The Ultimate Guide to Retiring to Florida: Everything You Need to Know

Anyone considering retiring to the Sunshine State, Florida, is undoubtedly well aware of its charms. Imagine a lifestyle living near beautiful beaches, hundreds of golf courses, in a year-round warm climate, and zero state income tax. Its reputation for a high quality of life at affordable prices has long made Florida a top destination for retirees. But is retiring to Florida all as promised?

In this comprehensive guide, we navigate the various aspects of retiring in Florida. Get a feel for the housing options and healthcare facilities. We break down state-specific tax information and Florida’s retirement-friendly regulations and include the state’s top cities for retirees.

So, if you’re ready to swap snow for sunshine and embrace a relaxed coastal lifestyle, this guide is your go-to resource.

Why Florida is a popular retirement destination

One of the main draws of retiring to Florida is the weather. With its mild winters and sunny summers, Florida’s year-round tropical climate is perfect for outdoor activities and relaxation. Northerners get to hang up their snow shovels for beach chairs, even in January.

The affordable cost of living is another big draw. Compared to many other states, the cost of housing, healthcare, and everyday expenses in Florida is relatively low. That matters when you’re living on a fixed income. Retirees in Florida can stretch their retirement savings further and enjoy a comfortable lifestyle as they age in place.

Florida may be a narrow peninsula, but it’s 447 miles long. Driving from Key West to Pensacola takes over 12 hours! Its size makes Florida highly diverse. You have the “Gateway to Latin America” in the Miami metro, the “Theme Park Capital of the World” in Orlando, college towns like Gainesville, and tiny fishing villages like Apalachicola. Up and down the state are laid-back coastal towns, small inland hamlets, and the nation’s largest retirement community. Retirees can easily find a home that suits their needs and preferences.

Florida’s retirement drawbacks

Like any retirement destination, Florida isn’t perfect. Living here has its drawbacks, and it’s wise to know them before you uproot south.

That same warm weather that makes Florida winters so appealing has two major detractors:

1- Florida is prone to hurricanes from June to November. While not all areas of Florida are affected equally, the threat of hurricanes and the need to prepare for them can be a significant concern for retirees. Plus, due to the hurricane risk, the cost of homeowners insurance is soaring and sometimes unobtainable.

2-The hot and humid climate can be uncomfortable for some people, especially during the summer months. High humidity may exacerbate certain health conditions, especially if you have cardiac or weight concerns. If you want to live in Florida full-time for retirement, maybe spend a full August there first.

The warm winter weather also attracts “snowbirds,” the nickname for seasonal residents who flock to Florida during the winter months. This can increase traffic and demand for services during the peak season. Add onto that the tourists. The combination increases traffic, longer wait times at restaurants, and creates a more bustling atmosphere than some retirees might prefer.

In another side effect of being warm and humid, Florida is a veritable wildlife wonderland. Be ready to deal closely with insects and pests, including mosquitos, palmetto bugs, and termites. Bugs are a fact of life in Florida. Pest control may be a recurring expense for homeowners.

Depending on where you live, the public transportation options can be limited, which may concern retirees who prefer not to drive. Miami is the only Florida city with a rail transport option; elsewhere, it’s buses for public transport and primarily cars in most places.

Aside from hurricanes, Florida is prone to other natural hazards like flooding in low-lying areas. Climate change is increasing erosion along its coastline and impacting waterfront cities. But you’re not safe inland, either. Certain parts of the state are at risk for sinkholes, which have swallowed houses.

Cost of living in Florida for retirees

The allure of Florida has long been a lower cost of living, but is that still the case? Popularity leads to more people, which pushes up the demand for housing and lifestyle essentials.

Compared to other states, Florida falls middle-of-the-road. In 2022, it cost $50,689 to live here, based on MERIC data.

Median housing costs ran $1,137 to $1,981 per month, with median monthly mortgage payment at $1,618. Utilities were averaging $411 a month for 2022, which included cable and internet costs. Groceries ran $323.83 per person per month.

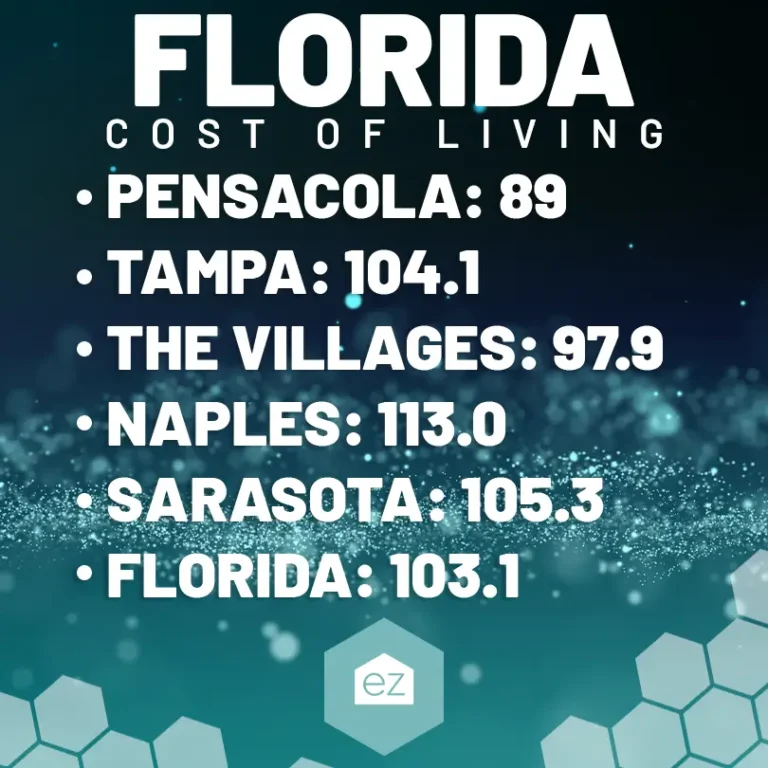

But the actual cost of living ranges widely across Florida’s many regions and depends on your lifestyle. Using 100 as the national indexed average score, here’s how the top five retirement destinations in Florida ranked in cost of living on Sperling’s Best Places Index:

Tax considerations for retirees in Florida

Retirement-friendly tax policies make Florida an attractive destination for retirees. The state is one of just seven without a state income tax. Nor does Florida tax Social Security benefits or retirement account withdrawals from pensions, 401(k)s, and IRAs. Retirees keep more income in their pockets for essentials or fun spending.

Even more tax exemptions and credits benefit retirees. For example, the state has a homestead exemption, which reduces the taxable value of a primary residence. One $50,000 exemption is specific for persons 65 and older, dropping the property tax bill even further! The Save Our Homes program may lock in your property taxes to a lower rate, too, if you qualify.

Prescription and nonprescription drugs are exempt from taxation, and most groceries are also exempt (except prepared foods and other products). Finally, Florida has no inheritance or estate tax.

Healthcare options for retirees in Florida

Regarding healthcare, Florida is known for its retirement-friendly healthcare programs and resources. Some Medicare and Medicaid healthcare options are specifically designed for retirees. These programs provide retirees with affordable healthcare coverage, ensuring they can receive the medical care they need without breaking the bank.

Additionally, several top-ranked medical facilities and research centers increase access to quality care. Mayo Clinic-Jacksonville ranked no. 1 in the state and had national rankings in nine specialties. AdventHealth Orlando, UF Health Shands Hospital, and Tampa General Hospital rounded out the state’s top four hospitals and also have specialties with national accolades. Retirees can rest assured knowing that they have access to some of the best healthcare professionals and treatment options in the country.

Housing options for retirees in Florida

When it comes to housing options, Florida is flush with variety. Pick what you want; as long as it’s not a winter ski chalet, Florida’s got it.

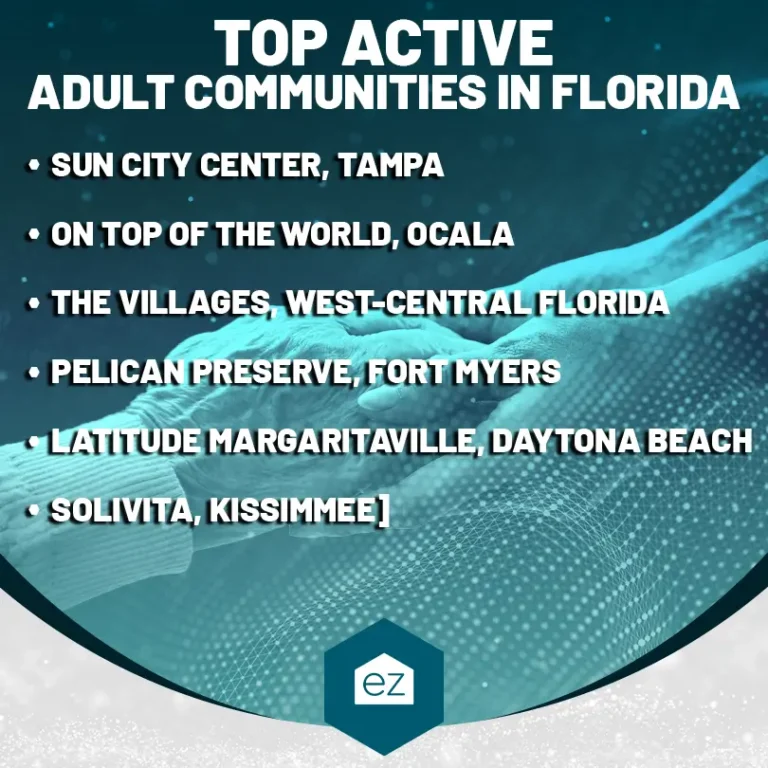

Active adult communities are particularly popular because these communities are specifically designed for retirees. They come with in-built perks like golf courses, swimming pools, and social clubs. Active adult communities aim to provide a sense of community with endless activities to stay fit and healthy as you age.

Prefer a waterfront lifestyle? Florida has no shortage of waterfront condos and homes. The hardest part will be choosing what kind of waterfront you want. Pick from the 900+ miles of shoreline, island living, riverfront, lakefront, or canal-front. Retirees can find a home with peaceful water views and easy access to all the water activities you’d want.

The best cities for retirement in Florida

When choosing the perfect city for retirement in Florida, consider what you want out of your retirement: lots of cultural attractions, dining, and things to do, or the sound of waves in the backdrop every day?

But specific population centers have drawn legions of retirees for part-time or full-time living, making them top retirement cities.

- Naples: Located on the southern Gulf Coast, Naples’ upscale amenities and pristine beaches are its selling points. The city delivers a high quality of life for retirement, with over 80 championship golf courses, high-end and boutique shopping centers, and nationally ranked beaches like Marco, Sanibel, and Captiva Islands. Naples ranked the third-best retirement city in Florida for 2023.

- Sarasota: With its stunning beaches, pervasive love for the arts, and diverse community, Sarasota is a popular choice for retirees. The city has a thriving sports tourism industry, which translates to a highly active lifestyle. Choose from: sailing, rowing, bicycling, pickleball, golf, tennis, swimming, and so much more! Its beautiful waterfront parks and gardens, Circus Museum, and packed dining scene add to its allure. US News and World ranked it no. 5 in the state for retirees in 2023, but it’s held the top spot many times.

- The Villages: You can’t write about retirement in Florida and not mention The Villages. The nation’s largest planned retirement community spans several counties in Central Florida–and it’s still growing! Residents gain numerous amenities, like dozens of golf courses, over 3,000 social clubs, plus all the essential shopping and medical care–just a golf cart ride away! It doesn’t rank because The Villages is technically not a city.

- Pensacola: For 2023, this Panhandle city took top marks for retirement in the Sunshine State. Its beaches are gorgeous with the classic white sands and sapphire-blue backdrop. Escape the crowds at Gulf Islands National Seashore and its untouched beaches. Between Pensacola Bay and the Gulf shores, the waterfront is robust and ample. But it’s still a small enough city to afford housing. For veterans, the local Naval base adds access to VA healthcare.

- Tampa: This centrally located Gulf Coast metro is a jam-packed city with more going on than you’d think if you’d never heard of it before. Its Tampa General Hospital is a top-ranked hospital and only one of multiple healthcare providers in the metro. For entertainment, Tampa has large entertainment districts like Channelside and Ybor City, a theme park, four professional sports teams, major performance arts venues, and yes, waterfront access. It’s also a cruise port.

Is retiring to Florida right for you?

Before retiring to Florida, carefully research and visit potential locations to assess whether they align with your lifestyle and preferences. Factors like climate, cost of living, healthcare, and personal preferences should all be weighed when making this significant life decision. Consulting with a local real estate agent, financial advisor, or retirement expert can also provide valuable insights.

And if Florida doesn’t have what you’re looking for, why not try next-door Georgia and Alabama?

Start Your Home Search

Preston Guyton

Share this Post

Related Articles

Living in Florida

All About Living in Naples, Florida

Living in Florida

Your Melbourne, FL, Real Estate Market Profile

Living in Florida

Your Palm Coast Real Estate Questions Answered

Living in Florida