A Guide to Delaware Property Taxes

For real estate owners, investors, and homeowners in Delaware, understanding property taxes is crucial to managing their investments. Luckily, Delaware stands out for its tax-friendly policies. That doesn’t make comprehending the process any less complicated. Walk through the critical elements of Delaware’s property tax system, including rates, assessments, exemptions, and appeals.

How Delaware Compares

There’s good news when it comes to state property tax rates. Delaware ranked 10th in the nation for lowest effective property taxes. This measures the percentage of taxes paid against the median home value. For 2023, that was 0.61% on a median home value of $337,200. Homeowners paid an average of $2,067.97 in property taxes.

Delaware Property Tax Rates

In Delaware, homeowners pay no statewide property taxes. Instead, property taxes are determined at the local level. Rates vary depending on the county, city, and school district your property is in.

Tax rates are measured in mils. All three counties define a mil as $1 per every $100 of value. In simpler terms, if a home is valued at $100,000, then the homeowner charged a one mil tax rate would owe $1,000 in property taxes.

Additionally, Delaware’s three counties’ tax systems use a different assessment value. School districts and municipalities typically use the same assessment value, but in a few places, it is different.

Assessment Process

Property values in Delaware are changing. For decades, the counties have not reassessed their property values. Some use property values dating to the 1970s!

In 2020, a Delaware Court found this system unconstitutional. The ruling required all three counties to reassess property values for the first time in decades and to start regular property valuation assessment cycles. This change is an ongoing multi-year process.

All three counties hired Tyler Technologies to conduct the first re-appraisal in as many as 50 years. The process of updating records, verifying data, and analyzing began in 2020-2021, with results reported in 2023-2024.

That means property taxable values are changing in the coming years. Current homeowners should receive documents and information about the reassessment and new values. Home buyers and Delaware property owners should go directly to the local county tax office to get the most recent update about how this impacts them.

Understanding Your Local Assessment

Because each county has unique quirks, we’ve broken down the property assessment and tax rate information by county.

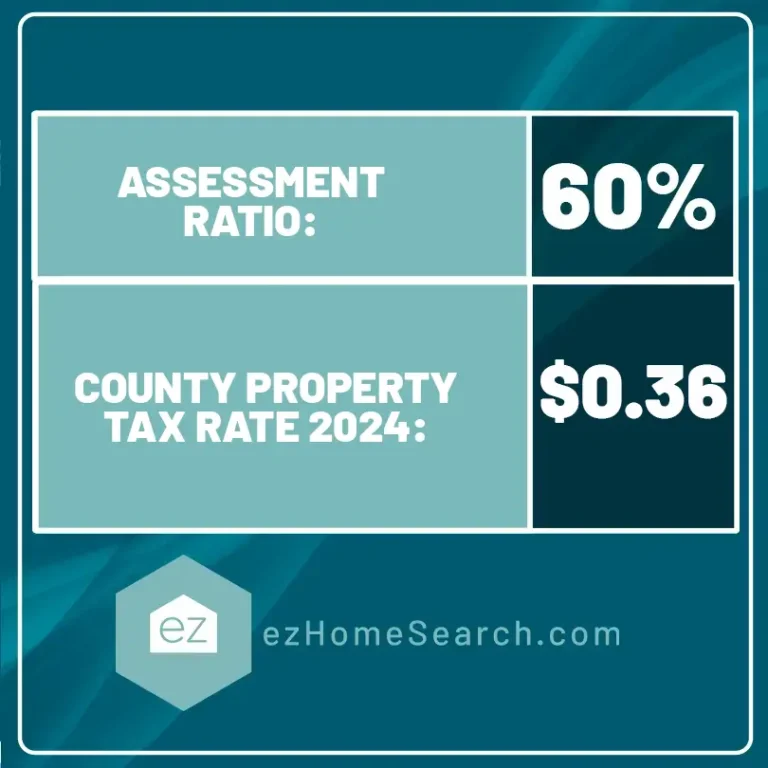

Kent County

Property tax rates

Based on the 2023-2024 fiscal year, school taxes range from 1.6503 to 2.1048. The county also has a library tax of 0.33 million in every district, but in Milford, it is 0.775. The jurisdiction also has a VO-Tech Tax of 0.1591, which supports the county’s vocational-technical education schools.

Kent County’s fiscal year runs from June 1 to May 31 of the following year. Annual taxes are due by September 30.

Property Values

Property values are based on the 1987 reassessment, the last date Kent County properties were assessed. Taxes are assessed on 60% of those values. Even the property’s sale does not trigger a reassessment. Only a change in the property itself that meets the reassessment criteria, like a renovation to add bedrooms or square footage.

Kent County’s property reassessment process received the data from the independent property appraiser in March 2023. As of 2024, the data is still being reviewed, and homeowners are being notified of their valuation change.

The county does have a 15% cap on property tax revenue increases, so its Levy Court (a pre-Revolutionary term for “tax court”) will evaluate what changes to make to property tax rates with the new assessment data that minimize tax revenue changes. That likely means tax rate cuts.

A letter to residents notes that the County Levy Court has only changed property taxes three times since 1989.

Properties will be reassessed again in 2028.

Appealing Property Taxes

You can’t change the tax rate but can appeal the property value. All residential appeals must be filed by March 31 with the Board of Assessment Office in Kent County. You must appear in person at the hearing or be represented by a Delaware attorney-at-law.

Homestead Exemptions

Persons older than 65 or 100% disabled can qualify for reductions in their property tax liability. The requirements are:

- Have been a Delaware resident for five years

- Have lived in the property as a primary residence for one year

- Have the property in their or a spouse’s name

- Meet income requirements

You’ll have to reapply for this exemption every year.

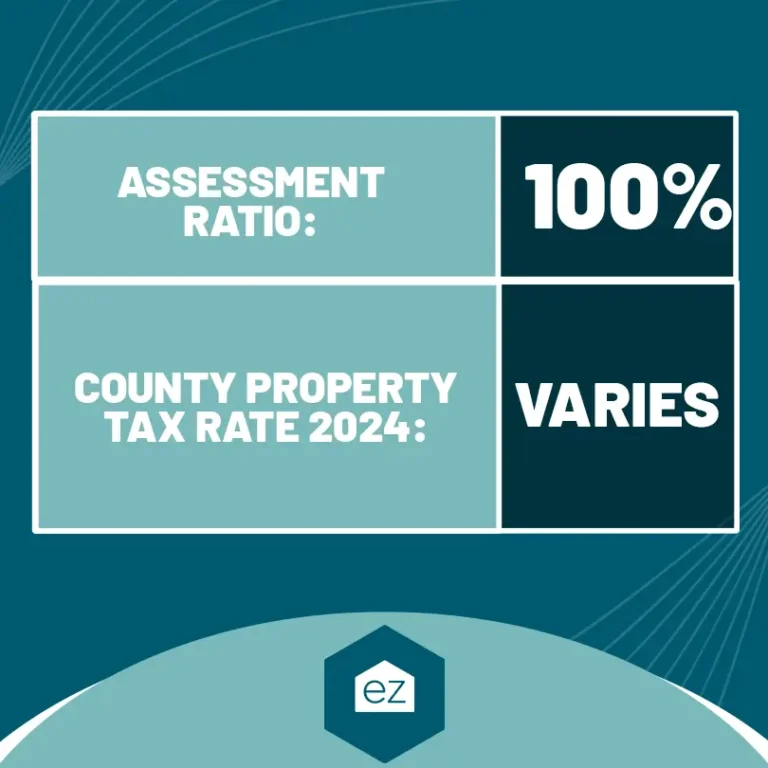

New Castle County

Property Tax Rates

Tax rates are based on the district the property falls inside. See this map to find the district in which the property you are interested falls.

For the 2023-2024 tax year, this ranges from 0.2523 in Wilmington to 0.8054 for Clayton, Smyrna, and the county’s unincorporated areas. School district taxes range from Smyrna’s 1.675 up to Christina’s 3.18. Additionally, all the school districts but Smyrna charge a Crossing Guard tax. Additional taxes include a VO Tech tax, Delaware City Park, and a street light tax.

You should receive a tax bill by the end of July. All payments are due by September 30. Any late taxes do incur interest penalties of 6% on county taxes, 5% on school taxes, and 1% on other taxes.

Property Assessments

Property values are based on the 1983 appraisal. These are updated if the property is new or recently improved. The county began its property assessment process in 2020.

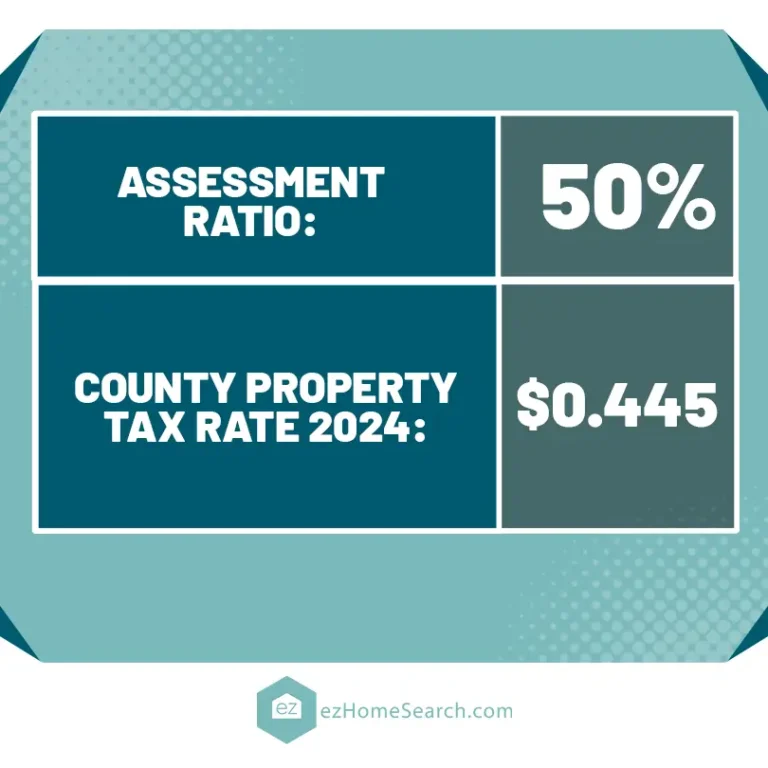

Sussex County

Property Tax Rates

In addition to its county levy, Sussex County charged $0.0467 for library taxes. School taxes in 2023 ranged from 3.2340-4.6638, depending on which district the property fell in.

The county’s fiscal year runs July 1 – June 2023, with property taxes calculated from July 1. The bills are typically sent by August 15, with payment due by September 30. There are supplemental taxing periods for newly built homes.

Assessment Value

As for assessment value, Sussex County used 1974 appraised property values. Of course, this amount is changing. The most recent reassessment update noted that 81% of the property parcels had been evaluated, with a completion timeline in spring 2024.

Appeals on taxable value can be filed with the Sussex County Assessment Office.

Exemptions

Sussex County has a unique property tax subsidy based on annual income for low-earning residents. The requirements are to be a full-time resident and earn less than $15,800 for single residents or $20,000 for married residents. The subsidy applies only to the county portion of the tax.

Its Over 65 and Disabled Tax Exemption requires the applicant to be a full-time Sussex County resident for the prior five years. Income is restricted to no more than $6,000 for single or $7,500 for married homeowners, excluding Social Security benefits. The exempted amount is capped at $12,500 of assessed value.

Additional Tax Exemptions

Delaware has two statewide property tax credit programs supplementing the county-specific ones noted above.

The Senior School Property Tax Credit is for residents 65 and older. Once you qualify, you don’t need to reapply every year. The credit will be deducted from the tax bill before the county mails the bill. The deadline to apply is April 30.

The Disabled Veterans School Tax Credit is for those with a 100% disability related to their service. Applicants must have lived in Delaware for the last three years before their application date. Applications go to the county, which will deduct it from the property tax bill before mailing. You will only need to reapply if you move.

Appealing Assessments

If you believe the assessed value of your property is not accurate or fair, you have the right to appeal the assessment. Delaware has a clearly defined appeals process, usually starting with filing an appeal to your county’s Board of Assessment. If unsatisfied with the outcome, you can take your appeal to the State Property Assessment Appeal Board. Understanding the timeline and the required documentation is crucial for a successful appeal.

Delaware Property Taxes

While Delaware’s property taxes are relatively low, owner still should be informed about the details behind your tax bill. Policy shifts may affect tax rates, especially as the counties shift to the new required property valuation system. As always, consult a tax professional for specific advice tailored to your situation.

Manage your financial obligations more efficiently by keeping informed of the Delaware property tax landscape. That leads to potential savings and a better understanding of your property’s value.

This article is not intended to serve as tax advice. Consult a taxation professional for taxing advice.

###

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

City Guide

Getting to Know Hartford, CT

City Guide

Your EZ Guide to Moving to Arkansas

City Guide

A Guide to Connecticut Property Taxes

City Guide