A Guide to Connecticut Property Taxes

Every state uses residential property taxes in some capacity to offset the costs of providing public services. Without them, we wouldn’t have ambulances, libraries, road maintenance, and schools. But how much you’ll pay as a homeowner varies widely across states. New homeowners may wonder how Connecticut property taxes compare. Our guide explains how the taxes for homes are assessed and where you can find more information.

Note: While Connecticut also charges vehicle property taxes, this article is only about real estate.

How Connecticut Property Taxes Compare

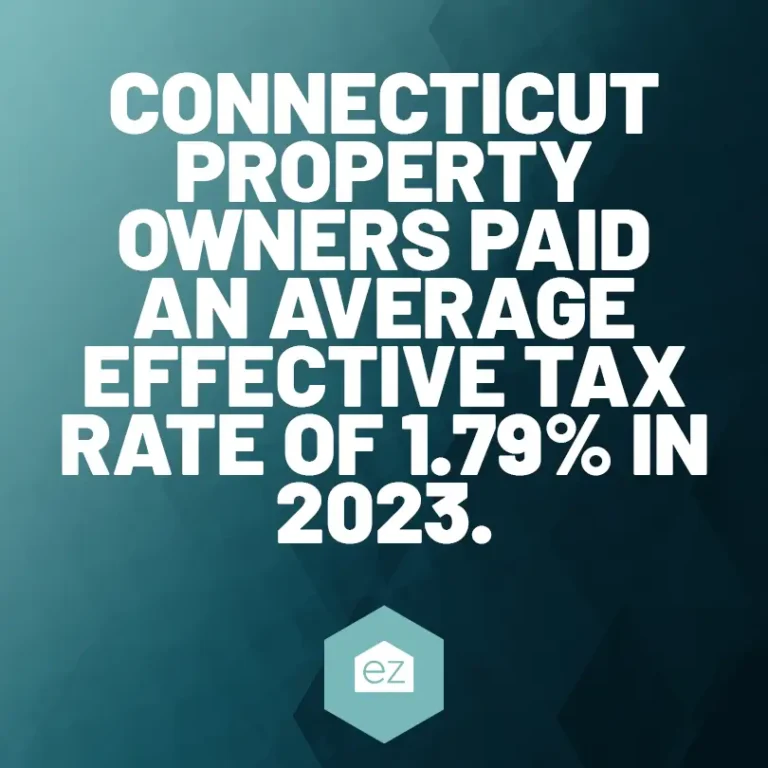

While the property tax burden of Connecticut homeowners has improved somewhat, the downside is that homeowners still pay more than most states. Connecticut was the fifth most expensive state for taxes by the average effective tax rate in 2023.

This metric measures how much local homeowners pay as a percentage of their home’s value in property taxes. That came to 1.79%. On a median property value of $347,200, that amounts to $6,213.

How Connecticut Assesses Property Taxes

Connecticut property taxes use the assessed value of real and personal property. Typically, the local assessors use the home’s fair market value on October 1 to set their tax rolls. You may hear the tax rolls called the “Grand List.”

Towns must revalue all the properties within their boundaries every five years. Every town is on a different cycle during this revaluation process.

Local assessors determine the property values, which include land and buildings. Factors that impact assessment include the property’s age, size, and type of construction.

Remember, an accurate assessment is essential as it directly affects your property tax bill.

The tax assessment is typically on 70% of the property’s fair market value, but some taxing districts use a different assessment ratio. In Hartford, residential property taxes are levied on 36.75% of the fair market value.

The taxing district determines when property taxes are due. In Bradford and Waterbury, residential real estate taxes are due in two installments on July 1 and January 1. That’s the case for the majority of taxing districts.

Understanding Property Tax Rates in Connecticut

Connecticut does not have a single state-wide property tax rate. Each municipality sets its own mill rate each year. For that reason, the local Town Collector is the best resource for information about the timing of the tax bill, its charges, and exemptions.

A “mill rate” is the tax payable per dollar for a property’s assessed value. For the state, it is measured as 1/1000 of a dollar or as equal to $1 for every $1,000 assessed.

As a simplified example, say your home was worth $400,000. A mil rate of “1” would mean your owed property tax would be $400.

To calculate your Connecticut property tax, multiply the mill rate by your property’s taxable assessed value (70%) and divide by 1,000.

The Board of Finance or Town Council meets annually to set a new budget and determine what mill rate to charge to cover its operating budget.

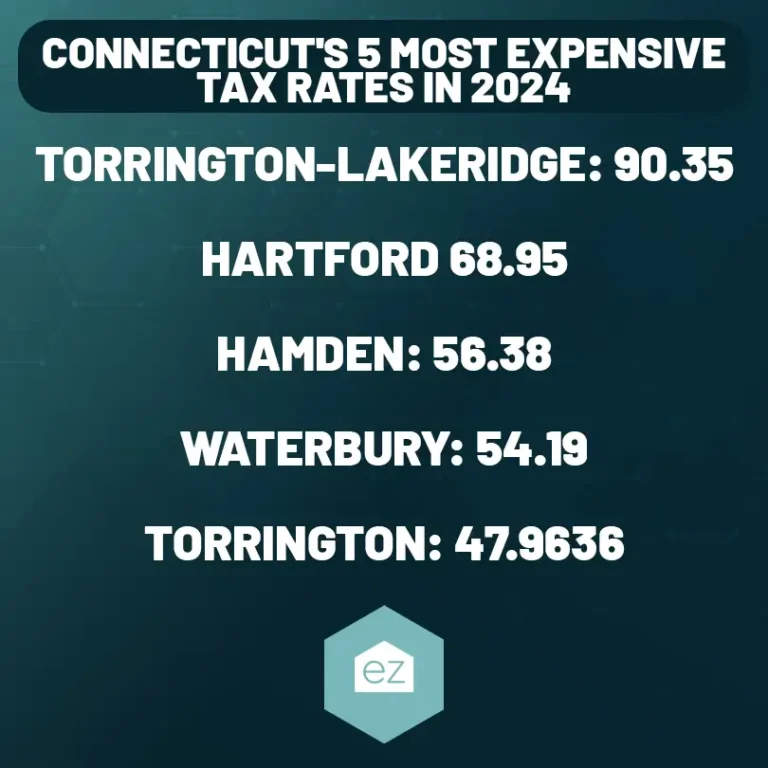

The mill rate is critical because it affects how much you pay relative to the value of your property. As of 2024, the mill rates ranged from 0.0001 for the Brandford-Stony Creek Association to 90.350 for the Torrington-Lakeridge Tax District.

Of course, property values matter. A taxing district may have a low rate, but if the property values average higher, the homeowner could still be paying thousands in taxes.

Find the most recent mill rates for Connecticut towns and areas.

Property Tax Exemptions in Connecticut

To lighten the burden on taxpayers, Connecticut provides various exemptions. Here are some you might be eligible for:

Veteran Exemptions: Veterans who served during wartime and were honorably discharged may qualify for a $1,000 exemption. The exemption extends to surviving spouses. An additional exemption is available for disabled veterans or those who meet specific income thresholds. Applications must be filed by October 1.

Disability Exemption: Individuals with a disability could get a reduced tax rate. Documentation is required.

Seniors: Are you 65 or older? You may be eligible for tax relief programs depending on your income, residency status, and the city of Connecticut you live in.

Blind Exemption: Residents with 100% blindness may be eligible for property tax exemptions.

Elderly Deferral Program: This jurisdiction-specific program is for those over 65. It defers taxes but charges interest. Taxes are due later, usually on the property’s sale or ownership transfer. Only some cities have this program.

Check with the property’s local Tax Assessor or Tax Collector, as there may be specialized exemptions for that area. Among these are taxing exemptions for forests, farms, open spaces, and farmers and merchants.

Appealing Your Property Taxes

If you believe your property tax assessment is not accurate or fair, you have the right to an appeal. In Connecticut, it is your statutory right as a property owner to ensure fair taxation.

Start by contacting your city’s Tax Assessor. Each jurisdiction has a specific process for filing an appeal with your local Board of Assessment Appeals.

Submit your appeal by the deadline — often February 20, but dates vary by town.

Be prepared to provide evidence to support your claim, such as an independent appraisal.

Understanding Connecticut Property Taxes

Remember: the local Connecticut tax assessor’s office is a helpful resource for any questions or concerns about property taxes. Staying informed can save you money and ensure that you pay no more than your fair share of property taxes in Connecticut.

While efforts have been made to ensure the accuracy and reliability of the information presented, laws and regulations regarding property taxes, exemptions, and eligibility criteria may vary and are subject to change over time. Additionally, the information provided here regarding Connecticut’s property taxes is intended for general informational purposes only. It should not be construed as legal, financial, or tax advice.

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

City Guide

Getting to Know Hartford, CT

City Guide

Your EZ Guide to Moving to Arkansas

City Guide

What to Know About Living in Atlantic City

City Guide