Price Adjustments Picking Up Steam

The consistently high mortgage rates and home prices are wearing on the real estate market. Over the last quarter, active inventory rose as home sales activity slowed. Nationwide sales are down 15% year-over-year. Days on the market are also increasing in tandem with the reduced sales. Those factors are bringing the market closer to balance, considered a six-month supply of inventory.

For sellers, that means they can’t expect to command the same price growth or sales prices that they were at the same time last year. In fact, as the sales pace has slowed over the last few months, sellers find themselves having to reduce their initial list price to get prospects in the door.

Slowing sales price growth

Sales price growth slowed throughout 2023. Prices are still increasing, but the months of double-digit increases are far in the past. Median home prices only grew 0.4% in September 2023 over September 2022. They have declined month-over-month since June 2023.

Conditions are at a tipping point. The days of multiple offers and concessions have closed. Now, it’s about making the numbers work for buyers. Sellers must make price adjustments to match what people can afford, or their homes will linger on the market.

Affordability is a real challenge for home buyers nationwide. The proof is in the data. It takes a national median income of $114,627 to comfortably buy the median-priced home. However, the median household income is $74,580. Even though price growth from September 2022 to September 2023 declined seasonally, households still needed an additional $6,000 to purchase a home, thanks to inflation and interest increases.

The monthly mortgage payments are beyond the reach of the median household budget. The 7-8% mortgage rates end up costing thousands more. Wage growth hasn’t kept pace or come close to catching up yet.

Something had to give, and sellers made the first move. Data for October 2023 showed 7% of listed homes adjusted prices downward. That’s the highest number in about eleven years.

Matthew Walsh, housing economist for Moody’s Analytics, told Fortune that home prices will drop about 4.5% over the next two years despite pervasive low inventory. But it may take even longer for the housing market to become affordable again.

Where home prices are dropping

The shift in housing prices isn’t equal nationwide. Markets in the West and Northeast are plagued by extremely low listings, which keeps pressure on the housing prices. And some markets, primarily in the South and Midwest, are seeing more price adjustments than others.

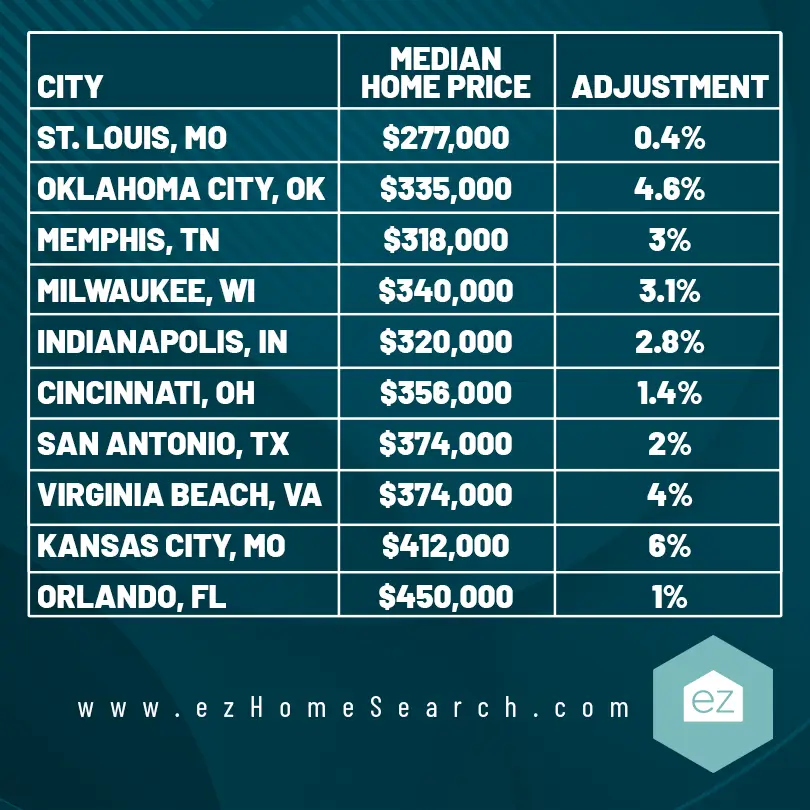

Here is where Business Insider’s analysis found the most significant change in October 2023 home prices:

St. Louis, MO: With a median home price of $277,000, about 21% of its listed homes cut their price. Still, the market had overall 0.4% price growth.

Oklahoma City, OK: Around 24% of its listings dropped their prices, but the market had a 4.6% median home price growth to $335,000.

Memphis, TN: Home price growth dropped by half a percentage point to $318,000. Around 24% of its listings dropped their prices by about 3%.

Milwaukee, WI: Home prices here dropped an average 2.8 percentage points and accounted for about 22% of its listings. The median home price stood at $340,000, a price growth of 3.1%.

Indianapolis, IN: A staggering 29% of homes reduced their prices. That price adjustment was slight, at 2.8%, for a median home price of $320,000.

Cincinnati, OH: The city had a median home price of $356,000, a 10% home price growth. That’s after about 18% of its listings reduced their prices by an average 1.4%.

San Antonio, TX: Homes in the Alamo had a median home price of $347,000, which was a 2% reduction from the prior year. Around 28% of its listings reduced their prices.

Virginia Beach, VA: Around 21% of its listings dropped prices. With a median home price of $374,000, Virginia Beach real estate remains in demand, and home prices grew 4% YOY.

Kansas City, MO: The city had a 6% median home price growth and achieved $412,000. That’s after around 19% of its listings reduced their prices.

Orlando, FL: This high-demand tourist city saw around 23% of its listings reduce their prices, even if that was just a slight 6%. Home price growth here is stabilizing, with just 1% year over year to $450,000.

Other major markets are reporting year-over-year pricing declines. Dallas-Fort Worth, for example, which often ranked as a “hot” market in the nation, had prices drop 0.2%. Miami-Fort Lauderdale and San Jose-Sunnyvale also had year-over-year declines, the latter a 1.3% drop.

And if they haven’t reported price adjustments, the sales price growth has become minimal in places like Detroit, Austin, Houston, Raleigh, San Francisco, and Riverside, all below 1%.

Still, the downward motion in home prices hasn’t become a widespread decline just yet. It will take more significant economic and housing inventory shifts to enable that to happen. The data signals a stabilizing of the market, something that has been long in coming.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Real Estate News

New Laws Taken Action On Rising Squatting Reports

Real Estate News

White House Proposals Aim to Boost Housing Supply

Real Estate News

NAR Settlement Set to Reshape The Business of Real Estate

Real Estate News