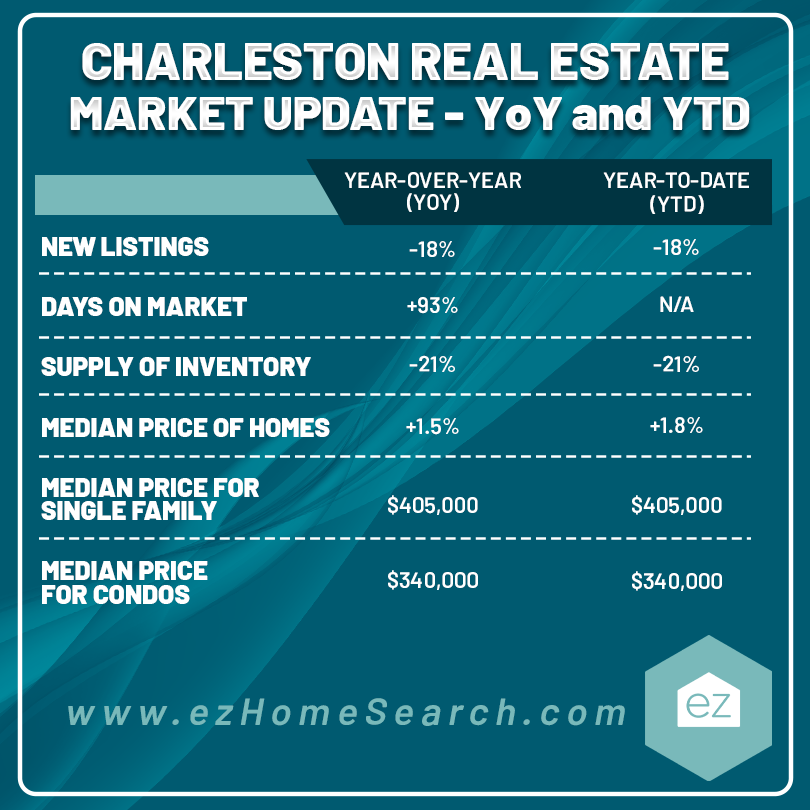

South Carolina is a top place to move to, but higher mortgage rates and housing prices are tempering sales activity midway through 2023. These factors have impacted sales activity in the greater Charleston real estate market. July 2023 reported shrinking inventory, with regional new listings down 18%. Meanwhile, median sales prices inched upward to 1.5%.

The big picture in Charlotte metro real estate

New listings for all residential properties were down year-over-year (YOY) and year-to-date (YTD), both by 18%. It contributed to a closed sales rate decline of 21%. To put the current sales activity in perspective, July’s pending and closed sales figures are slightly below the pre-pandemic levels of 2018 and 2019.

In another sign of slowing sales activity, the days on the market increased by 93% YOY, bringing the market to one year of sustained gains in this metric.

The total inventory of homes for sale was 21% less than the prior year. However, condos did have an inventory gain of nearly 9%.

However, the sustained 1.7 months of inventory showed demand for Charleston area homes remains stable. Even though fewer people are buying due to greater economic factors, fewer homes are on the market. Home prices may not be record high, but July saw price growth rebound after two months of decline, with a 1.5% YOY increase and a 1.8% YTD increase. Median prices for July 2023 were $405,000. Condos had the most price growth, at 9.7% to $340,000.

The Charleston-Trident metro includes Charleston, Dorchester, Colleton, and Berkeley Counties.

Charleston County real estate

Single-family homes had the most significant change in their new listings. As of July 2023, they were down 28.1% YOY and 22% YTD. The median prices rose by almost 12% YOY to $641,750. Condominium sale prices also grew but by a smaller 6.7% to $390,500; this segment had only a 2.4% drop in inventory.

A look at the sales activity in some of the county’s regions in July 2023:

Dorchester County

New listings for single-family homes were 21% fewer than July 2022. The median sales price did rise 4% to $386,685, supporting a year-to-date bump of 4.7%. The inventory of homes for sale declined by 21%, while the days on the market averaged 30.

Dorchester County includes Summerville and parts of North Charleston.

Berkeley County

The data showed a new listing drop of 13% and a total inventory fall of 25%. Unlike surrounding counties, its median sales price decreased 3.5% to $381,000 for single-family homes. Year-to-date prices were down 0.8%. Condo prices were neutral year-over-year at $300,000.

The county includes Hanahan, Goose Creek, Moncks Corner, Daniel Island, parts of North Charleston, and Summerville.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate Information

The Role of a Buyer’s Agent in Real Estate Transactions

Real Estate Information

Who’s Buying What? Exploring Home Buyer Generational Trends

Real Estate Information

Your EZ Guide to Idaho Property Taxes

Real Estate Information